The "One Big Beautiful Bill" Act: How It May Impact You

With a flurry of activity leading up to July 4, Congress passed a sweeping budget reconciliation bill – referred to as the “One Big Beautiful Bill" Act (OBBBA) – that tackled two main goals for the current administration: extending tax breaks from the 2017 Tax Cuts and Jobs Act (TCJA) and delivering on many campaign promises. This legislation brings long-awaited clarity to the tax code, and introduces new planning opportunities.

Below is a summary of key changes, although specific planning opportunities are best explored with your Baird Financial Advisor, who can leverage a full wealth planning team and advanced tax modeling tools to tailor any strategies to your unique goals.

Changes to TCJA-Related Income, Taxes and Credits

One of the most significant outcomes of the OBBBA is the extension of the current income tax rates and brackets, originally enacted under the 2017 Tax Cuts and Jobs Act (TCJA). These rates, which were set to expire at the end of 2025, will now remain in place – avoiding a 1–4% increase across most income levels. In addition, the OBBBA extends several key TCJA provisions:

- Enhanced Child Credit: Taxpayers can receive a credit up to $2,200 (a $200 increase) per child in 2025, with inflation adjustments beginning in 2026.

- Lifetime Gift and Estate Tax Exemption: Instead of reverting to $7 million in 2026 following the TCJA sunset, the exemption will increase to $15 million, with annual inflation adjustments thereafter.

- Alternative Minimum Tax: While most provisions remain unchanged, new thresholds beginning in 2026 will expand the number of taxpayers subject to the AMT. As a result, couples with income over $1 million are more likely to owe additional tax under these rules beginning next year.

Changes to TCJA-Related Deductions

The OBBBA makes several important updates to deductions originally introduced under the TCJA, giving taxpayers new opportunities to reduce their taxable income:

- Standard Deductions: The enhanced standard deduction will not only remain in place but will increase for 2025: $31,500 for joint filers (up from $30,000), and $15,750 for single filers (up from $15,000).

- Itemized Deductions: The reductions that have been in place for the last several years have now been made permanent, with a few tweaks such as a new deduction for educators and coaches. The most significant change for itemizers is concerning state and local taxes.

