New CBO Outlook Adds Fuel to Budget Fight – Washington Policy Research

On February 15, the CBO released its Budget & Economic Outlook, outlining a worsening U.S. fiscal environment and amplifying the coming fiscal fights in Washington. U.S. debt-to-GDP is projected to increase to 118% from 97% by 2033, higher interest rates are increasing debt servicing costs, and long-term demographic pressures are building into Social Security and Medicare.

The Congressional Budget Office (CBO) update added $3.4 trillion of new deficits over the next 10 years since its May 2022 forecast. More than half of this increase is the result of legislation and executive actions taken since last summer and another 40% is due to a change in the economic environment—most notably, higher inflation and its effect on interest rates. As such, the CBO projects that federal spending will remain elevated at roughly 24% of GDP, significantly above the budget’s long-run average of 20% of GDP and more consistent with an economic emergency level of spending. These elevated spending levels are not being matched with higher tax revenues, leading to higher deficits and faster debt accumulation.

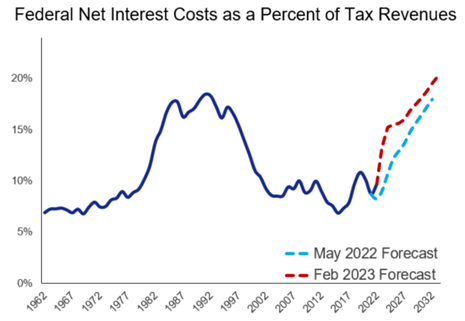

Interest costs are in a regime change. For the past 35 years, the U.S. government has been able to cut taxes and increase spending without a meaningful change in the budget’s debt-servicing cost. As long as inflation was low, interest rates stayed low and debt-servicing costs were manageable. Those days are over due to higher inflation. As interest rates rise to squeeze out inflation, the net interest cost on the debt increases. The CBO underestimated interest costs by $76 billion in FY22 and $198 billion in FY23. Importantly, increased spending on interest crowds out other spending items. Historically, when U.S. debt servicing costs hit 14% of tax revenues, financial markets begin to impose fiscal austerity on policymakers. Interest costs hit 11% of tax revenues in January, but will get close to 14% later this year.

Interest costs are in a regime change. For the past 35 years, the U.S. government has been able to cut taxes and increase spending without a meaningful change in the budget’s debt-servicing cost. As long as inflation was low, interest rates stayed low and debt-servicing costs were manageable. Those days are over due to higher inflation. As interest rates rise to squeeze out inflation, the net interest cost on the debt increases. The CBO underestimated interest costs by $76 billion in FY22 and $198 billion in FY23. Importantly, increased spending on interest crowds out other spending items. Historically, when U.S. debt servicing costs hit 14% of tax revenues, financial markets begin to impose fiscal austerity on policymakers. Interest costs hit 11% of tax revenues in January, but will get close to 14% later this year.

Trust fund insolvency is a catalyst for austerity. Short-term budget pressures are now bleeding into longer-term structural issues caused by demographics. The CBO projects that three major trust funds will become insolvent over the next 10 years: 1) Highway in 2028; 2) Social Security Old-Age in 2033; and 3) Medicare Hospital Insurance in 2033. Without Congressional action, Social Security benefits will be cut by 25% in 2033. This will likely become an action-forcing event for Congress to deal with the budget’s longer-term structural issues on the tax and spending side. Interestingly, the last time Social Security was facing a funding crisis like this 40 years ago, net interest costs were more than 17% of tax revenues and Congress stepped in with a major tax and spending reform package to replenish Social Security.

The debt ceiling fight is the starting point for these new fiscal fights. The CBO’s bleak outlook on the U.S. fiscal environment will encourage fiscal hawks in Congress to push for spending cuts and other fiscal reforms throughout 2023. This will show up as part of the debate over how to raise the U.S. debt ceiling later this year, as well as in the debate over government spending and reauthorizing other government programs. The CBO believes the U.S. government can continue to operate without raising the debt ceiling until at least July. As such, the CBO report sets the stage for a summer debate over whether spending cuts should be included in a package to raise the debt ceiling.

The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient to base an investment decision on. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Strategas Asset Management, LLC and Strategas Securities, LLC are affiliated with and wholly owned by Robert W. Baird & Co. Incorporated, a broker-dealer and FINRA member firm, although the firms conduct separate and distinct businesses.

Copyright 2023 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.