New Momentum for Tech Regulation – Washington Policy Research

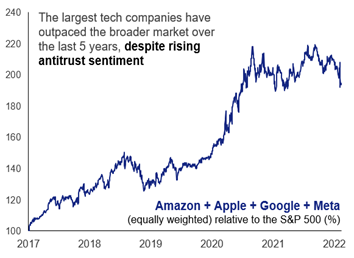

Both political parties have criticized big tech for years without coming to a consensus on how to regulate them. That appears to be changing, but any effort will likely be limited in nature rather than large-scale reform.

Tech Regulation Legislation Advancing in Washington

In June 2021, the House Judiciary Committee passed a slew of bills to rein in the big tech industry, but these bills did not move forward to a full House vote. Months later, we are seeing action on more limited bills in the Senate.

In June 2021, the House Judiciary Committee passed a slew of bills to rein in the big tech industry, but these bills did not move forward to a full House vote. Months later, we are seeing action on more limited bills in the Senate.

In January 2022, the Senate Judiciary Committee passed legislation by a vote of 16-6 that would prevent the large tech companies from preferencing their own products on their platforms, such as Amazon highlighting its products more prominently than those of its competitors or Google favoring its own shopping results through its search function.

Then in February, the committee voted 20-2 to advance a bill that targets Google and Apple’s control over their app stores. Both bills were amended in committee to address concerns raised by the industry, but the votes demonstrate strong bipartisan support for action.

Senators still have concerns that could water down both bills further before they come to the floor for a vote. Congress has other priorities to address while members try to work out these issues, but the idea of limited tech regulation should be on investors’ radar screens as an area for potential action.

Biden Administration Creating a Tougher Antitrust Environment

Both the federal antitrust regulators and the state attorneys general have been investigating antitrust behavior among the big tech companies, and these legal challenges will still take years to be finalized. However, the Biden administration’s antitrust agenda is not directed just at the tech companies. The administration is also taking a tougher stance on approvals for any large merger. In recent months, antitrust enforcers rejected a large merger in the insurance industry and one in the defense industry.

With the recent run-up in inflation, President Biden is arguing that industry consolidation is leading to higher prices for consumers. Therefore, large mergers could have a target on their backs, whether the industry is tech, meatpacking, or pharmaceuticals.

In addition, Biden has appointed antitrust hawks as heads of the FTC, the Antitrust Division of the DOJ, and competition policy at the National Economic Council. These appointments create a more difficult environment for mergers with longer review times and the threat of no concessions for a deal to be approved.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient to base an investment decision on. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Strategas Asset Management, LLC and Strategas Securities, LLC are affiliated with and wholly owned by Robert W. Baird & Co. Incorporated, a broker-dealer and FINRA member firm, although the firms conduct separate and distinct businesses.

Copyright 2022 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.