Policy Implications of the 2022 Midterm Elections

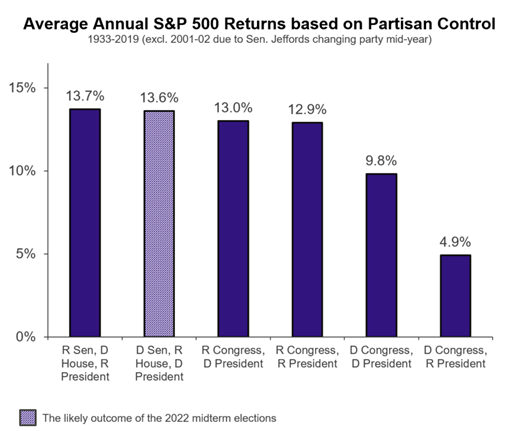

The 2022 midterms were very tight. Republicans are expected to gain control of the House, though by smaller margins than the consensus expected, and Democrats have taken the Senate. As a result, Congress will likely be closely divided in 2023, increasing the need for compromise to enact policy.

With the results coming in, Republicans appear set to take control of the House of Representatives, though by a smaller margin than the consensus had expected, while Democrats were declared the winner of the Senate with one outstanding race on Dec. 6 in Georgia. Generally, midterm elections have been referendums on the president’s first two years of office, but despite President Biden’s approval rating near just 40%, the election was less of a referendum and more of a choice between the two parties. This allowed Democrats to overcome historical precedent in the number of House seats lost by the president’s party. The red wave did not materialize because Independent voters split evenly between the two parties.

Regardless of the outcome of the Senate, Republicans taking control of the House means that we will have a gridlock scenario in Washington in 2023. Notably, a Republican House takes tax increases off the table for the next two years. Democrats maintaining control of the Senate creates opportunity for bipartisanship, but it will remain an uphill battle for a divided Congress to find areas of compromise. Much of the coming two years will be defined by disagreements as both parties try to get their priorities enacted through the budget. Narrow majorities in the House and Senate will increase the appetite of members of Congress to pass policy priorities in the “lame duck” session (i.e., before the new Congress is seated in January).

Regardless of the outcome of the Senate, Republicans taking control of the House means that we will have a gridlock scenario in Washington in 2023. Notably, a Republican House takes tax increases off the table for the next two years. Democrats maintaining control of the Senate creates opportunity for bipartisanship, but it will remain an uphill battle for a divided Congress to find areas of compromise. Much of the coming two years will be defined by disagreements as both parties try to get their priorities enacted through the budget. Narrow majorities in the House and Senate will increase the appetite of members of Congress to pass policy priorities in the “lame duck” session (i.e., before the new Congress is seated in January).

Congress will look to enact the FY23 budget and the National Defense Authorization Act (which outlines US defense priorities). Members will also push to attach additional legislative items to those must-pass bills, such as an extension of expensing for the R&D tax credit, some extension of a child tax credit or low-income housing tax credit, retirement legislation, and health care legislation (including avoiding cuts to Medicare and health care providers).

Putting it all together, an active “lame duck” session of Congress could amount to a modest boost in fiscal policy by the end of the year. It will be up to the market to decide whether that boost is inflationary (and therefore, makes the Fed’s job to rein in inflation harder) or whether it might offset a potential recession. Once we move into 2023, it will be harder for Congress to provide a fiscal boost as net interest costs on the US debt will increase significantly, putting pressure on accommodative fiscal policy. Should Congress fail to raise the debt ceiling in the post-election “lame duck” session, much of 2023 will be focused on a narrowly divided Congress trying to figure out how to get the votes to raise the debt ceiling.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient to base an investment decision on. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Strategas Asset Management, LLC and Strategas Securities, LLC are affiliated with and wholly owned by Robert W. Baird & Co. Incorporated, a broker-dealer and FINRA member firm, although the firms conduct separate and distinct businesses.

Copyright 2022 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.