Significant Consumer Stimulus Arrives in 2026

The U.S. consumer faced headwinds in 2025, including a government shutdown that halted federal employee pay and food stamp benefits. However, once we get into 2026, the consumer should benefit from significant consumer stimulus that is coming down the pike.

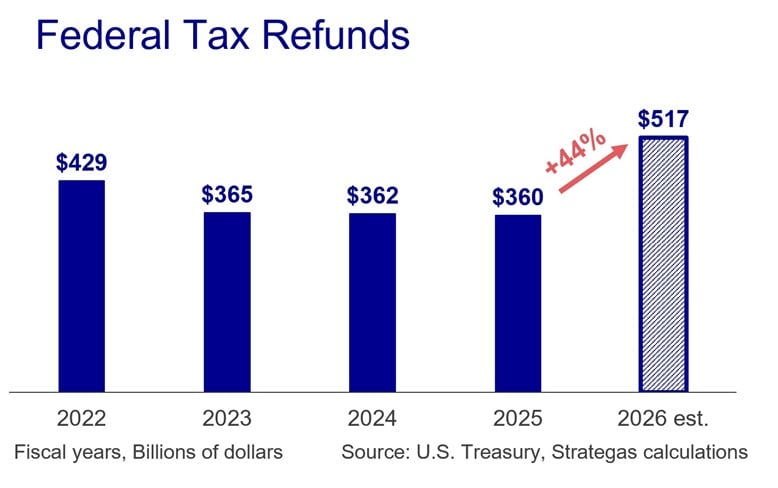

The OBBBA serves as a delayed stimulus. The One Big Beautiful Bill Act, enacted in July, included both consumer and business tax cuts that were designed in part to offset the negative economic impact of the tariffs imposed this year. However, there was a timing mismatch for the consumer. Had the tax bill cut individuals’ income tax rates directly, it would have immediately reduced the amount of income tax withheld from paychecks, essentially giving workers a raise as soon as the bill was enacted. Instead, Congress changed tax deductions. Hence, the tax cuts will instead arrive in the form of tax refunds in early 2026. Although there is talk from the Trump administration about providing tariff refunds to certain individuals, those refunds are likely not needed given the size of what is already in the pipeline. Our calculations conclude that consumers will see an aggregate 44% increase in tax refunds in 2026 compared to this year’s tax refunds.

Lower, middle, and slightly upper-income consumers will all benefit from the tax bill. The roughly $150 billion in tax refunds consists of 1) an increase in the standard deduction, 2) no tax on tips, overtime, or car loan interest, and 3) an increase in the child tax credit. Also included are an increase in the state and local tax deduction from $10,000 to $40,000 (for those earning less than $500,000) and an additional $6,000 senior tax deduction for those earning up to $75,000. Consumers tend to spend their tax refunds, which should lead to higher retail sales and benefit states via higher sales tax revenues.

Business tax cuts were also key components of the bill. The OBBBA included four key business tax credits: 1) 100% expensing for capital equipment purchases (versus 40% expensing for 2025); 2) 100% expensing for domestic research and development costs (versus amortization over five years); 3) a more generous corporate interest deduction (based on EBITDA versus EBIT); and 4) immediate expensing for the building of production and manufacturing facilities (a new tax provision to encourage more domestic manufacturing). All four of these tax cuts were made retroactive to January 2025.

Companies already began to reap tax benefits in September. Companies have already benefited from $100 billion in lower corporate tax revenue as of September tax payments. Another $135 billion comes in 2026. Therefore, business and consumer tax cuts combined will result in approximately $285 billion of fiscal stimulus in 2026. That is a significant economic tailwind—nearly 1% of GDP in total. In addition, this stimulus is coming at the same time that the Federal Reserve is expected to further loosen financial conditions by 1) continuing to cut interest rates; and 2) no longer contracting its balance sheet. Both moves should benefit both consumers and businesses into 2026.

APPENDIX – IMPORTANT DISCLOSURES

Past performance is not indicative of future results. This communication was prepared by Strategas Securities, LLC (“we” or “us”). Recipients of this communication may not distribute it to others without our express prior consent.

This communication was prepared by Strategas Securities, LLC (“we” or “us”). Recipients of this communication may not distribute it to others without our express prior consent. This communication is provided for informational purposes only and is not an offer, recommendation or solicitation to buy or sell any security. Unless otherwise cited, market and economic statistics come from data providers Bloomberg and FactSet. This communication does not constitute, nor should it be regarded as, investment research or a research report or securities recommendation and it does not provide information reasonably sufficient upon which to base an investment decision. This is not a complete analysis of every material fact regarding any company, industry or security. Additional analysis would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any particular client and is not presented as suitable to any other particular client. Investment involves risk. You should review the prospectus or other offering materials for an investment before you invest. You should also consult with your financial advisor to assist you with your analysis, risk evaluation, and decision-making regarding any investment.

The performance and other information presented in this communication is not indicative of future results. The information in this communication has been obtained from sources we consider to be reliable, but we cannot guarantee its accuracy. The information is current only as of the date of this communication and we do not undertake to update or revise such information following such date. To the extent that any securities or their issuers are included in this communication, we do not undertake to provide any information about such securities or their issuers in the future. We do not follow, cover or provide any fundamental or technical analyses, investment ratings, price targets, financial models or other guidance on any particular securities or companies. Further, to the extent that any securities or their issuers are included in this communication, each person responsible for the content included in this communication certifies that any views expressed with respect to such securities or their issuers accurately reflect his or her personal views about the same and that no part of his or her compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in this communication. This communication is provided on a “where is, as is” basis, and we expressly disclaim any liability for any losses or other consequences of any person’s use of or reliance on the information contained in this communication.

Strategas Securities, LLC is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), a broker-dealer and FINRA member firm, although the two firms conduct separate and distinct businesses. A complete listing of all applicable disclosures pertaining to Baird with respect to any individual companies mentioned in this communication can be accessed at https://www.rwbaird.com/research-coverage/. You can also call 1-800-792-2473 or write: Baird PWM Research & Analytics, 777 East Wisconsin Avenue, Milwaukee, WI 53202.