A Final Thought on the 2020 Election

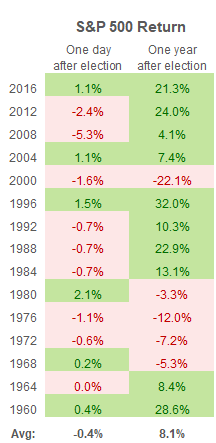

While this election might have more ambiguity than we’re used to, with so much uncertainty over control of the Senate and contested results, one thing is clear: The market’s reaction the day after the election hasn’t historically told us anything about where it’s headed long-term. As Figure 1 demonstrates, presidential elections can definitely move the market, but their impact doesn’t tend to last very long.

Figure 1: While short-term market movement is common after a presidential election, it hasn’t correlated with fundamental market shifts. Source: FactSet.

This has held true regardless of party. In 2012, the market responded to Barack Obama’s reelection with a -2.4% swoon, only to rebound to a +24% showing one year out. A similar dynamic took place in 1988, when the market initially responded to George H. W. Bush’s election with a -0.7% market dip, only to rise to nearly 23% a year later. Whether it’s a Democratic president or a Republican one, whether the market initially rises or falls in response – history tells us there’s no correlation or predictive power between the market’s initial reaction post-election and what that means for investors long-term.

For sure, there will be a lot of emotion on Election Day, and in the following weeks the market might respond in kind – initially. Instead of making assumptions on what those next-day results might mean for your portfolio, we invite you to check out our Investing in an Election Year video by Baird Market Strategist Mike Antonelli and companion article. These pieces will give you more informed insight into the intersection of politics and market performance.

The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.