How Washington's Newest Bill Could Shape the Economy

While the new One Big Beautiful Bill Act (OBBBA) has a notable impact on Americans’ individual tax and wealth plans, its influence also extends more broadly. To unpack these factors, Investment Strategist Ross Mayfield sat down with Jeannette Lowe, Managing Director of Policy Research at Strategas.

Ross: Tariffs have shaped economic conversations in Washington this year. How does the administration see them fitting into its broader tax policy approach?

Jeannette: When the White House announced nearly $700 billion of tariffs on April 2, the result was a stock market selloff and lower presidential economic approval ratings. Had the policies remained, investors warned of an increased risk of recession. Instead, the White House reduced the size of the tariffs and spread them out, giving Congress time to enact the OBBBA in July. Subsequently, as tax legislation gained traction, recession odds fell.

At a high level, the administration sees U.S. trade policy as having created an imbalanced economy, with excess consumption and too little production. The COVID-19 pandemic worsened this when supply chains shut down. To rebalance, the White House is combining trade and tax policies: Higher tariffs act as a tax on U.S. consumption, while lower taxes on business investments (via the OBBBA) aim to spur domestic production. In our view, the net effect is that lower taxes should largely offset tariff costs.

Ross: Building on that, there has been significant focus on how tariffs and tax cuts might affect the budget deficit and national debt. What is Strategas’ outlook on how this might play out?

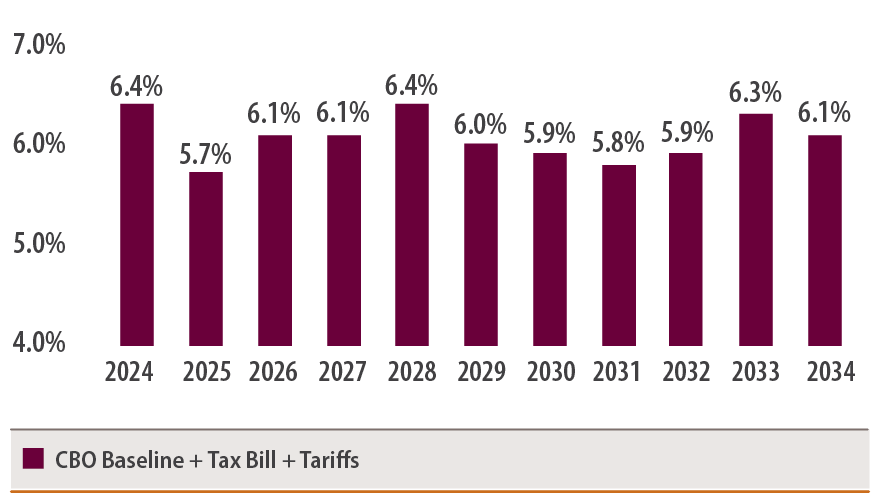

Jeannette: Public debate over the OBBBA has highlighted fears of large deficits, with analysts estimating a $3.4 trillion increase over 10 years. However, these estimates exclude tariff revenues, which we believe will offset the cost of the new tax cuts. The Congressional Budget Office recently found tariffs to date would reduce the deficit by $3.3 trillion over 10 years – making the combined effect roughly deficit neutral. There could be upward pressure on the deficit if tariffs imposed through the International Emergency Economic Powers Act are ruled illegal by the Supreme Court and required to be rebated. While this bears watching, the administration has plans to reimpose the tariffs through other means.

Budget Deficit as a Percent of GDP To Stay Elevated but Steady in the Coming Decade

Timing also matters. Tax cuts in the bill are more immediate, while the spending cuts phase in over several years. The 2017 Tax Cuts and Jobs Act tax breaks continue into 2026 (with some enhancements from the OBBBA), consumer breaks (like no taxes on tips or overtime) will take effect in 2025, and new business tax rules are more immediate. Meanwhile, the cuts to Medicaid, food stamps, student loans and renewable energy tax credits phase in slowly. The result is a fiscal stimulus tailwind through 2029, with a drag beginning in 2030.

Ross: While we've touched on how the bill will affect individual taxpayers, we know it also contained notable changes for businesses. What are some of these changes, and what could they mean for the economy?

Jeannette: Alongside $150 billion of consumer aid in early 2026, the legislation also includes several provisions affecting businesses. Some of these include:

- 100% expensing of capital equipment purchases. The TCJA allowed full expensing of capital equipment, but also included a phaseout which dropped it to 40% expensing in 2025. Now, the OBBBA restores full expensing for new equipment put into service after January 19, 2025. This change allows businesses to reduce their taxable income (and, therefore, tax liability) more quickly than with traditional depreciation methods.

- 100% expensing of domestic research and development costs. The TCJA required companies to amortize research and development expenses over five years beginning in 2022. The OBBBA now allows full expensing beginning in 2025.

- A broader corporate interest deduction. The TCJA made this deduction more restrictive beginning in 2022 by changing the calculation of adjusted taxable income, which increased tax and financing costs for capital-intensive industries. The OBBBA reverts the deduction back to one based on earnings before interest, taxes, depreciation and amortization, effective in 2025.

- 100% expensing for factory construction. Firms may now deduct 100% of the expenses for building production facilities if construction begins before 2029 and they are in service before 2031.

Taken together, these policies could encourage additional U.S. investment in equipment and production facilities, since companies will be able to write off such expenses. When combined with the new consumer tax provisions included in the bill, the measures amount to a net fiscal stimulus of 0.4% of GDP in FY25 and of 0.9% in FY26.