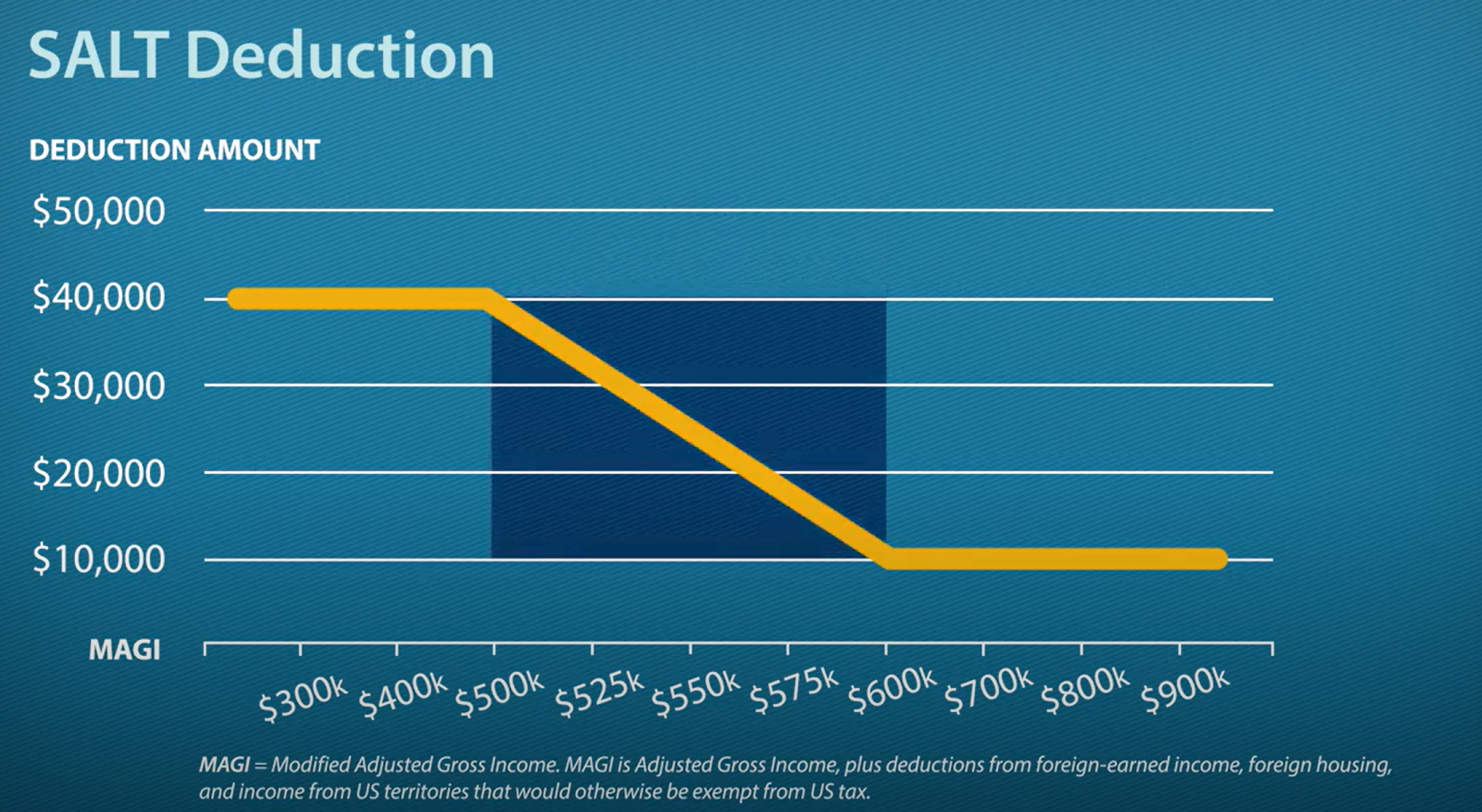

- State and Local Taxes (SALT): One of the biggest focuses throughout the budget reconciliation process has been the deduction for state and local taxes (SALT). The OBBBA has increased the limit to $40,000 (up from $10,000) for 2025 with an increase of 1% per year through 2029. Without further legislation, it will revert back to $10,000 in 2030. There are additional phaseouts based on income and tax filing status – this creates a window where taxpayers within that income range could see an effective tax rate on those dollars as high as 45% – connect with your Baird Financial Advisor for more specific guidance and planning measures.

- Mortgage Interest: The mortgage interest deduction limits are unchanged from current rules (homeowners can only deduct interest on qualifying loans up to $750,000). However, the deduction for private mortgage insurance (PMI) returns in 2026, subject to income qualifications.

