March Wealth Strategies

Understanding Roth IRAs

Smart financial decisions begin with a clear understanding of all your options. Baird’s Wealth Strategies webinars feature the insights and perspectives of market and planning specialists to help you make the best decisions for your circumstances. In March 2023, Baird’s Director of Advanced Planning Tim Steffen explained the basics of Roth IRAs and how to incorporate them into your retirement strategy.

Tim Steffen, CPA-PFS, CFP®, CPWA®

Director of Advanced Planning

Baird Private Wealth Management

Individual retirement accounts, or IRAs, come in several varieties, each with its own features and benefits. Because they each treat contributions and withdrawals differently for tax purposes, it’s important to make sure you’re invested in the right IRA for you. Below are four key characteristics to know about the popular Roth IRA.

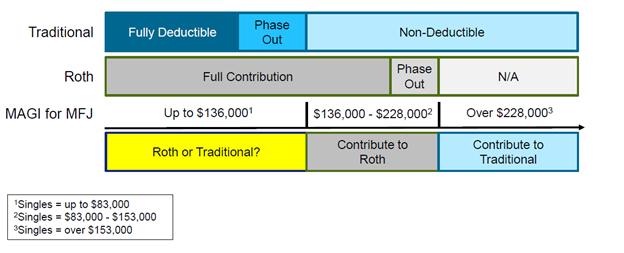

Your Eligibility Depends Primarily on Income

Your ability to contribute to either a traditional or Roth IRA – the two most common individual retirement accounts – will primarily depend on your income level. Once your income exceeds a certain threshold, tax laws prohibit a Roth IRA contribution – but at lower levels of income, both traditional and Roth options are available (see the chart below). If you are eligible for either option, your current tax rates and projected tax rates in retirement will help drive the decision. (If your employer offers a Roth option in the company retirement plan, such as a 401(k) or 403(b), there are no income limits for contributing, so current and future tax rates become the key factors in deciding where to save.)

Taxpayers with a modified adjusted gross income above $153,000 ($228,000 for couples) are ineligible to contribute to a Roth IRA.

You Can Convert a Traditional IRA to a Roth IRA

If contributing to a Roth isn’t an option, you can still fund one via a conversion. A Roth conversion takes the funds held in a traditional IRA and moves them into a Roth IRA. The amount converted will be taxed as ordinary income in the year of conversion, but future growth will be tax-free once inside the Roth.

The biggest question for traditional IRA owners considering a conversion is, once again, current vs. future tax rates: You would have to decide if paying the tax on your account today, in exchange for tax-free growth in the future, is better than paying tax on your account during retirement. Other factors to consider with a conversion include having funds available to pay the conversion tax and how long you can wait to use the funds after conversion – the longer you can wait before retirement to access your Roth funds, the more effective a conversion will be, as your funds will have more time to grow after being taxed.

Note that for those subject to Medicare, a conversion can trigger a higher premium due to higher income. Also, a Roth conversion is a permanent decision, as recharacterizing your Roth IRA back to a traditional IRA is no longer possible.

You Can Make a Backdoor Roth Contribution

While high-income earners are ineligible to contribute to a Roth IRA, a backdoor contribution may still be an option. This can be accomplished by making a non-deductible contribution to their traditional retirement account and then converting it into their Roth account. This strategy only applies if you are not also planning to roll over funds from an employer plan in the same year and own no other traditional, SEP or simple IRAs. All of this must be reported on Form 8606 in your tax return.

There Are Rules to Withdrawing Funds From a Roth IRA

While withdrawals from a Roth are generally tax-free, there are some rules to follow. There are three asset buckets in a Roth IRA: direct contributions, funds added through conversions, and earnings. Contributions are always withdrawn first, tax- and penalty-free with no waiting period. Converted amounts are withdrawn next, also tax-free and potentially penalty-free if certain conditions are met. Earnings are withdrawn last, but earnings require certain age and other requirements to be met to avoid taxes or penalties. Note that Roth 401(k) and IRA withdrawals follow slightly different rules, so check with your advisor to be sure you won’t trigger a penalty before you withdraw.

If the idea of tax-free withdrawals during retirement is appealing to you, be sure to check out Tim’s webinar for more details. Your Baird Financial Advisor will also have valuable perspective on whether a Roth IRA is right for you.

Visit our Wealth Strategies page for information on upcoming webinars.

The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.