Everything You Need To Know About Tariffs

International trade has been in the news of late, as the Trump administration has enacted tariffs on a range of goods across a range of trading partners. To understand the “what, why and how” of this new trade paradigm, we asked a few questions of Strategas’ Chief Economist Don Rissmiller.

Q: What Are Tariffs and What Do They Accomplish?

A: At its simplest, a tariff is a tax that is levied on imported goods and paid by the importer. That tax brings in revenue to the government – and given that the U.S. has a substantial federal budget deficit, the revenue would be welcome. Tariffs can also accomplish political objectives: Global firms want access to the U.S.’s large domestic consumer market, and tariffs – or even the threat of tariffs – can be used to influence other countries’ actions. (We saw this firsthand when Colombia had refused to accept deported migrants from the U.S. in January.) Tariffs can further be used to interrupt trade flows that may not be desirable due to national security concerns, such as high-tech products that can have military applications.

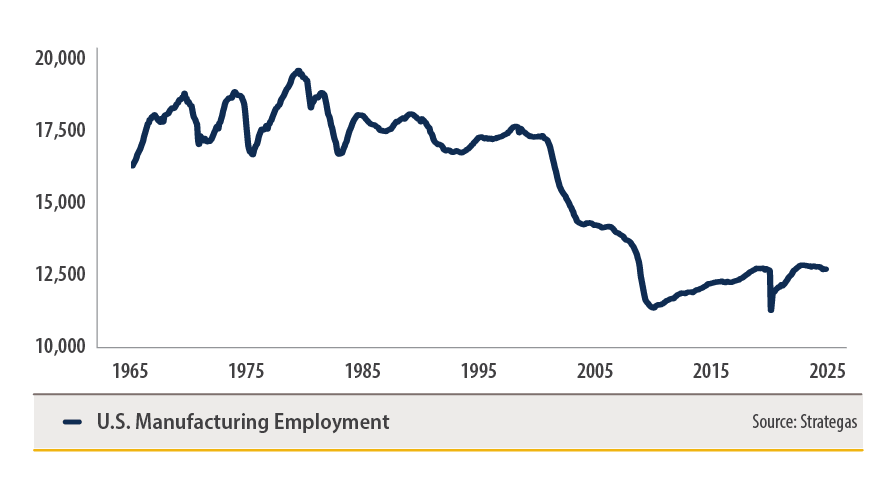

Even more fundamentally, tariffs can challenge the entire system of global trade that has been in place for decades (and which some members of the administration feel has been unfair to America). For years, entities around the globe have socked away excess savings into U.S. markets (primarily U.S. Treasurys – the closest thing to a global risk-free asset), which has kept the U.S. dollar artificially strong. A strong dollar makes U.S. goods more expensive on the global market, which punishes U.S. manufacturers over time. By imposing tariffs on a wide range of goods (thus making it less beneficial to import), the current administration would hope to reignite domestic manufacturing and level the playing field.

By making imports more expensive, tariffs could help reverse the slump in domestic manufacturing.

Q: Historically, How Have Tariffs Impacted the Economy?

A: Drawing conclusions from previous experiences with tariffs throughout history is not straightforward. For example, certain economies like the U.K. (i.e., an island) are unlikely to have developed as quickly as they did without robust international trade. Yet for the U.S., a much larger and resource-rich nation, the range of economic outcomes is wider, from the Smoot-Hawley tariffs in 1930, which contributed to the Great Depression, to the 2018 Trump 1.0 tariffs, which had little macroeconomic impact.

For an economy that is a large global producer, tariffs can be devastating if they cascade into a global trade war, with countries levying import tariffs on each other’s goods. Yet a consumer-focused economy (like that in the U.S.) can benefit from competing forces: If domestic production can grow enough to offset the hit to consumption, the overall economic impact of tariffs can be neutralized domestically over time.

Q: How Might Tariffs Impact the U.S. Stock Market?

A: Stock prices are a function of company earnings and interest rates. With a tariff, companies that benefit from a resulting increase in domestic production will see a tailwind for earnings, while those in the crosshairs of the tariff’s tax component will be disadvantaged. However, price changes due to tariffs are not guaranteed to pass all the way through the supply chain. Local consumers can still substitute non-affected products, and foreign producers might hold their market share (limiting price pass-through) if they believe the tariffs are temporary.

All said, a broad trade war could lead to a “stagflationary” outcome, which would pair weak growth with high inflation. Historically, such an outcome has been bad for real equity returns (e.g., the U.S. in the 1970s). Reduced global capital flows would also threaten companies whose valuations have been supported by foreign buyers.

However, there are offsets available to help provide a cushion, including extended tax cuts (more growth) and lower energy prices (less inflation). A sustained boost in productivity from the private sector (e.g., via artificial intelligence tools or a reduced regulatory burden) would also help ease the weight of tariffs on profits. All said, it’s the combined impact of monetary, fiscal, trade and regulatory policies that will determine future growth, inflation and stock prices. The risk of a trade war is clear – but there’s also likely support from those other policy pillars. To be fair, in 2025, that support can’t come soon enough.

This information has been developed by a member of Baird Wealth Solutions Group, a team of wealth management specialists who provide support to Baird Financial Advisor teams. The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.

Strategas has been recognized in Extel’s (formerly Institutional Investor) 2024 All-America Research Team survey and remains, for the 8th consecutive year, Extel’s highest ranked provider of exclusively macro research, preceded only by providers of both macro and bottom-up research.