Key Takeaways from the Tax Bill

There are five key components of the tax bill: 1) Extension of $400 billion of expiring tax provisions; 2) Passage of President Trump’s campaign promises; 3) Pro-growth provisions to boost business investment; 4) Spending cuts; and 5) A $5 trillion increase in the debt ceiling.

Extension of Expiring Tax Provisions

Regardless of which party was in power, Congress was most likely going to act by the end of the year to extend expiring tax provisions in order to prevent a $400 billion tax increase on middle-class families in 2026. Congress chose to extend these tax cuts permanently, which means that it will require another act of Congress to change the tax rates in the future. Several tax changes were also included, such as an increase in the state and local tax deduction (on a temporary basis) to $40,000 a year for individuals earning $500,000 or less and an increase in the estate tax exemption (on a permanent basis) to $15 million beginning in 2026, with the threshold indexed to inflation in future years.

President Trump’s Consumer Aid Campaign Promises

Trump campaigned on ending taxes on tips, on overtime, on Social Security, and on auto interest payments. Each of these four campaign promises was included in the bill in some form. However, each of these provisions was made temporary and they will not apply beginning in tax year 2029 unless extended in the future.

Pro-Growth Provisions

The new tax law allows for:

- 100% expensing of capital equipment purchases

- 100% expensing of research and development (R&D) costs

- A more generous corporate interest deduction

- Full expensing for the building of factories

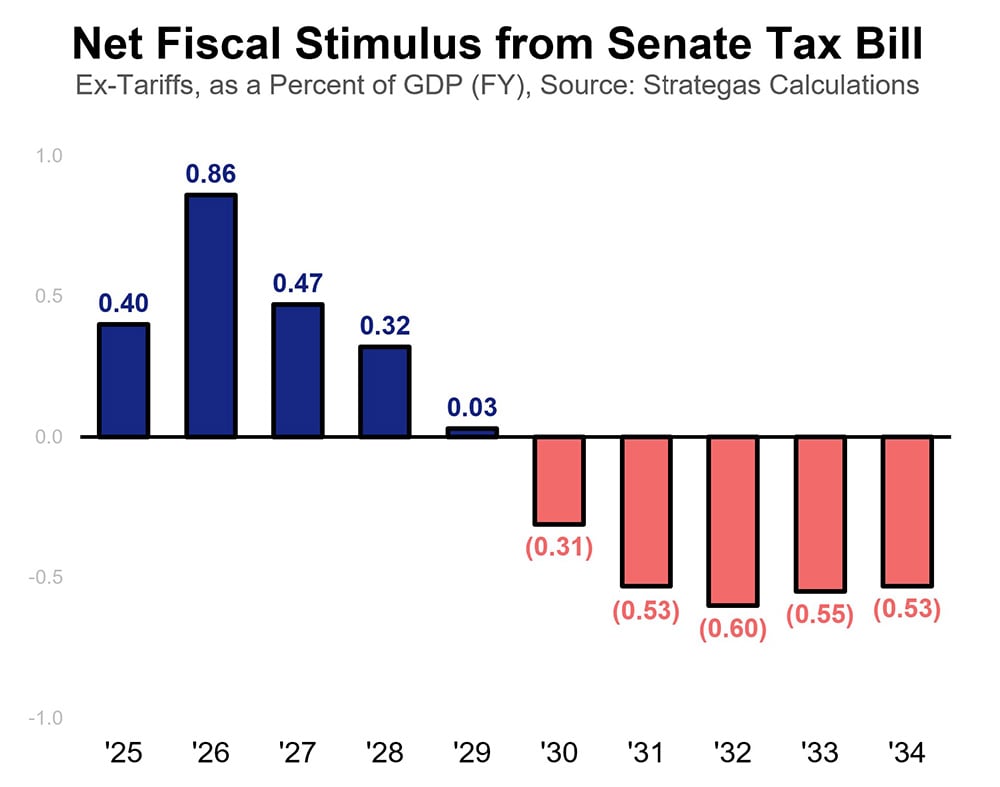

Together, these policies should create a building boom in the U.S. When combined with the consumer tax provisions in the bill, they provide a net fiscal stimulus of 0.4% of GDP in FY25 and of 0.9% of GDP in FY26, helping to offset the impact of tariffs in those years.

Spending Cuts

The tax bill includes various spending cuts in an effort to reduce federal expenditures and to pay for the tax cuts. While the Congressional Budget Office has not yet provided its final cost estimate of the legislation, we estimate that the cuts will amount to $1.3 to $1.6 trillion over the next 10 years. These include major changes to renewable energy spending, Medicaid, food stamps, and student loans. Some of these cuts to federal spending will also have a ripple effect on state budgets, requiring states to either cut programs or find alternative sources of funding for affected programs.

Debt Ceiling

The tax bill, upon enactment, lifted the U.S. debt ceiling by $5 trillion. The U.S. hit the debt ceiling in January 2025, which prohibited Treasury from issuing net new debt. Now that the debt ceiling is lifted, Treasury can begin reissuing debt. By lifting the debt ceiling well in advance of the debt ceiling “X date” (the date when the Treasury Department would have exhausted its cash reserves and extraordinary measures), this also avoids any financial market volatility that would normally be expected to occur if the US came close to defaulting on its debt.

Appendix – Important Disclosures

Past performance is not indicative of future results. This communication was prepared by Strategas Securities, LLC (“we” or “us”). Recipients of this communication may not distribute it to others without our express prior consent.

This communication was prepared by Strategas Securities, LLC (“we” or “us”). Recipients of this communication may not distribute it to others without our express prior consent. This communication is provided for informational purposes only and is not an offer, recommendation or solicitation to buy or sell any security. Unless otherwise cited, market and economic statistics come from data providers Bloomberg and FactSet. This communication does not constitute, nor should it be regarded as, investment research or a research report or securities recommendation and it does not provide information reasonably sufficient upon which to base an investment decision. This is not a complete analysis of every material fact regarding any company, industry or security. Additional analysis would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any particular client and is not presented as suitable to any other particular client. Investment involves risk. You should review the prospectus or other offering materials for an investment before you invest. You should also consult with your financial advisor to assist you with your analysis, risk evaluation, and decision-making regarding any investment.

The performance and other information presented in this communication is not indicative of future results. The information in this communication has been obtained from sources we consider to be reliable, but we cannot guarantee its accuracy. The information is current only as of the date of this communication and we do not undertake to update or revise such information following such date. To the extent that any securities or their issuers are included in this communication, we do not undertake to provide any information about such securities or their issuers in the future. We do not follow, cover or provide any fundamental or technical analyses, investment ratings, price targets, financial models or other guidance on any particular securities or companies. Further, to the extent that any securities or their issuers are included in this communication, each person responsible for the content included in this communication certifies that any views expressed with respect to such securities or their issuers accurately reflect his or her personal views about the same and that no part of his or her compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in this communication. This communication is provided on a “where is, as is” basis, and we expressly disclaim any liability for any losses or other consequences of any person’s use of or reliance on the information contained in this communication.

Strategas Securities, LLC is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), a broker-dealer and FINRA member firm, although the two firms conduct separate and distinct businesses. A complete listing of all applicable disclosures pertaining to Baird with respect to any individual companies mentioned in this communication can be accessed at https://www.rwbaird.com/research-coverage/. You can also call 1-800-792-2473 or write: Baird PWM Research & Analytics, 777 East Wisconsin Avenue, Milwaukee, WI 53202.