Is College Right for You?

By Jeannette Haen, Baird Education Planning Consultant

By Jeannette Haen, Baird Education Planning Consultant

For many high school students, the questions can start even before freshman year has ended: Where will you want to go to college? What will you major in? Which campuses will you want to tour? And of course: What do you want to do with your life?

The reality is, a four-year degree is a significant financial investment – and like many financial investments, you have to decide if the benefit is worth the cost. Here are a few things high school students should consider as they start to chart their own life’s journey after graduation.

Understanding the Costs of College

You probably won’t be surprised to learn that a college degree is a considerable financial commitment. According to the Education Data Initiative, the average cost of college in the United States (including books, supplies, and daily living expenses) in 2022 was $35,551 per student per year – making a four-year degree an investment of more than $140,000. While there are ways to lower that price tag (such as qualifying for student aid or choosing colleges that are in-state vs. out-of-state, nonprofit vs. for-profit, public vs. private), the decision to attend college will likely have a significant impact on your finances.

There’s also the cost of student loan debt: Upon graduation, the average student loan debt from federal and private loans is more than $40,000. At a 5% interest rate, repaying that debt will cost roughly $300 to $400 per month for in most cases 10 years or longer. Should you default on your federal loan, the entire balance (including interest) becomes due immediately, and your loan holder can begin collecting by garnishing wages or federal payments like tax returns. Choosing to take on student loan debt is not a decision to be made lightly.

The Financial Benefits of a College Degree

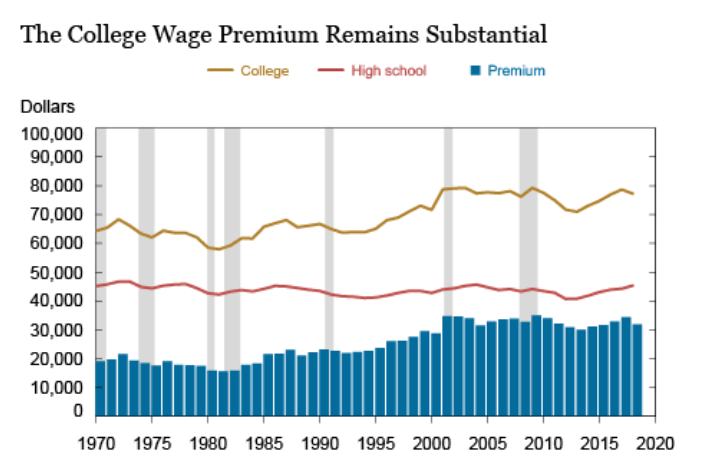

While the expenses of attaining a college degree might seem intimidating, they are often outweighed by the financial benefits. According to the Bureau of Labor Statistics, college graduates outearn those without a bachelor’s degree by more than $27,000 annually on average, or roughly $1.2 million over the course of a lifetime. Moreover, that difference in earnings between college and high school graduates is increasing more quickly than tuition costs are rising.

Figure 1. The gap in earnings between high school and college graduates has increased by more than 50% over the past 40 years. Source: U.S. Census Bureau and U.S. Bureau of Labor Statistics. Dollar figures are expressed in constant 2018 dollars.

This is in addition to other significant financial benefits of a college degree. A college education has been shown to open career pathways that offer powerful financial employment benefits, such as employer-sponsored retirement and health insurance and lifelong networking opportunities.

Is a Four-Year Degree the Right Choice for You?

When weighing the costs of college against the financial benefits, keep in mind that the best path to building wealth will be different for everyone.

- For some professions, a college degree can be well worth the financial investment. Students at one California university can expect to pay more than $80,000 per year in tuition and expenses, for example, but that same university’s degree in computer and informational sciences generates an average lifetime return on investment of more than $4 million.

- Should you choose to pursue an undergraduate or graduate degree, make sure your decisions on what college to attend and what courses to study are aligned with your earning potential. The prestige of an Ivy League or private school might not give you the best return on investment if you’re pursuing a career whose benefits are not primarily financial, such as in social services or elementary education.

- Many lucrative careers do not require a four-year degree at all. Positions such as elevator mechanics, construction managers and air traffic controllers can all provide profitable and rewarding careers without a college education. (One Georgetown report found that 16% of all high school graduates outearn the average college graduate.) But don’t assume that you can secure such a position after high school without some additional investment and training: Success in these careers will often require an apprenticeship or coursework at a vocational trade school.

- In between a high school diploma and a bachelor’s degree is a middle ground, where a degree is not necessary to join an industry but might be needed for advancement. In these cases, the specifics around which college you graduate from or the major you select might be less important than the diploma itself.

- For those on the fence about pursuing a college education, it might be worth exploring a “gap year” – a time for students to gain independence and important life experiences, volunteer, earn income and explore where their real interests are. While a gap year can take you off the college track, there is some research showing that most gap-year students return to college within a year and academically outperform their non-gap-year peers.

Helpful Tip:

You can use your 529 Education Savings Plan to pay for most vocational and trade schools and apprenticeship programs.

Several Paths to Earning a College Degree

Even if you decide to pursue a post-secondary education, you still have options beyond enrolling in a traditional program right after high school:

- Community colleges. You can attend a community college or extension school to earn an associate's degree or to complete core coursework before transferring to a four-year school.

- Online education. Much of the world is online now due to the pandemic – including college. Many traditional, big-name schools offer remote learning options, often at a reduced cost, and some institutions only offer online degrees. If you choose this option, make sure your chosen school is accredited – accredited schools are widely seen as providing a higher-quality education and tend to have greater access to federal funding for scholarships.

And of course, explore all your options for financial aid. Filling out the Free Application for Student Aid should be a top priority – even if you don’t qualify for need-based aid, you might be eligible for merit-based aid. There are other sources of college funding beyond that provided by the federal government. Those who serve in the armed forces, for example, may be eligible for free education (tuition + fees) as well as repayment on college loans, depending on such factors as rank and years of active service.

Now What?

Before embarking on an expensive college journey, do some research into the educational requirements for your chosen field and what your options are. If you take a gap year, make sure that your time out of school is well-spent in pursuit of your longer career goals. And keep in mind that there is more to a college education than strictly its return on investment – for many, the relationships they form and the broader perspectives they develop make the college experience well worth the cost.

One final point: It’s okay if you don’t have your whole career path planned out. But the last thing you want is to take on tens of thousands of dollars in debt in a field it turns out you’re not interested in. You’ll be better served by taking your time to figure out what career would bring your life meaning. The good news is you don’t have to do this alone – your family’s Baird Financial Advisor is your partner in determining the right investments and plan for your goals in life.

The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.