So Now What?

We’ll face many elections over our lives. Not all of them will feel as intense as the most recent one, but they will always be emotional and weighty events. This is precisely why we believe politics and investing do not mix well. Politics are hot-blooded and volatile; investing should be evidence-based and rational. To put it bluntly, politics and investing go together like toothpaste and orange juice.

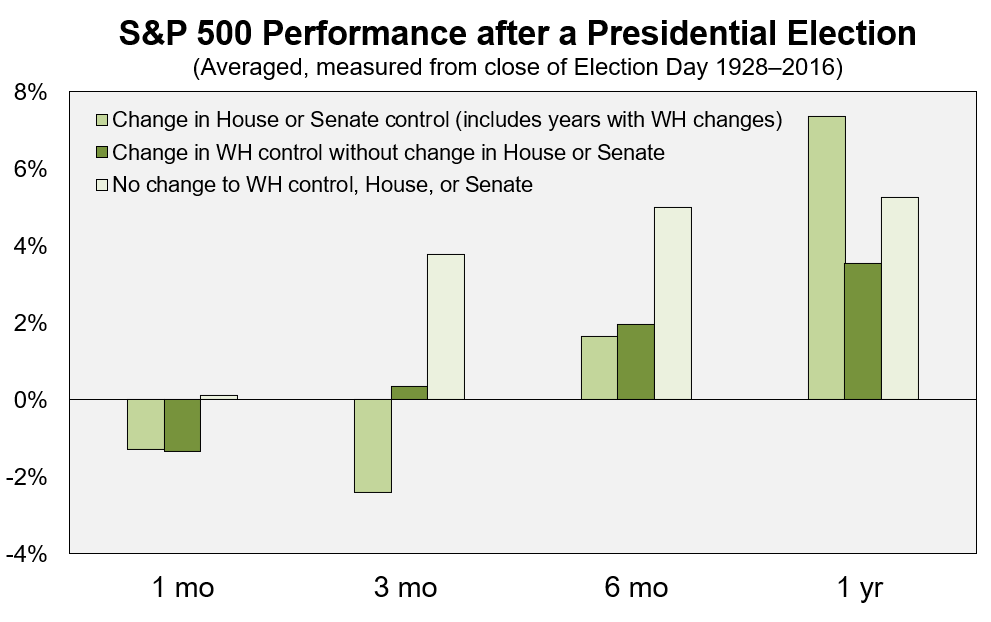

With control of the Senate still up in the air, political volatility may remain elevated over the coming months. The good news for investors is that however the chips may fall in Washington, historically it has not mattered for the patient, long-term investor. As you can see in this chart, near-term S&P 500 returns have been a mixed bag in any of the three potential outcomes. But one year out, the average return under all three scenarios has turned positive. Uncertainty will abate, the government will govern and market focus will broaden to include other factors.

History is littered with surprises, and the kinds of things that truly move the market are never known in advance. An investor has no edge – none! – in trying to time the market based on some guess about what might happen in the short run. But they do have an edge when they focus on their own behavior and stay as patient as possible. When our advisors craft a plan for a client, the plan is to meet that client’s goals regardless of what happens in life. Pandemics, elections, booms, busts – a durable financial plan can not only survive an uncertain future, but profit from it

Let the political intrigue play out as it will, and if this is an anxious time for you, we hope you can spend time focusing on all the things that matter most to you: contentment, a legacy, time spent with family and friends, living life to the fullest. Do what you can to stop obsessing about the future – and if your financial situation is one of the things that is keeping you awake at night, please reach out to your Baird Financial Advisor.

The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.