What’s In Store for 2026?

2026 has opened amid major economic shifts – from trade policy changes to midterm election dynamics to the timing of fiscal stimulus – that could shape new opportunities for investors. Here’s what the macroeconomic experts at Strategas are keeping an eye on as the new year unfolds.

Investment Strategy and Asset Allocation

2025 ended with a great deal of economic uncertainty, due in part to the government shutdown, tariff ambiguity and the lag between passage of last year’s tax legislation (mid-2025) and when its tax refunds and incentives will take effect (2026 and on). These factors have created concerns around hiring and business investment, but we expect conditions to improve as the bill’s tax incentives gain traction. Our view is that fiscal stimulus paired with easier monetary policy should help keep the economy out of recession in the near term.

While stocks remain expensive, strong profits help justify those high valuations. We anticipate +9% S&P 500 earnings growth in 2026 – it is tough to see the economy getting into too much trouble with earnings growing at roughly twice the pace of GDP. We also expect our investment themes from last year – artificial intelligence, an industrial power renaissance, companies with steady cash flows, and deglobalization – to remain relevant. And for 2026, we’re adding a fifth: beneficiaries of a stimulus-driven consumer spending wave.

In terms of asset allocation, we see opportunity shifting away from U.S. Large-Cap Growth and toward the industrial power players in U.S. Large- and Mid-Cap Value. Among U.S. equity sectors, we favor Financials, Industrials, Utilities and Consumer Discretionary. In a period of heightened uncertainty, deglobalization and a weaker dollar, gold and other alternative assets will likely serve as both core holdings and transition assets.

Washington Policy

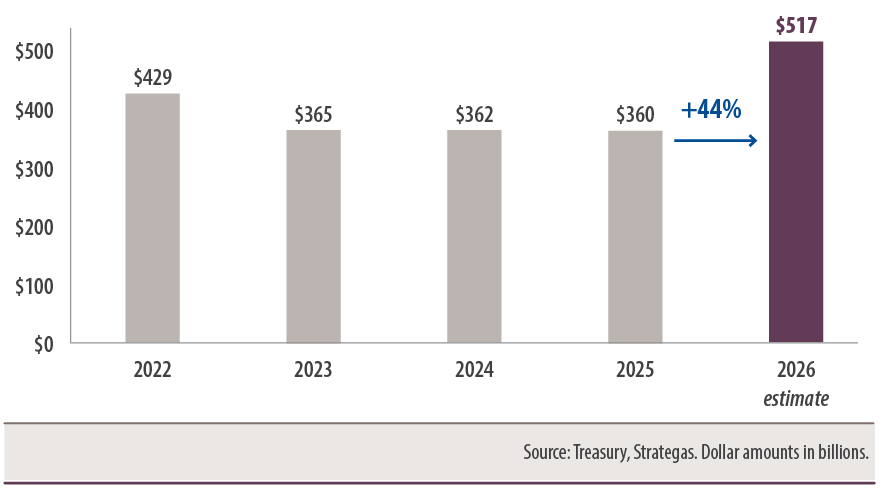

We anticipate nearly $300 billion in tax cuts for consumers and businesses in 2026 – at a time when the Federal Reserve is already cutting rates. This one-two punch of fiscal and monetary policy should offset the negative impact of tariffs, though there is potential for higher volatility until consumer stimulus hits the economy around tax season. When this tailwind does arrive, we believe U.S. growth will accelerate into the back half of the year.

Stimulus in the form of more than $500 billion in tax refunds could spur economic growth in the second half of the year.

The timing of that tailwind could even be positive: Midterm election years tend to be more challenging for the S&P 500, with an average intra-year decline of 19%. These selloffs, however, have proven to be great buying opportunities – the index has not declined in the 12 months following a midterm election since 1942.

The U.S. Economy

Inflation and higher interest rates have weighed on housing and manufacturing in recent years, and 2025’s tariff shock and government shutdown put additional pressure on economic activity. However, supply chain issues have remained manageable, and U.S. rents remain in a slowing trend. While the bout of inflation that started in 2022 appears to be over, history tells us that a second wave is possible. Productivity gains, especially from technology like AI (a topic addressed in this issue), could help keep prices in check.

Last year saw a reduction in interest rates, justified first by lower inflation and reinforced by a cooling labor market. The Fed will likely want to get monetary policy back to a neutral setting through additional rate cuts, though they don’t appear to be in a rush. Meanwhile, a growing U.S. budget deficit has the potential to crowd out other economic activity, and fixing this requires walking a fine line: Cutting the deficit too abruptly could stall the economy, but letting it run too hot could spark inflation if consumers lose confidence in prices remaining stable.

Taking all this into consideration, we are optimistic about the likelihood for growth in 2026: We place our odds at a 20% chance of recession, 60% chance of soft landing or expansion and a 20% chance of surprise to the upside. With strong earnings, policy support and clear investment themes, we believe 2026 offers significant opportunities for disciplined investors.

Strategas has been recognized in Extel’s (formerly Institutional Investor) 2025 All-America Research Team survey and remains, for the 9th consecutive year, Extel’s highest ranked provider of exclusively macro research, preceded only by providers of both macro and bottom-up research. Extel rankings issued October 2025 based on data through June 2025. Strategas was ranked the #1 Macro-Only Sell-Side firm in Extel’s All-America Research survey. Rankings, ratings or awards may not be representative of any specific client’s experience. Extel official rankings and methodology at extelinsights.com/results

This information has been developed by a member of Baird Wealth Solutions Group, a team of wealth management specialists who provide support to Baird Financial Advisor teams. The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.