The 2020 Surge in Retail Trading

Mike:

John, I think it’s time we address the elephant in the room, a topic that has been discussed endlessly on Twitter and in the blogosphere: the rise of the retail trader. CNBC reported in late July that E-brokers like TD Ameritrade, Robinhood, and Charles Schwab (to name a few) have seen record retail volumes lately. Why has retail trading surged in 2020? There are a couple of reasons for this, but it’s mostly because everyone is stuck at home, there were no sports to watch, commissions have been set to zero, and the stock market has seen an extraordinary surge off its March lows.

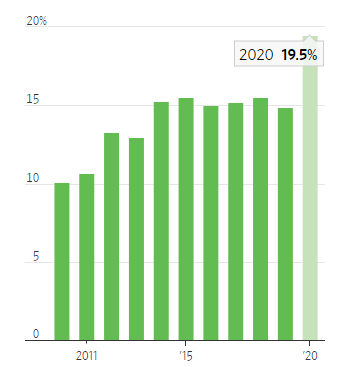

According to Citadel Securities, the market-making arm of the firm owned by Ken Griffin, retail traders “now account for about a fifth of stock-market trading and as much as a quarter on the most active days.” (Bloomberg).

On August 31st, the WSJ published an article titled “Individual-Investor Boom Reshapes U.S. Stock Market” with the following chart:

Individual Investor's Estimated Share of U.S. Equities Trading Volume

Note: 2020 data are for January through June.

Source: Bloomberg Intelligence

This is a topic that’s near and dear to my heart, as I spent the first 19 years of my career as an institutional equity trader. I have a fairly hot take on this, but first I want to hear what you have to say about it. Is this necessarily a bad thing? Will this end poorly?

John:

To answer your questions directly:

“No,” it isn’t necessarily a bad thing. The problem isn’t trading by retail investors. It’s trading by investors who are uninformed and inexperienced, or who have no one providing them with the advice they need to successfully achieve their goals.

For more than 50 years, individual equity ownership has been steadily “democratized.” First by mutual funds, which were once the leading edge of financial innovation. Then by index funds. Then by defined contribution plans like 401(k)s and Individual Retirement Accounts (IRAs). Then by Exchange-Traded Funds (ETFs). Now by online brokerage and advisory platforms.

But that trend hasn’t been accompanied by a corresponding uptick in financial literacy. Which is one reason that I donated the proceeds from my last book, A Force for Good, to two foundations that promote financial literacy (one of the biggest hurdles keeping investors from realizing their financial goals), and why the answer to your second question is “Yes”… it probably will end poorly.

Mike:

You stole my thunder! I was going to say that while I am not bothered by the Rise of Retail™ in 2020, I just want to see a commensurate rise in education. It’s one thing to spend $1,000 on a stock because you love the company or the business they are in, but it’s another thing to understand how and why the stock moves.

One of the biggest problems I found when trading equities was learning this lesson: It’s not the news that matters, it’s the reaction to the news. This speaks to “expectations,” which is often the most powerful force moving stocks in the short term.

For example: Let’s say the company you own reports earnings and announces record revenues and profits, yet you wake up the next day and the stock is down 15%. You might say to yourself, “This whole thing is rigged, it makes no sense, the investing world is bogus.” What you fail to realize is that those record earnings might be less than the market expected, so technically the stock “disappointed” the Street. It’s a subtle lesson but hard to learn without someone there to help you. I am not against people having access to trading and learning how to invest - I just want to help them along the way.

John:

If you want to help them, then you have to ask: Are retail investors trading stocks for the right reason?

If they’re trading stocks to make money, that’s not the right reason.

I can hear you shouting, “What? Why do I say that?” Because individuals with an online trading account and $17,000 in capital are up against the most sophisticated investors in the world, managing trillions of dollars, with access to the best analytics, artificial intelligence algorithms parsing big data, and a 360-degree view of where money is flowing around the globe. Think of an amateur golfer playing Dustin Johnson. They might tie the first hole… but over a full tournament? Or a complete season? They will most certainly lose.

What’s the right reason to trade stocks? As part of a disciplined plan that aligns with your long-term goals. Nobody can beat you at that game, because only you know what your goals are. Or how much risk you’re willing to take to achieve them. Or what your time horizon is. (You may recall that as one of the “Lessons Learned From Investing in Volatile Times” that we discussed a few months ago.)

I know neither you nor I are against the rise in retail trading, Mike. We just want to see it done with the right education and for the right reasons. A Baird Financial Advisor can be of huge help in this area; if you’re a retail trader or thinking about getting into it, please make as much use as you can of their expertise.

Oh… and one more thing. From time to time in our industry there are companies that can't seem to avoid creating problems for themselves. We saw a bunch of those during the financial crisis. Online brokerage platforms may have added millions of new accounts this year, but check out the costs:

- A $1.25 million FINRA fine for “best execution” violations;

- An SEC civil fraud investigation related to the practice of selling customers’ order flow;

- Inaccurately claiming SIPC insurance coverage for cash management accounts.

Every time we see ethical violations in the middle of a stock market trend, it’s time to wave a red flag and shout: “Investors beware!”