Trump's Tariffs Face Legal Risk

President Trump’s tariffs have moderated since his April 2 “Liberation Day” announcement. The level of tariffs has been lowered from $670 billion to about $375 billion today. In our view, this policy is more likely to hurt growth than to stoke inflation. The tariffs also face real legal risk that could lead to more trade uncertainty in the weeks and months ahead.

Trump’s Tariffs Face Legal Risk, But the Administration Has A Back-Up Plan

The president created real economic risk on April 2 by putting nearly $700 billion in tariffs on the table. In our estimation, the effect of leaving the initial tariffs in place would have been to shave several percentage points off GDP and put the US economy into a recession. The strong financial market response, coupled with Trump’s falling approval ratings on the economy, seemed evidence that he was burning his hand on the stove with that policy.

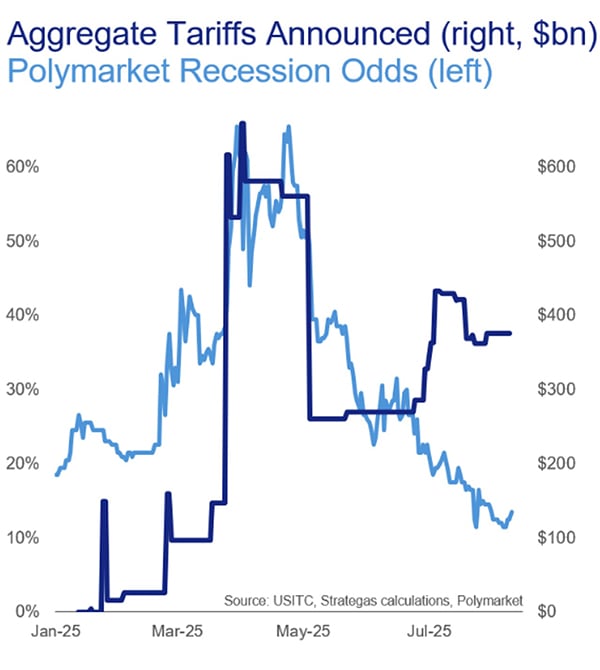

As a result, the level of tariffs was lowered from $670 billion to $270 billion and Congress was given time to mitigate the negative impact of the tariffs by passing the One Big Beautiful Bill Act (which provides tax cuts for consumers and businesses). Recession risk fell, as shown in the chart below, once Congress enacted the tax bill. The bill’s $280 billion of new tax cuts over the next 12 months helped significantly to offset the tariffs.

Since the bill passed, tariffs have increased another $100 billion to about $375 billion.

Although the president has yet to announce tariffs on semiconductors and pharmaceuticals, those proposals are being watered down with exemptions for companies that manufacture in the US or build with the intent to do so. The effective tariff rate is, therefore, tracking below 15%—despite estimates in the press that the effective tariff rate is closer to 18% or 19%. By our measure, an 18-19% rate would require $560-600 billion in tariff revenue over 12 months, which is far more than is being implemented.

We expect the Court of Appeals for the Federal Circuit to issue its decision shortly as to whether Trump can issue tariffs under the International Emergency Economic Powers Act (IEEPA).

In May, the lower court, the Court of International Trade, ruled that it was not permissable, and the administration appealed (note: only the tariffs imposed under IEEPA are being challenged, not sectoral tariffs on steel, aluminum, autos, copper, etc.). If the administration loses at the Court of Appeals, we expect an appeal to the Supreme Court, which could hear the case in October and possibly rule in January. Removal of the tariffs would be a significant capital market event. The court could also require the tariffs imposed under IEEPA to be rebated, which could amount to $100bn in fiscal stimulus being injected into the economy over a period of time (and a corresponding deficit increase).

Still, even if the tariffs are ruled unconstitutional, the White House has a back-up plan to reimpose the tariffs through other authorities that have a stronger legal footing.

The drawback for the administration is that it would be a less efficient process than declaring a national emergency. Therefore, if the courts rule against the IEEPA tariffs, tariffs would not go away completely, but it would result in significantly more trade uncertainty over the coming months.

Appendix – Important Disclosures

Past performance is not indicative of future results. This communication was prepared by Strategas Securities, LLC (“we” or “us”). Recipients of this communication may not distribute it to others without our express prior consent.

This communication was prepared by Strategas Securities, LLC (“we” or “us”). Recipients of this communication may not distribute it to others without our express prior consent. This communication is provided for informational purposes only and is not an offer, recommendation or solicitation to buy or sell any security. Unless otherwise cited, market and economic statistics come from data providers Bloomberg and FactSet. This communication does not constitute, nor should it be regarded as, investment research or a research report or securities recommendation and it does not provide information reasonably sufficient upon which to base an investment decision. This is not a complete analysis of every material fact regarding any company, industry or security. Additional analysis would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any particular client and is not presented as suitable to any other particular client. Investment involves risk. You should review the prospectus or other offering materials for an investment before you invest. You should also consult with your financial advisor to assist you with your analysis, risk evaluation, and decision-making regarding any investment.

The performance and other information presented in this communication is not indicative of future results. The information in this communication has been obtained from sources we consider to be reliable, but we cannot guarantee its accuracy. The information is current only as of the date of this communication and we do not undertake to update or revise such information following such date. To the extent that any securities or their issuers are included in this communication, we do not undertake to provide any information about such securities or their issuers in the future. We do not follow, cover or provide any fundamental or technical analyses, investment ratings, price targets, financial models or other guidance on any particular securities or companies. Further, to the extent that any securities or their issuers are included in this communication, each person responsible for the content included in this communication certifies that any views expressed with respect to such securities or their issuers accurately reflect his or her personal views about the same and that no part of his or her compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in this communication. This communication is provided on a “where is, as is” basis, and we expressly disclaim any liability for any losses or other consequences of any person’s use of or reliance on the information contained in this communication.

Strategas Securities, LLC is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), a broker-dealer and FINRA member firm, although the two firms conduct separate and distinct businesses. A complete listing of all applicable disclosures pertaining to Baird with respect to any individual companies mentioned in this communication can be accessed at https://www.rwbaird.com/research-coverage/. You can also call 1-800-792-2473 or write: Baird PWM Research & Analytics, 777 East Wisconsin Avenue, Milwaukee, WI 53202.