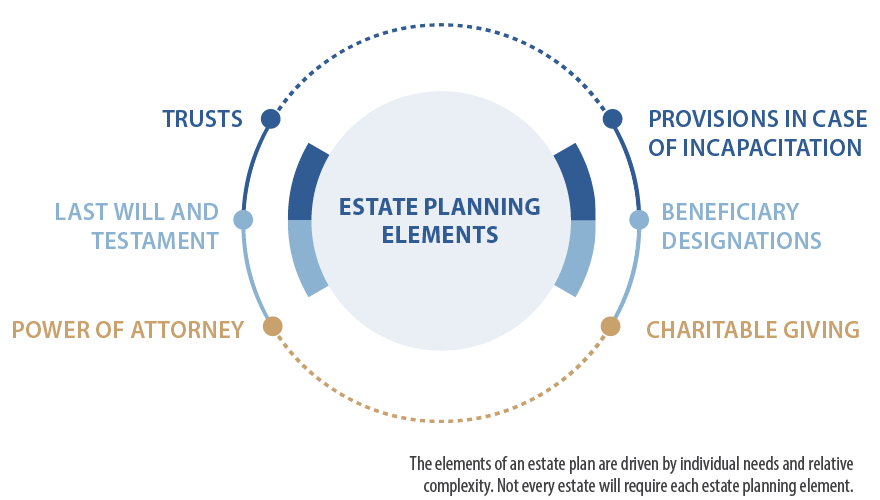

When “Will Power” Isn’t Enough: Adding Muscle to Your Estate Plan

For many, an estate plan begins and ends with a will: If you’ve spelled out how your estate is to be divided, so the thinking goes, then your estate plans are complete. The reality is, a robust estate plan does more than specify “who gets what” – it can lower your taxes, preserve your healthcare decisions and boost your charitable giving. Let’s explore what elements of a complete estate plan could look like.

Last Will and Testament

A will is a legal directive of how, when and to whom you want your assets to be distributed upon your death. If you die without a will, your assets will likely be dispersed according to the laws of your state, rather than per your personal wishes. That process typically involves a probate court, which can be time-consuming, costly and very public.

Power of Attorney

A power of attorney document is a legally binding document that appoints someone to manage your affairs on your behalf. A financial power of attorney allows someone to complete financial transactions for you, such as managing investments, paying bills and filing taxes. You might also choose a power of attorney for healthcare, also known as a living will or healthcare directive, to make medical decisions on your behalf. In either case, you can specify what the representative can and cannot do and how long the power is effective.

Powers of attorney become especially crucial in cases of incapacitation – and while no one likes to think about the prospect of this happening to them, it’s a real possibility, especially as we get older. A robust estate plan can employ protections like springing powers of attorney (wherein decisions are made by your agent on your behalf only if you become incapacitated) and give decision-making abilities to the financial institutions you trust before the worst happens and you can’t make those decisions yourself.

Beneficiary Designations

Beneficiary designations are added to assets like life insurance policies and retirement accounts to specify who will inherit the assets upon the account owner’s death. Importantly, a beneficiary designation overrides anything set forth in a will or trust. Reviewing these designations at least annually is essential to ensure your assets to go to the right people.

Charitable Giving Considerations

Estate planning tools can support your legacy, whether it’s passing to loved ones or loved causes. There are a variety of estate planning tools that can help with philanthropic giving, including charitable trusts, charitable endowments and family foundations. It’s important to keep in mind, though, that any charitable contributions incorporated into estate planning are held to strict tax laws on how much can be donated, which assets are eligible and how much is tax-deductible. Because of these guidelines, working with your Baird Financial Advisor and estate planner can help you reach your philanthropic goals in a tax-efficient manner.

Trusts

A trust is a legal arrangement in which your assets are held by a third party (known as a trustee) for the benefit of a beneficiary. There are several reasons you might choose to move assets into a trust as you find your financial situation becoming more complex. A few common ones include limiting your exposure to taxes, growing your estate for the benefit of your descendants or increasing the effectiveness of your charitable giving. Trusts can be revocable or irrevocable, depending on your needs and circumstances, and because they are not subject to probate, they can be useful for anyone seeking to shield their estate from creditors, lawsuits and fraudsters.

Of course, even the most robust estate plans are never set-it-and-forget-it: As your life and relationships evolve over time, so too should your estate plans. Make it a point to sit down with your Financial Advisor at least every three to five years, but also whenever you go through a major life event, to ensure your estate plan continues to reflect your current estate and wishes.

This information has been developed by a member of Baird Wealth Solutions Group, a team of wealth management specialists who provide support to Baird Financial Advisor teams. The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.