Investing in Your Values

Your investments are essential for turning your vision for the future into reality. But what if they could do more – what if you could use your investments to put your principles in action?

Traditionally, investors have built their portfolios based on their tolerance for risk – which investments would give you the greatest return with the least amount of risk. Lately, that rationale has started to evolve: Investors still want top performance, but only by investing in companies that share their values. And socially responsible investing, or SRI, is more than a passing trend – the investment philosophy has steered $12 trillion in assets in 2018, a 38% increase from just two years before.*

Doing Well by Doing Good

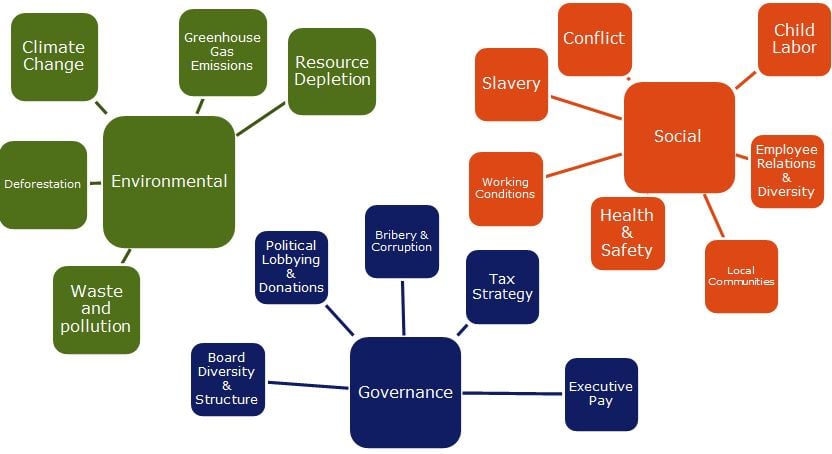

The idea behind socially responsible investing is to align your investment decisions with your personal ethics and morals. These values are widely broken down into environmental, social and governance issues, or ESG:

- The environment category looks at the impact companies have on the environment. Are they heavy polluters? Do they take action to conserve natural resources? Do they regularly comply with governmental regulations?

- The social category looks at how the company does business. Do they give back to the local community? What are the working conditions like? Do they work with vendors who adhere to a similar set of values?

- The governance category looks at a company’s accounting and organizational structure. Do they use lobby politicians to gain favorable treatment? Are there internal rules in place to avoid conflicts of interest? Are owners of common stock allowed to vote on important company issues?

If you’ve ever thought “I don’t want to profit from companies that are harming the environment” or “I’d like to invest in businesses that help my local community,” you’ve given some consideration to socially responsible investing. Figure 1 shows some of the ESG factors that drive this investing philosophy.

Figure 1. There are many ways to incorporate ESG factors into your investment decision-making.

Putting Your Money Where Your Values Are

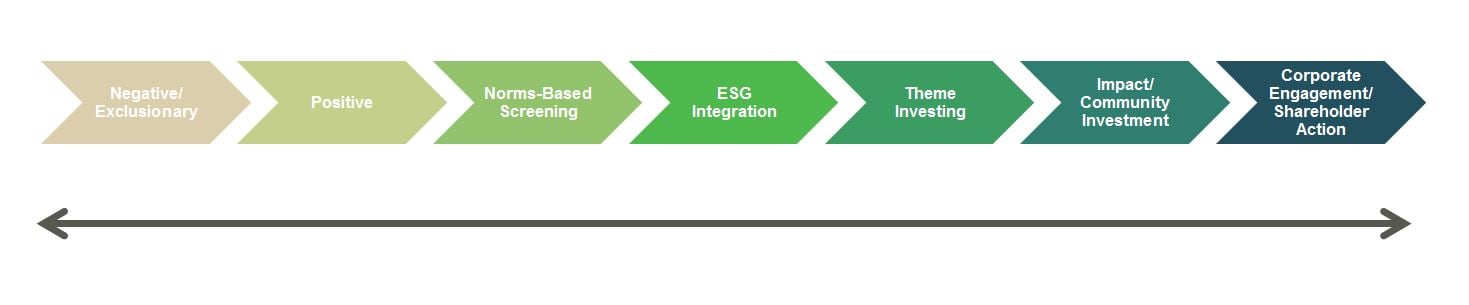

If you choose to introduce socially responsible investing into your portfolio, the next question becomes how – and how much. Just as there are many ESG factors that can steer your decision-making, there are many investment strategies you can follow to implement SRI into your portfolio.

In the past, SRI investors had tended toward a passive, exclusionary approach to portfolio construction, choosing only to omit certain companies or sectors (“I want to exclude tobacco companies from my portfolio”). Today, investors have a full range of SRI options, from negative screening to impact investing all the way to using shareholder power to influence how an organization does business. Figure 2 shows a spectrum of common SRI choices.

Figure 2. Common SRI strategies, ranging from passive to active.

So how do you decide which option is right for you? In part two of this two-part series, we’ll look in more detail at the strategies investors have available to them. You can check out part two here, or contact your Baird Financial Advisor for SRI advice specific to your situation. Not a Baird client? Find a Financial Advisor.

This information has been developed by a member of Baird Wealth Solutions Group, a team of wealth management specialists who provide support to Baird Financial Advisor teams. The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.

*The Forum for Sustainable and Responsible Investment, ussif.org.