Bank Failures Spark Questions Over Deposit Insurance

Following the failures of Silicon Valley Bank and Signature Bank and the inability to find a buyer for either on short notice, federal regulators announced on March 13 that all uninsured deposits at the two banks would be guaranteed, keeping those depositors whole. Our Washington Policy Research team explores the debate in Washington about whether to expand federal deposit insurance.

Expansion of deposit insurance under debate.

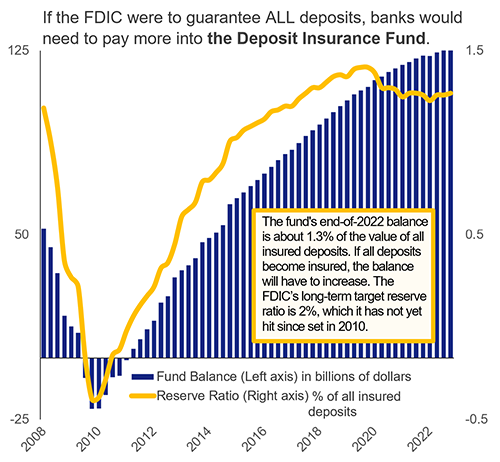

The Federal Deposit Insurance Corporation (FDIC) guarantees deposits at FDIC-insured banks of up to $250,000 in case of a bank failure. Those deposits are restored through the FDIC’s Deposit Insurance Fund, into which banks pay premiums. No insured deposits have been lost since this fund was established. The 2008 Financial Crisis resulted in a bump to the insured limit to $250,000 (from $100,000). But when Silicon Valley Bank and Signature Bank collapsed this month, federal regulators allowed deposits above $250,000 to be guaranteed by declaring the failures a systemic risk to the broader banking system. That helped prevent a larger bank run but also sparked a debate about the role of deposit insurance.

Deposit flight to bigger banks.

Despite assurances that the fallout from the two bank failures was contained, worried depositors still fled regional and smaller banks with the big banks securing most of those transferred deposits. One of the proposals floating in Washington is to expand deposit insurance to all deposits for two years (or for a shorter period). Proponents argue that it would prevent deposit flight and keep big banks from getting even bigger.

More insurance means higher costs.

More insurance means higher costs.

Although the FDIC can reduce some impact on the Deposit Insurance Fund by selling off the assets of a failed bank, insuring all deposits would still require banks to contribute more in premiums. Increasing bank premiums would effectively impose a fee on responsible institutions to pay for the failures of their less responsible peers. Further, bank managers might have less incentive to be responsible if they know all deposits are insured. Customers could also be affected if banks choose to pass higher costs on to them. Other options being discussed include keeping a limit but raising it above $250,000 (which would still mean a higher insurance assessment on banks) or creating a private insurance market to cover deposits over $250,000 at well-managed institutions.

Not yet ripe for Congressional action.

These proposals are garnering support from both sides of the political aisle, but evidence of more problems within the financial sector will likely be needed before Congress might act. Congressional action is not the only option, either—the Federal Reserve could impose more capital or liquidity requirements on banks or institute supervisory changes to prevent similar bank failures in the future.

Ongoing public interest.

This issue—and any actions and reactions that stem from it—will continue to weigh on the minds of depositors, investors, and policymakers. We’ll be watching closely as events unfold over the coming weeks and months.

The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient to base an investment decision on. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Strategas Asset Management, LLC and Strategas Securities, LLC are affiliated with and wholly owned by Robert W. Baird & Co. Incorporated, a broker-dealer and FINRA member firm, although the firms conduct separate and distinct businesses.

Copyright 2023 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.