ESG Investing During the COVID Pandemic

Mike:

John, my friend, how are you? It’s been a while since we’ve had a face-to-face chat, but one of the last things we talked about was values-based wealth management, the notion that aligning your core values to investing is more than just security selection. It was a great conversation over a cup of coffee – do you remember having coffee with people?

2020 has given me a chance to reflect on what’s important and how I might be able to make a change in my community, and part of that is thinking about how I invest my money. ESG investing is sometimes used as a part of values-based wealth management, so I was curious how those kinds of funds were performing this year. I figured this was a good time to reconnect on the topic.

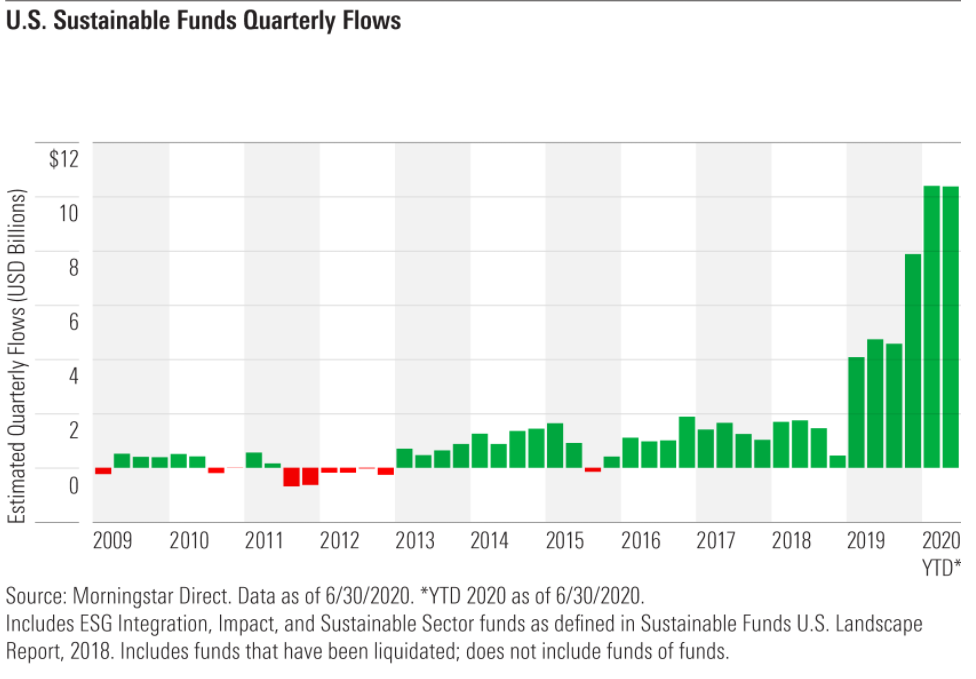

There were a lot of hot takes that ESG investing was only a bull market thing, that it wouldn’t last once a nasty bear market reared its head. But check out this chart from Morningstar:

Using fund flows as a measure of demand, it looks like ESG not only survived the onset of COVID, it thrived. What say you, John? Has ESG investing moved from a trendy topic in the investing world to a force to be reckoned with? Why do you think these funds saw record inflows in Q1 2020?

John:

You’re spot on, Mike. Around the world, more money is flowing into strategies that have some element of social responsibility embedded in them than any other type of investment strategies. I enthusiastically support that trend. Helping individuals and institutions align their values with their investments and encouraging responsible corporate behavior will have a bigger impact on issues like climate change, gender equity, racial diversity and income inequality than any amount of government regulation. And we now have enough data over a long enough period of time to demonstrate that if you do socially responsible investing right, not only do you not need to give up performance – you can actually improve long-term performance.

Mike:

I grabbed 3 ESG indices and compared their performance to the S&P 500 over a three-year timeframe. All three of them outperformed the broader index even with some nasty market conditions (late 2018, early 2020).

Now, a lot of this is due to their composition (overweight tech, underweight energy) and we don’t have a ton of data here, but it looks to me like ESG investing is starting to show its chops even outside of bull markets. The biggest question on my mind is how will ESG funds perform if “growthy tech” hits a soft patch? That being said, I firmly believe that 2020 has revealed the role good businesses can play in a time of crisis. The ones who are acting on behalf of us all should benefit from investor capital.

Victor Hugo said, “Nothing is stronger than an idea whose time has come,” and I think ESG’s time has come.

John:

No question, this is a powerful incoming trend. In the U.S., still only 25% of institutionally managed assets are invested in socially responsible strategies, according to the U.S. SIF Foundation, with the percentage much lower in individual accounts. So there is still a long way to go, which means companies that behave in ways that attract socially responsible capital should outperform those that don’t or won’t.

But three things need to happen for momentum to continue building:

- First, education. While most people have heard about SRI, ESG, negative screening, impact investing and values-based investing, few understand the differences between these various approaches, much less how to implement them. I’ve spent a lot of time with clients just giving them a framework for how to understand what’s going on.

- Second, planning. A recent article in The Economist pointed out there is a lot of “woolly thinking” around SRI. Investors need to think clearly and carefully up front about what exactly they want to accomplish before putting a new socially responsible investment strategy into place.

- Third, rigor. We need to develop better metrics and more consistent standards for how to evaluate companies and organizations along dimensions of socially responsible behavior. That’s happening … slowly. When it does, though, the sky’s the limit.

Mike:

Dear reader: Our chat about how ESG is performing in 2020 is intended to show you that this style of investing continues to gain traction in our industry, but ultimately it’s in your hands to use investing as one way to put your core beliefs and values into action. Values-based wealth management – something we are passionate about here – is more than just ESG/SRI investing, it’s about aligning your values to your financial goals and partnering with an advisor to make that happen. If socially responsible investing is important to you, then make sure to work with your advisor to seek out and reward those industries and companies who you feel are behaving responsibly.

Be the change you want to see.

The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.