Managing Family Dynamics in Business Succession

Director of Baird Family Wealth

When a family business changes hands, the most challenging conversations often aren’t about balance sheets or insurance needs – they're about relationships. In many family businesses, succession planning requires you to balance the needs of the company, the owners, the family and the employees.

As you create a transition plan for your business, use this guide to help you consider the emotional dynamics that come with this significant change.

Identifying and Preparing Your Successors

One of the most critical parts of developing your transition plan is ensuring your successor is ready to take over the company when it comes time to do so. Because of this, it’s ideal to begin thinking about who you’d like to control the company years in advance. As you think about who that person or people might be, keep the following questions in mind:

- Do they demonstrate the ability to lead and manage the business?

- If not, can you provide them with the training and mentorship they need?

- Do they truly want to run the business, or do they feel obligated to?

- Are they prepared to balance the family business legacy with future growth strategies?

- What is the contingency plan if they become uninterested or unable to take over the business?

- If you have external shareholders from the family, what is their view of the successor?

By the time you’re ready to officially begin the transition, your successors should know the company’s financials, operations, policies and procedures – and should also have established relationships with key stakeholders, including everyone from the company’s financial advisors to its employees. Often, business transitions struggle – or even fail – because the successor is not properly trained to manage the business. In the whirlwind of transition planning, remember to prioritize time for setting your successor up for success.

Understanding and Navigating Family Dynamics

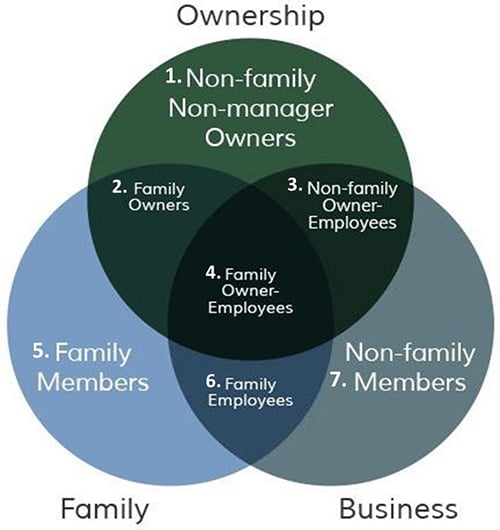

Within a family business, relatives may play many different roles. Some are owners who are deeply involved in daily operations, others may be owners who are not active in the business, and some are employees without ownership. Often, there are also family members who don’t participate in the operations of the business, but still have a voice in family decisions. Each of these perspectives bring unique expectations – and sometimes conflicting priorities.

Everyone’s voice should be heard as your family navigates this transition – and one of the most effective ways to ensure this is through regular family meetings. This way, everyone has an opportunity to share perspectives. Your Baird Financial Advisor can also serve as a neutral facilitator here, helping your family to work through complexities by offering unbiased advice. In your family meetings, consider exploring the following questions:

- Should family members who don’t play an active role in the business share in its ownership and profits?

- If multiple relatives own the business, but only one is actively running it, how should that person be compensated?

- If every heir is not a shareholder or involved in the business, how can the estate be equalized? Is equal fair?

Choosing a Transfer Method

Every business transfer method carries its own tax and legal considerations – but in family business transitions, each strategy can also best serve a specific kind of family dynamic. In some cases, a transition method – like gifting shares during your lifetime or passing ownership through an inheritance – makes the most sense. Often, this works best for families who want equal inheritances among relatives. The challenge here, though, is making sure active family members don’t resent non-active relatives who inherit equal shares. In these situations, families will sometimes use equalization strategies, like passing on trusts or life insurance, to balance inheritances without putting strain on the business.

In other families, a buy method – like a structured buyout, installment sale or formal agreement – can be a better fit. These approaches often work best when a family wants ownership shares to reflect the contribution a relative makes to the business. The tradeoff here is that successors may feel pressured by the financial responsibility, and other relatives may question whether the terms are fair. Having clear communication and transparent agreements are essential to keeping trust intact in these situations.

Another factor to consider as you choose a transfer method is how you can best ensure your own retirement security as the original owner. If most of your wealth is tied up in the business, you may lean toward a buy method that provides income to you through installment payments or even an outright sale. On the other hand, if you have significant assets outside of the business, you may have more flexibility to use gifting transition methods.

Remember: No method is better than another. Your family values are what should guide this decision. If your goal is equality among relatives, transition methods may be the right choice – but if your goal is rewarding contribution, buy methods may feel like a better fit. Your Baird Financial Advisor can help you and your family determine which of these methods may work best for you.

As you build your family’s transition plan, remember to create a team of advisors and experts who you can count on for guidance. Often, family businesses can benefit from an estate planning attorney, tax advisor, trust officer, insurance agent and your Financial Advisor. Together, this team can help align tax efficiency, estate planning considerations and family dynamics.

Once your family has thoroughly talked through the foundation of your transition strategy, reach out to your Baird Financial Advisor for your family business transition checklist – a step-by-step guide to successfully passing your business from one generation to the next.

This information has been developed by a member of Baird Wealth Solutions Group, a team of wealth management specialists who provide support to Baird Financial Advisor teams. The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.