Incorporating Responsible Investing Into Your Portfolio

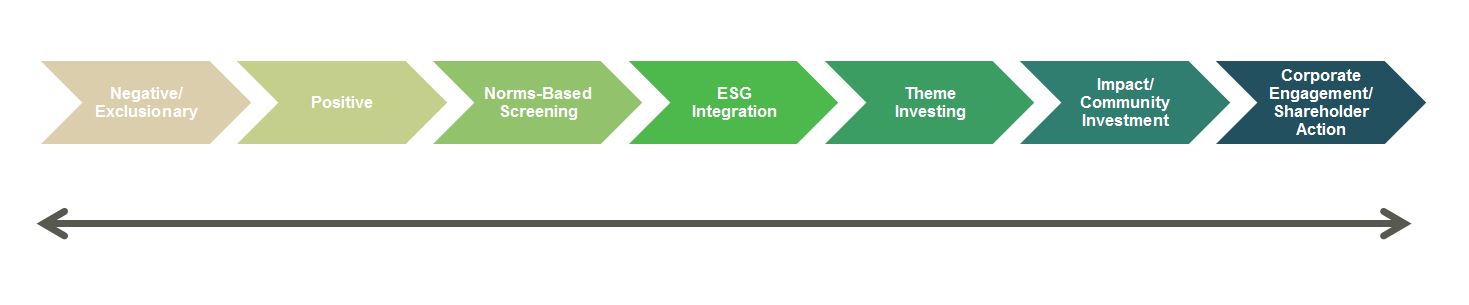

In a recent article, we examined the trend of investors looking beyond traditional risk/reward considerations and exploring investments that could help make a positive difference in the world. In particular, we looked at some of the more common approaches to what is often referred to as “responsible investing”: Environmental, Social and Governance (ESG) and Socially Responsible Investing (SRI). Both of these approaches rely on screening techniques to align the companies in your portfolio with your values and principles.

Negative Screening

Typically associated with SRI, where your personal values and beliefs define what is and isn’t an acceptable investment, negative screening enables you to identify and omit prospective investments that don’t meet your standards. Some refer to this as a “do no harm” approach, and the stocks excluded are generally seen as contributors to negative or potentially detrimental societal or environmental outcomes. Excluded companies might be part of the alcohol, firearms, gambling or tobacco industries – sometimes referred to as “sin stocks.” Or they may engage in practices you deem harmful, like fossil fuel polluting, animal testing or deforestation.

The fact that negative screening is exclusive (instead of inclusive) makes this form of responsible investing one of the easiest to implement. You simply tell your asset manager what you aren’t okay with and companies that do those things are not considered for your portfolio.

Positive Inclusion

Positive inclusion is the primary investment selection method associated with an ESG approach, which typically doesn’t employ negative screens. Companies are researched and ranked based on their ESG practices and how those might impact both sustainability and profitability. An investor following a positive inclusion strategy may be concerned about the environment, looking specifically to invest in alternative energy suppliers or organizations that promote water conservation. Positive inclusion can also be used to screen for managers whose offerings agree with your investment preferences.

Because positive inclusion is equally focused on what a company or manager does and how they do it, this approach can be more involved and often requires more due diligence and monitoring.

A Customized Approach

While negative screening and positive inclusion can meet the needs of most individuals interested in responsible investing, institutional or high-net-worth investors can also opt for a more hands-on approach. Rather than select a prepackaged SRI or ESG option, these investors will typically work with their asset manager to restrict buying in some areas and seek out specific types of investments in others. If you are actively involved in the composition of your portfolio and have investible assets of at least $250,000, this kind of approach might be your preference.

What About Performance?

You might worry that limiting your investment options to companies that meet your responsible investing criteria could compromise potential returns. A 2015 meta-study from the University of Oxford showed that companies with better sustainability practices tended to have better operational performance and often superior stock price performance relative to companies rated lower for ESG1. While no investment strategy can guarantee superior returns, this research suggests responsible investing can be good for returns as well.

Before pursuing any specific responsible investment strategy, you should talk to your Baird Financial Advisor about your specific situation and what kind of social impact you want your money to make. There may also be opportunities to incorporate your values outside of your portfolio. Not a Baird client? Find a Financial Advisor.

1Clark, G.L., et al. From the Stockholder to the Stakeholder: "How Sustainability Can Drive Financial Outperformance", March 2015.