Power Surge

In our Winter issue, Strategas listed a resurgence in industrial power as an economic theme to watch for in 2025. Here they discuss how artificial intelligence and industrial innovation are fueling this rapid rise in the demand for electricity.

Why 2025 Is Poised for an Industrial Power Renaissance

Whether it is an increased mandate for electric vehicles, the development of artificial intelligence, the production of cryptocurrencies or just the continued improvement in global standards of living, the demand for electricity and other sources of industrial power seems poised to grow rapidly in the next several years.

Artificial intelligence (another of our key themes for 2025) stands out specifically. All eyes have been on this area since OpenAI unveiled ChatGPT in 2022, with AI becoming a focal point of almost every company regardless of the industry they’re in. (At this point, CEOs seem to be at greater risk of getting fired by spending too little on artificial intelligence than too much.)

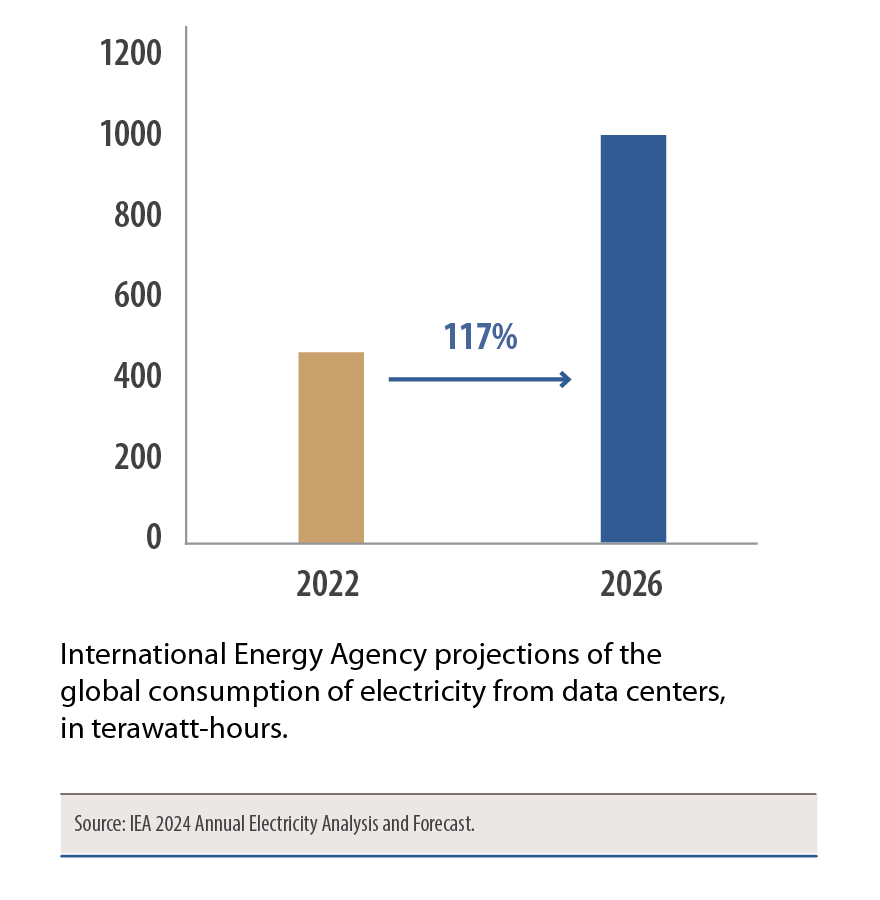

While forecasts for AI’s energy consumption vary widely, what appears to be accepted is that even “simplistic” AI-powered searches require exponentially more energy than standard searches. To put this in perspective, executive research and advisory firm Gartner estimates that AI will make up as much as 3.5% of global electricity demand by 2030 – which would be roughly double the energy consumption of all of France. What’s more, AI usage has driven the increased demand for data and, thus, data centers – which themselves require a tremendous amount of power, be it for computational usage or temperature control. With AI seemingly just scratching the surface on its utilization, these numbers could end up being significantly higher than currently estimated.

Energy consumption from data centers is expected to continue to climb.

Where the Power Will Come From

Despite subsidies for “green” alternatives, nearly 80% of electricity production in the United States is derived from fossil fuels (60%) and nuclear power (20%). Natural gas alone accounts for roughly 43% of U.S. electricity generation, and new plants are being built around the country to power data centers domestically and meet the growing liquefied natural gas (LNG) demand from abroad. Even coal, whose share of net power generation has fallen dramatically (from 50% in 2001 to 16% today), could play a role – Interior Secretary Doug Burgum recently suggested the U.S. should restart shuttered coal-fired power plants to help meet rising electricity demand.

Still, alternative power solutions are likely to fill a large and potentially growing role in the coming years. The administration’s interest in deregulating the energy sector should prove to be a catalyst for the nuclear power industry. President Trump’s recent executive order aimed at boosting U.S. nuclear power is yet another acknowledgment of the massive power needs ahead.

AI is projected to make up as much as 3.5% of the world’s electricity demand by 2030 – roughly double the energy consumption of all of France.

Although building and maintaining nuclear power facilities require vast amounts of capital and time, recent progress on small modular reactors could pave a more economical and flexible path forward for the industry. Finally, while President Trump has taken aim at green energy spending early in his second term, broad-based rollbacks to clean energy incentives will continue to face some resistance as many GOP lawmakers represent states that benefit meaningfully from nuclear, wind and hydroelectric power projects. Renewables – in some capacity – will play a role in the next phase of U.S. power generation.

Opportunities Associated With the Resurgence of Industrial Power

To play the likely rise in electricity costs, investors should consider their exposure to classic utilities – but also to companies involved in scalable alternatives to fossil fuels, the construction of new manufacturing facilities, and grid modernization efforts. And while no investment comes without risk – like pullbacks in AI-related capital spending and policy changes like green energy rollbacks – we believe the desire to reestablish America as a leader in manufacturing suggests growth in the industrial power space is only likely to accelerate from here.

Strategas has been recognized in Extel’s (formerly Institutional Investor) 2024 All-America Research Team survey and remains, for the 8th consecutive year, Extel’s highest ranked provider of exclusively macro research, preceded only by providers of both macro and bottom-up research.

This information has been developed by a member of Baird Wealth Solutions Group, a team of wealth management specialists who provide support to Baird Financial Advisor teams. The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.