New Deductions Created by the OBBBA

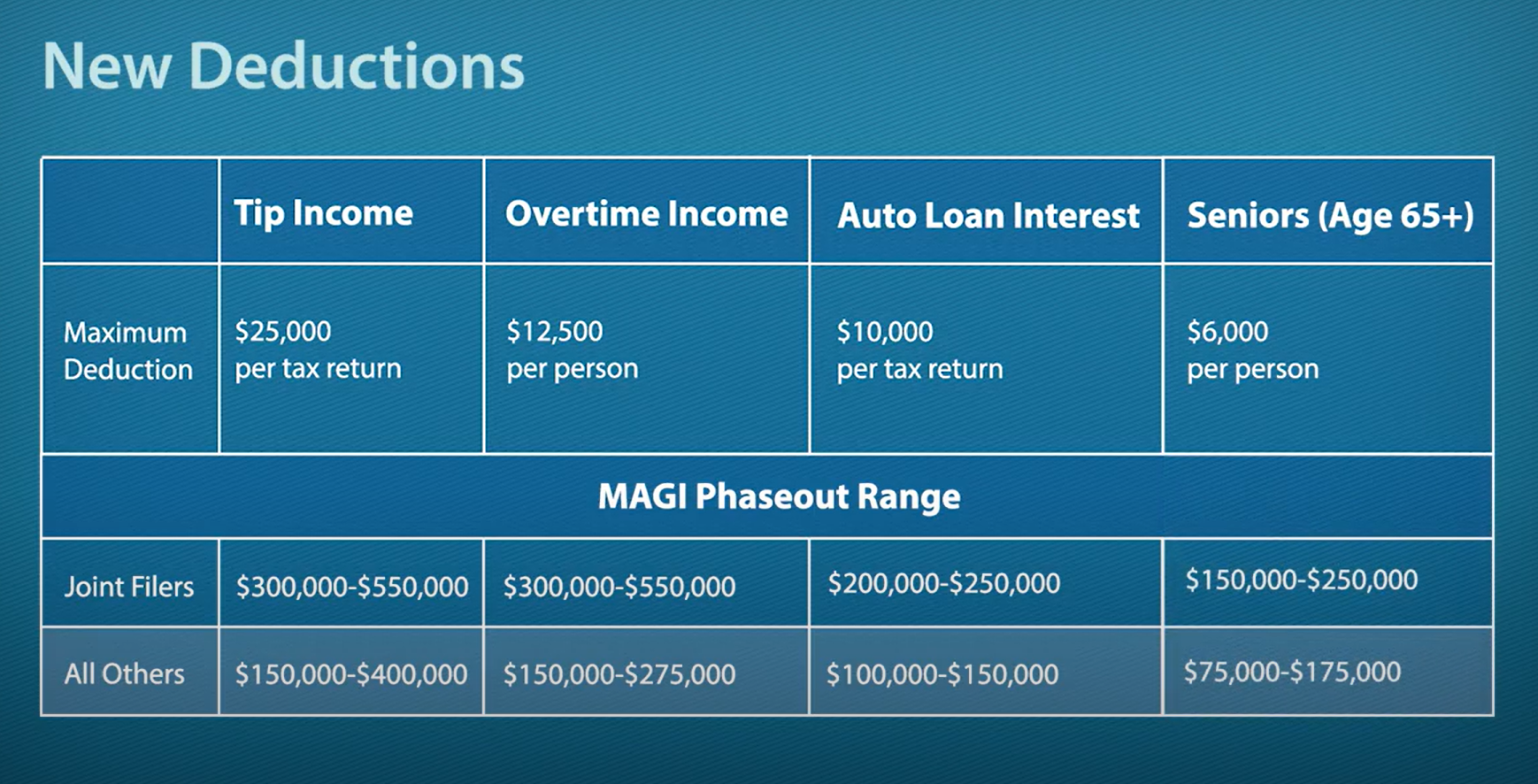

The OBBBA introduces three new deductions for 2025 through 2028, each with specific eligibility requirements and income limits. While each of the deductions can be used by taxpayers who use the standard deduction or itemize, they are not considered adjustments and do not lower the adjusted gross income.

- Tip Income: Taxpayers in traditionally tipped occupations can deduct up to $25,000 in qualified tip income. These “traditionally tipped occupations” will be defined by the IRS within 90 days of enactment. Deductible tip income must be reported on a form provided by the employer or contractor and will still be subject to employment taxes.

- Overtime Income: Joint filers can deduct up to $25,000 of qualifying overtime ($12,500 for single filers) The deduction applies only to the additional pay received above the standard rate and must be reported by the employer. It will also be subject to employment taxes.

- Auto Loan Interest: Taxpayers can deduct up to $10,000 in interest on a loan used to purchase a qualifying vehicle. Certain rules apply, including: the car must be purchased (not leased) between 2025 and 2028, must be for personal use, and final assembly must have occurred in the United States.

Additionally, the OBBBA introduced a new deduction for seniors to partially address one of the President’s campaign promise to make Social Security benefits tax-free. Taxpayers age 65 or older can deduct up to $6,000 per person, though income phaseout rules apply and the provision is only available now through 2028.

Taxpayers will need to be especially mindful as their income approaches these phaseout levels. Actions like a Roth conversion or realizing a capital gain could inadvertently push your income beyond these limits—causing the loss of valuable deductions and increasing the effective tax cost of those decisions. Your Baird Financial Advisor team can help you build a thoughtful, multi-year tax strategy that accounts for these nuances, and identifies opportunities to optimize your total wealth plan.

Charitable Giving Changes Created by the OBBBA

The OBBBA introduces several updates to charitable giving rules, offering new opportunities and limitations depending on how taxpayers file:

- For those who claim the standard deduction: Starting in 2026, joint filers can claim a separate deduction of up to $2,000 ($1,000 for all other filers) for cash gifts, provided they are not made to a private foundation or donor advised fund.

- For those who itemize deductions: Starting in 2026, high earners in the top 37% tax bracket who itemize will see the value of their deductions capped at a 35% tax benefit. The OBBBA has also introduced a floor for charitable contributions. Beginning in 2026, only contributions exceeding 0.5% of adjusted gross income will be deductible.

