Washington Policy Research – January 18, 2022

Heading into the new year, there are several big changes to monetary and fiscal policy that will undoubtedly impact financial markets. The Strategas Washington Research team kicks off 2022 by discussing some key themes for the year ahead and items for investors to watch as the year develops.

Key Policy Themes for 2022

The policy sands are shifting as we enter 2022: it’s a midterm election year, the US is less focused on the COVID-19 pandemic and more focused on fighting inflation, and the political climate continues to evolve. To help navigate this rapidly changing environment, we present below three of our key policy themes for the new year that will impact financial markets.

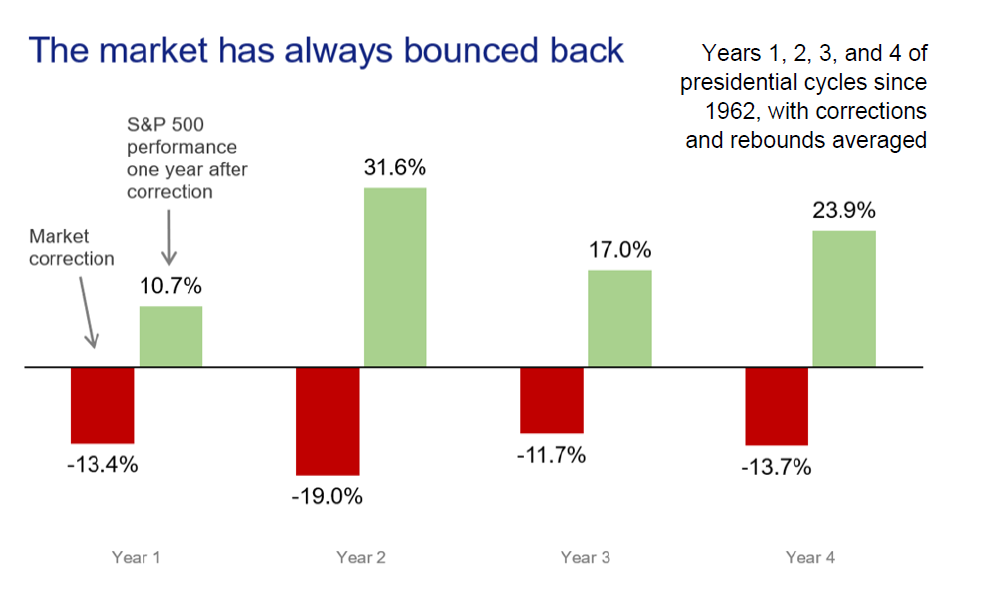

Midterm election years bring stock market volatility...and buying opportunities.

Historically, midterm election years are much more volatile for the stock market than non-midterm years. The average S&P 500 intrayear decline in midterm election years is 19%, as compared to just 13% in the other three years of the presidential cycle. We believe this is because 1) Presidents usually lose seats in midterm elections and try to motivate their bases with policies that are often anti-growth; and 2) Investors begin to grapple with a new political party taking over. However, this volatility also leads to great buying opportunities. Stocks have historically been up one year from the bottom by an average of 32%, and in addition, the S&P 500 has not declined in the 12 months following a midterm election since 1946.

Federal fiscal & monetary policy to tighten, but states are flush with cash.

After the federal government provided unprecedented fiscal support for the US economy in 2020 and 2021, that spending is now rolling off the books. Federal tax revenues are also up, as the economic recovery was stronger than expected. As a result, 2022 will mark the largest federal deficit reduction (currently estimated at 9% of GDP) since 1946. On the monetary side, the Fed is expected to raise interest rates to counter high inflation. However, though fiscal and monetary policy are tightening, states are currently flush with cash due to higher tax revenues and all of the federal aid that paid for states’ Covid-related expenses. As a result, we expect governors to offer tax cuts and spending increases, particularly as most of them are up for re-election this year. Our caution would be that governors and other leaders should not see the current budget surpluses as permanent increases in tax revenues and spend money on permanent new programs, as that could lead to future structural deficits in state budgets.

Congress will have to reduce the size of the Build Back Better spending bill for it to pass.

Inflation is probably the biggest headwind to passage of President Biden’s Build Back Better bill at this time. The version that passed the House in November will have to be cut in size and will likely only focus on a few priorities, such as spending on climate and health care, but negotiations are currently stalled. Therefore, the expected timeline for passage of the bill is being pushed back to February or even March. What is important is that the longer it takes for the bill to pass, the more difficult it will be to impose tax increases on individuals and small businesses retroactively to January 1, 2022. It also makes it more challenging for the corporate minimum tax and international tax changes to go into effect in 2023.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient to base an investment decision on. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Strategas Asset Management, LLC and Strategas Securities, LLC are affiliated with and wholly owned by Robert W. Baird & Co. Incorporated, a broker-dealer and FINRA member firm, although the firms conduct separate and distinct businesses.

Copyright 2020 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.