Russia-Ukraine War Renews Focus on Energy Policy– Washington Policy Research

Western governments have responded to Russia’s invasion of Ukraine by imposing massive sanctions on Russia. However, these actions are not cost-free for the West, with the rising price of oil being exhibit number one. These events have brought a renewed focus on US energy policy.

Russia-Ukraine War Renews Focus on Energy Policy

With direct Western military involvement in Ukraine still off the table, the goal has been to inflict “shock and awe” on the Russian economy. Russia’s central bank assets in dollars, yen, and euros are now frozen, making it even more difficult for Russia to evade sanctions. And while economic action is not likely to force Russia to back down in the short run, policymakers believe that a weakened Russian economy could force a negotiated settlement (or, at the very least, reduce Russia’s ability to invade other nations). However, the rapidly rising price of energy and other commodities threatens to put Europe into a recession—and raises the risk of recession in the US, as well. As Europe looks to reduce its dependence on Russian energy and the US looks to assist its allies with the shift, a renewed energy policy debate is taking place.

Higher energy costs make the Fed’s job more difficult (and impact the US midterm elections).

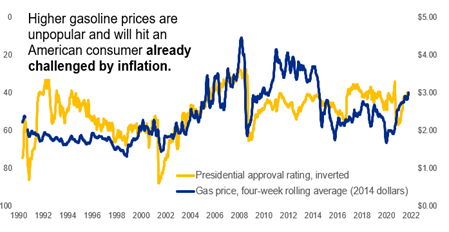

Inflation in the US is nearly 8.0% while unemployment is below 4.0% and interest rates are historically low. The Federal Reserve is beginning its process to normalize rates, a task that will become more difficult as high energy prices hamper economic growth. Moreover, there is a strong inverse correlation between a president’s approval rating and the cost of gasoline. This is important because the president’s approval rating is the single biggest determinant of the midterm election outcome. Our sense is that Congress will be looking to pass energy legislation sometime in 2022.

Inflation in the US is nearly 8.0% while unemployment is below 4.0% and interest rates are historically low. The Federal Reserve is beginning its process to normalize rates, a task that will become more difficult as high energy prices hamper economic growth. Moreover, there is a strong inverse correlation between a president’s approval rating and the cost of gasoline. This is important because the president’s approval rating is the single biggest determinant of the midterm election outcome. Our sense is that Congress will be looking to pass energy legislation sometime in 2022.

Energy policy is likely to receive more attention in Congress.

The energy component of the Russia-Ukraine conflict is leading to increased discussion of US and European energy independence. For now, the Biden administration is insisting that the best path to reduce dependence on Russian energy is to accelerate the transition to renewable energy while seeking short-term options to get new oil and gas onto the market. More specifically, the president is pushing for $500 billion in climate spending and tax incentives to increase renewable energy production, adoption of electric vehicles, and energy efficiency improvements. However, passage of these tax credits as a standalone measure is unlikely to receive the support of Democratic Senator Joe Manchin, who would like to see an “all of the above approach” with new offshore drilling, improved pipeline permitting, and liquid natural gas (LNG) exports. As a result, Senator Manchin wants a bipartisan energy bill from Congress that would include tax incentives for renewable energy AND provisions that support the domestic fossil fuel industry. This may be a bit of a tough pill for progressive members of the Democratic Party to swallow given their commitment to end the use of fossil fuels. But at $5 per gallon of gasoline, an American voter who is deeply worried about the cost of living, and midterm elections coming up, energy policy may become the surprise issue of 2022.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient to base an investment decision on. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Strategas Asset Management, LLC and Strategas Securities, LLC are affiliated with and wholly owned by Robert W. Baird & Co. Incorporated, a broker-dealer and FINRA member firm, although the firms conduct separate and distinct businesses.

Copyright 2022 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.