Policy Implications of Various Midterm Election Scenarios – Washington Policy Research

Policy implications of the November 8 midterms vary based on the election outcome scenarios. A good deal of uncertainty remains, particularly with regard to the Senate races. This is likely to be a close election and the 2023 Congress will likely be closely divided, increasing the need for compromise to enact policy.

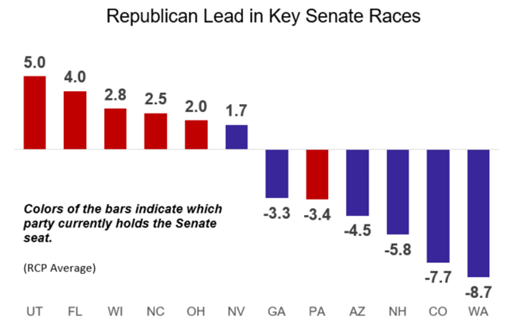

With less than a month until the midterm elections, there is still a good deal of uncertainty about the outcome and what that will mean for policy coming out of Washington. Republicans need to win a net five seats to gain control of the House. That seems likely given that: 1) the president’s party historically loses seats in the president’s first midterm election; 2) President Biden’s approval rating is in the low 40s, consistent with losses for his party; and 3) Republicans stand to gain seats from redistricting conducted this election cycle. In the Senate, Republicans need to win a net one seat to gain control. Control of the Senate is more in flux, with polling in the key races within the margin of error, indicating that they will be close. Here, we take a look at the policy implications of each of the three potential election scenarios.

Democrats retain control of the House and Senate. Congress will look to increase spending on pre-K, childcare, a child tax credit, and renewable energy, with potential tax increases to pay for the spending. We believe this is the least likely outcome of the three possible scenarios because of the fundamentals noted above. If Democrats do not retain control of Congress, tax increases are off the table in 2023.

Republicans win the House; Democrats keep the Senate. This would lead to a gridlock scenario where little would get done in the new Congress without compromise. Nevertheless, we’d expect a very active “lame duck” session of Congress as retiring members look to get their priorities passed and current members look to clear the decks ahead of the new Congress in January. During the lame duck, the FY23 budget, higher defense spending, and retirement legislation are all likely to be enacted. Additionally, in 2023, the options for bipartisan legislation under a split government scenario include legislation to re-shore or “friend shore” supply chains, legislation to improve US competitiveness with respect to China, a US-Taiwan trade agreement, privacy legislation, stablecoin regulation, and energy legislation.

Republicans win control of the House and Senate. This would also lead to a gridlock scenario, but one less open to compromise than a split Congress. President Biden would have the ability to veto any legislation passed for the next two years, and we could see a fight over raising the debt ceiling in 2023. Republicans in Congress would focus on immigration and energy policy, with US energy independence likely in focus given higher gasoline prices and the recent decision by OPEC+ to cut oil production.

Regardless of the outcome, all indications are that this could be a very close election in November, which means that neither party will have an outsized majority in 2023. Compromise will be needed to enact policy.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient to base an investment decision on. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Strategas Asset Management, LLC and Strategas Securities, LLC are affiliated with and wholly owned by Robert W. Baird & Co. Incorporated, a broker-dealer and FINRA member firm, although the firms conduct separate and distinct businesses.

Copyright 2022 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.