Washington Policy Research - October 4, 2021

Short-term Risk as a Congress Fights Over How to Lift the Debt Ceiling

What is the debt ceiling?

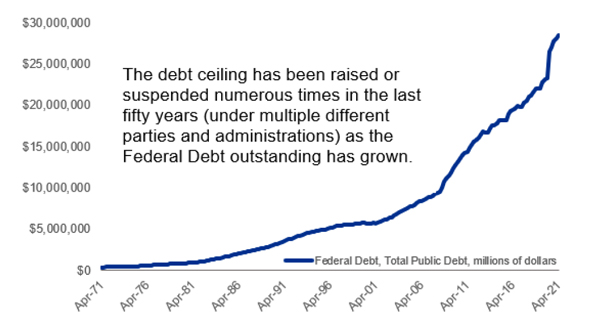

The debt ceiling is a congressional limit placed on the amount of debt that the US Treasury can borrow. When the limit is reached, Congress must pass a debt ceiling increase or suspend the debt limit for a period (so Treasury can continue issuing debt). Congress last suspended the ceiling in 2019, giving Treasury until July 31 of this year to issue debt. That date has, of course, now passed, and Treasury is employing “extraordinary measures” in order to prevent the US from having to issue new debt. Sometime later in October, Treasury will run out of extraordinary items and Congress will need to act. If the debt ceiling is not raised or suspended then, Treasury will need to prioritize what gets funded with existing cash flow (from federal tax revenue, etc.)

Is the risk higher this time vs. past episodes?

A congressional vote to raise the debt ceiling is a tough political vote, and the process is never easy. Over the past 40 years, budget reforms have been attached to debt ceiling increases, giving members of Congress cover to authorize more debt. The most contentious debt ceiling increase was in 2011 when government was split. In response to the $1 trillion deficit, House Republicans demanded spending cuts for their votes, which Democrats opposed. The ordeal led to a downgrade of US credit and stocks fell ~20%. Raising the debt ceiling remains difficult but the brinksmanship has waned somewhat as the memory of 2011 has faded. We expect greater risk this time, as both parties are dug into their positions.

As of today, do you expect the debt ceiling standoff to be resolved?

Few members of Congress want to breach the debt ceiling, but both parties believe responsibility to act lies with the other party. Republicans refuse to help Democrats because they are pursuing a multi-trillion dollar spending package. Conversely, Democrats believe some of the existing debt was accumulated under a Republican president and, thus, Republicans need to vote for the debt ceiling. The level of risk will be determined by the path taken. The debt ceiling can be raised through the budget reconciliation process, which allows for Democrats to move without Republican votes. Should they go this route, much of the risk will fade quickly. However, if Democrats choose to forgo that option, they functionally set up a game of chicken with Republicans as the deadline approaches. Financial markets will need to price in some risk of a policy mistake.

What is the likelihood that the US will default on its debt if Congress does not lift the debt ceiling by October 18?

The risk of the US breaching the debt ceiling is elevated but unlikely. Congress usually responds at the last minute. And even if Congress does not vote to raise the debt ceiling in time, there is more than enough cash flow for Treasury to service the debt. As such, there is a greater risk of the federal government being forced to prioritize their government expenditures, but we would classify an actual default risk to be low.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient to base an investment decision on. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Strategas Asset Management, LLC and Strategas Securities, LLC are affiliated with and wholly owned by Robert W. Baird & Co. Incorporated, a broker-dealer and FINRA member firm, although the firms conduct separate and distinct businesses.

Copyright 2020 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.