- Cash gifts to public charities will continue to be deductible up to 60% of AGI instead of falling to 50% as scheduled.

- Beginning in 2027, a new tax credit of up to $1,700 is available for charitable gifts of cash to scholarship-granting organizations that meet specific standards. Any amount claimed as a credit cannot also be claimed as a charitable contribution.

With some of these key changes, many taxpayers may consider accelerating or “bunching” their 2026 charitable gifts into 2025, in order to maximize their tax value. A effective way to do this is through establishing a Donor Advised Fund, which provides flexibility in choosing which organizations to support and when.

New Investment Savings Vehicle for Children

In addition to the family-related changes noted above, the OBBBA has created a new type of IRA savings account for children under age 18, named “Trump accounts.”

- Beginning in July 2026, accounts can be opened for those under age 18 with a maximum contribution of $5,000 per year (with annual inflation adjustments after 2027). Contributions are not tax-deductible but have no impact on the ability to make contributions to any other type of IRA.

- These accounts may also be funded by select third parties.

- Employers can contribute up to $2,500 for an eligible employee or their dependent – the contribution will count towards the annual $5,000 limit but is not considered taxable income to the employee.

- The federal government will make an initial $1,000 contribution to accounts for individuals born in 2025 through 2028.

- General funding contributions can also be made by state, local or tribal governments or charitable organizations, based on eligibility requirements.

- Before the child turns 18, there are limitations to what the account can be invested in. Distributions are also generally not allowed.

- After the child turns 18, the account is treated like a Traditional IRA, with all the same rules on contributions and distributions.

Education Funding Changes Created by the OBBBA

The OBBBA expands education-related tax benefits, offering greater flexibility for planning:

- 529 Plan Accounts: The definition of “qualified expenses” for 529 reimbursement has expanded: non-tuition expenses for elementary, secondary, religious and private school expenses are now allowed, as are expenses for acquiring and maintaining professional credentials. Beginning in 2026, a 529 account can also be used to pay up to $20,000 of elementary or secondary tuition (up from $10,000 currently).

- Employer Educational Assistance: Employers can provide up to $5,250 of educational assistance to employees tax-free. While the inclusion of student loan payments was scheduled to expire after 2025, the bill has made that inclusion permanent. The $5,250 limit will also be adjusted for inflation after 2026

Family-Related Changes Created by the OBBBA

The OBBBA introduces several updates aimed at supporting families and dependent-related expenses:

- Employer Assistance for Dependent Care: Employers can currently provide dependent care assistance of up to $5,000 to an employee tax-free. In 2026, that amount will increase to $7,500.

- Child and Dependent Care Expenses: The maximum tax credit for working parents will increase from 35% to 50% of qualifying expenses, with a new phaseout schedule with a floor of 20%.

- Adoption Expenses: The tax credit for expenses was modified to let $5,000 of the maximum $10,000 credit refundable, meaning the portion of the credit is available to those whose tax liability is less than $5,000.

Tax Changes for Business Owners

While this legislation is largely geared towards individual taxpayers, there are several changes that business owners should also be aware of:

- “Bonus Depreciation” Program: The OBBBA has made this TCJA-era provision permanent. Businesses can continue to deduct 100% of the cost of certain qualifying property in the year of the purchase.

- Qualified Business Income (QBI) Deduction: Owners of pass-through businesses can continue to exempt a portion of their income from tax; in 2026, the phaseout range will expand slightly, allowing even more taxpayers to qualify for the deduction.

- Tax Benefits for C Corporations: The tax benefits available when selling a qualified small business structured as a C Corporation have been expanded, making that form of ownership more attractive.

Maximize Your Tax Strategy with Your Baird Financial Advisor

This legislation introduces sweeping changes to the tax code—creating meaningful planning opportunities for virtually every taxpayer. Your Baird Financial Advisor is equipped with advanced tax modeling tools and backed by a team of in-house wealth planning specialists. Together, they can help you design a multi-year tax strategy aligned with your goals and support a comprehensive, multi-generational wealth plan.

Editor’s Note: This article was originally published July 2025 and was updated August 2025 with more current information.

This information has been developed by a member of Baird Wealth Solutions Group, a team of wealth management specialists who provide support to Baird Financial Advisor teams. The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.