Biden Considers Student Loan Forgiveness

President Biden appears to be more open to offering student loan forgiveness ahead of the November elections. However, the move is not guaranteed. As an alternative, the president could continue the current moratorium on student loan payments and interest.

A shift in stance influenced by political realities.

President Biden has long expressed support for $10,000 of student loan forgiveness but has not wanted to use executive action to do it. With a divided Congress unlikely to take up legislation on the issue, the November midterm elections fast approaching, and shaky presidential approval numbers (down 21 points from a year ago among younger voters), the president has recently indicated a greater openness to forgiving loans via executive action. However, Biden also has other political considerations, such as the impact forgiveness would have on inflation and the possibility of alienating voters opposed to the policy.

Forgiveness would likely be limited and means-tested.

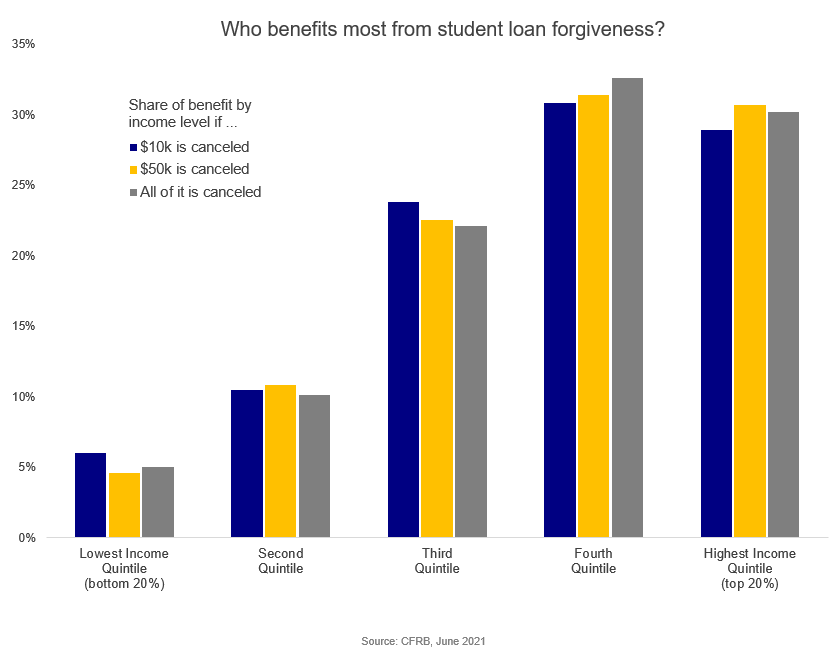

Any action Biden takes would only impact federal government student loans (not private), but the $1.7 trillion in outstanding student debt is nearly all federal. According to the Department of Education (DoEd), 43.4 million Americans have student loan debt with an average balance of $37,113. There have been calls for the president to offer $50,000 in forgiveness, but data indicates that this would disproportionately benefit high earners (as can be seen in the chart). Biden appears to favor $10,000 of forgiveness, potentially with a $125,000 income cap. Eligibility may also be limited to undergraduate loans. Finally, we’d note that a provision of the 2021 American Rescue Plan exempts federal, state, institutional, and private student loan forgiveness from federal income taxes through the end of 2025.

According to the group Committee for a Responsible Federal Budget (CRFB), the highest earners would get the greatest financial benefit from student loan cancelation. (June 2021)

Executive action could lead to legal challenges or red tape.

Biden has two forgiveness options: issue an executive order or direct the Department of Education to change its repayment rules. The first would likely face legal challenges as the president’s authority to act via executive action is questionable. If it did stand up in court, forgiveness would apply only to existing borrowers with no guarantee that future administrations would continue the policy. The second option would require working through the rules process to modify income-based repayment programs—which could take years to implement.

Extending the payment moratorium is a fallback option.

An executive action to forgive loans could come at any time but would most likely coincide with the August 31 expiration of a pandemic-era moratorium on payments of federal student loans and interest. As an alternative to offering loan forgiveness, that moratorium could be extended beyond August 31. This would provide some relief to younger voters while deflecting accusations of providing a handout or contributing to inflation. We’ll be keeping an eye on the politics, economics, and mechanics of the developing situation.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient to base an investment decision on. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Strategas Asset Management, LLC and Strategas Securities, LLC are affiliated with and wholly owned by Robert W. Baird & Co. Incorporated, a broker-dealer and FINRA member firm, although the firms conduct separate and distinct businesses.

Copyright 2022 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.