Tariff Revenue Offsets the Cost of Tax Cuts

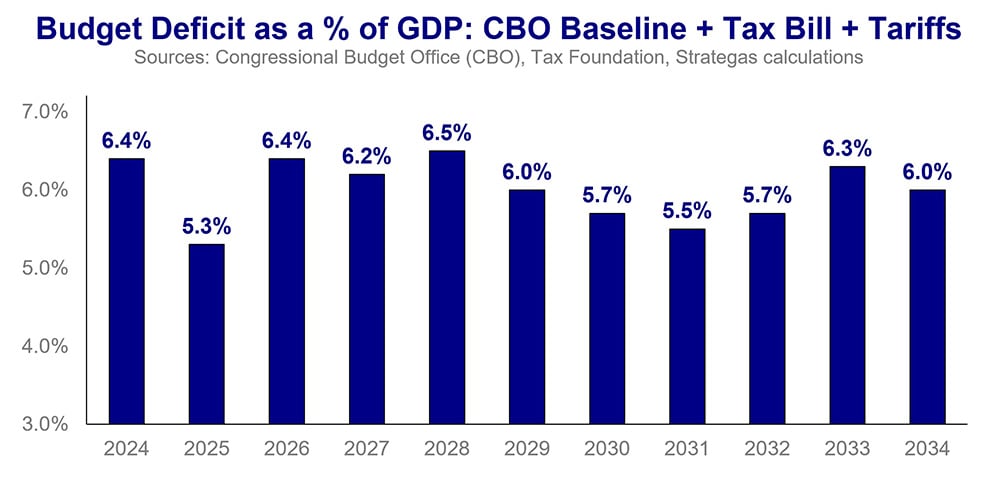

Investors and financial markets have expressed concern that the tax bill Congress is currently debating will increase the U.S. deficit and possibly lead to higher bond yields. This view comes from looking at the tax bill in isolation. However, the tariffs that have been implemented so far this year are expected to offset the cost of the tax cuts. Given the importance of tariffs to the U.S. fiscal situation, some of Trump’s tariffs seem here to stay.

Congress is moving forward on legislation to extend the 2017 tax cuts that expire at the end of 2025, which include new, temporary tax measures such as President Trump’s campaign promises (e.g., lower/no tax on tips), as well as tax provisions to encourage domestic investment (particularly in manufacturing facilities). The House passed its version and the Senate is now working on the legislation. In its current form, according to Congress’ official budget scorekeeper, the Congressional Budget Office (CBO), the bill reduces revenues by $3.7 trilllion over 10 years and lowers spending by $1.3 trillion primarily due to cuts to Medicaid, Supplemental Nutrition Assistance Program (SNAP), and the phasing out of tax credits that are used to support green energy. Taken together, the CBO estimates that the bill will increase the federal deficit by $2.4 trillion over 10 years. We would note that these numbers are likely to change as Congress continues to debate the bill.

However, the CBO estimates seperately that tariffs imposed since the start of the year will provide an additional $2.5 trillion of tax revenue over 10 years. Hence, the CBO’s estimate is that the tariffs will pay for the tax cut extension passed by the House. Our estimate has been that the tariffs and the tax bill will equalize one another and not increase or decrease the deficit, similar to the CBO’s conclusion.

According to our estimates, growth provisions added to the tax bill for business development mean that the deficit and nominal GDP will move in line with one another in the first five years the bill is in effect. From here, the tax legislation headed to the Senate focuses on four key components:

- Extension of expiring tax cuts, such as income tax rates, the child tax credit, standard deduction, Alternative Minimum Tax patch, and estate tax.

- President Trump’s campaign promises for lower taxes on tips, overtime, senior citizen income, and auto loan interest.

- Short-term growth provisions designed to spur business investment and modest consumer tax cuts.

- $1.3 trillion of spending reductions in the areas of student loans, health care, and renewable energy.

We expect the 10% “universal” tariffs on imports from all countries to remain in place as well as 30% additional tariffs on goods from China and sectoral tariffs (e.g., steel and aluminum). Given the importance of tariffs to the U.S. fiscal environment, the tariffs will likely last through future presidential administrations. If the courts rule against the tariffs, Trump has a back-up plan. Still, even with tariffs, the deficit is not improving. The deficit remains a concern, particularly as net interest costs to service U.S. debt continue to take up a larger portion of the federal budget and squeeze out other fiscal priorities. At some point the deficit will need to improve or Treasury will have to increase its long-term bond issuance.

Appendix – Important Disclosures

Past performance is not indicative of future results. This communication was prepared by Strategas Securities, LLC (“we” or “us”). Recipients of this communication may not distribute it to others without our express prior consent.

This communication was prepared by Strategas Securities, LLC (“we” or “us”). Recipients of this communication may not distribute it to others without our express prior consent. This communication is provided for informational purposes only and is not an offer, recommendation or solicitation to buy or sell any security. Unless otherwise cited, market and economic statistics come from data providers Bloomberg and FactSet. This communication does not constitute, nor should it be regarded as, investment research or a research report or securities recommendation and it does not provide information reasonably sufficient upon which to base an investment decision. This is not a complete analysis of every material fact regarding any company, industry or security. Additional analysis would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any particular client and is not presented as suitable to any other particular client. Investment involves risk. You should review the prospectus or other offering materials for an investment before you invest. You should also consult with your financial advisor to assist you with your analysis, risk evaluation, and decision-making regarding any investment.

The performance and other information presented in this communication is not indicative of future results. The information in this communication has been obtained from sources we consider to be reliable, but we cannot guarantee its accuracy. The information is current only as of the date of this communication and we do not undertake to update or revise such information following such date. To the extent that any securities or their issuers are included in this communication, we do not undertake to provide any information about such securities or their issuers in the future. We do not follow, cover or provide any fundamental or technical analyses, investment ratings, price targets, financial models or other guidance on any particular securities or companies. Further, to the extent that any securities or their issuers are included in this communication, each person responsible for the content included in this communication certifies that any views expressed with respect to such securities or their issuers accurately reflect his or her personal views about the same and that no part of his or her compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in this communication. This communication is provided on a “where is, as is” basis, and we expressly disclaim any liability for any losses or other consequences of any person’s use of or reliance on the information contained in this communication.

Strategas Securities, LLC is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), a broker-dealer and FINRA member firm, although the two firms conduct separate and distinct businesses. A complete listing of all applicable disclosures pertaining to Baird with respect to any individual companies mentioned in this communication can be accessed at http://www.rwbaird.com/research-insights/research/coverage/third-party-research-disclosures.aspx. You can also call 1-800-792-2473 or write: Baird PWM Research & Analytics, 777 East Wisconsin Avenue, Milwaukee, WI 53202.