Washington Policy Research - Sept.13, 2021

The September to Remember

Summer vacation is officially over. As Congress returns from recess, there’s a huge number of fiscal and monetary decisions to be dealt with, all of which will impact markets: the federal budget, the infrastructure bill, the debt ceiling, Fed tapering, Fed appointments, and of course, the massive $3.5T spending bill.

Infrastructure Bill

The House is set to vote on this bill by September 27. It has already passed the Senate with bipartisan support and would provide $548B in new spending for roads, bridges, drinking water, ports, the electric grid, & broadband. Progressive Democrats are pushing to have Biden’s $3.5T package passed at the same time, while moderates want the bipartisan measure to move first. The tension between these two factions will be key on many issues.

Federal Budget & Debt Ceiling

Federal government spending expires September 30 and the debt ceiling has technically expired (though the Treasury can use “extraordinary measures” to keep the US fulfilling its debts for another few months). Democrats want to pass a short-term continuing budget resolution to keep the government open and plan to include the debt ceiling in this measure as a means to secure Republican support. Republicans, however, don’t want to vote for the debt ceiling; they believe Democrats should raise it in their reconciliation bill since they are, after all, proposing trillions in new spending. This stand-off could lead to a government shutdown or headline risk of US default, which could negatively impact markets. Though there are options to resolve this, none are great.

$3.5T Spending Package

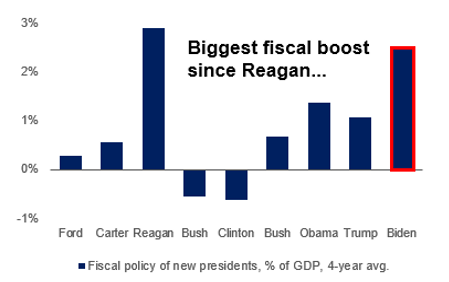

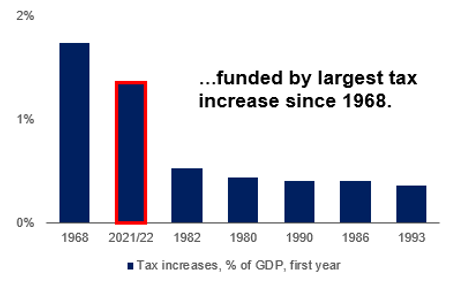

Democrats can pass this measure with just 51 votes in the Senate (using the budget reconciliation process), avoiding the need for Republican votes entirely. As originally envisioned, the bill would include the largest tax increase since 1968 and the largest spending package in more than 100 years, but moderates argue the current package is too big. We expect a smaller (but still sizable) bill that includes tax hikes on corporations, individuals, capital gains/dividends, and estates to ultimately pass.

Fed Tapering & Appointments

While the Fed planned to begin tapering asset purchases this fall, the underwhelming August jobs report likely gave them cushion to delay until the fiscal issues being debated are resolved. Elsewhere, Fed Chair Powell’s term expires in February. While progressives want a new Fed chair who will focus on regulation, President Biden could likely satisfy the faction with favorable candidates in other vacancies.

All of this as the economy slows, inflation persists, and fiscal drag builds. It will be a consequential few weeks for markets.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient to base an investment decision on. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Strategas Asset Management, LLC and Strategas Securities, LLC are affiliated with and wholly owned by Robert W. Baird & Co. Incorporated, a broker-dealer and FINRA member firm, although the firms conduct separate and distinct businesses.

Copyright 2020 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.