Get Your Finances Retirement-Ready

Download Baird's Retirement Checklist

Are you ready for retirement? Whatever your specific vision is – whether it’s travel, volunteering, caring for loved ones or spending more time with friends – it requires thoughtful planning well before the big day. Here’s what you can do now to ensure you’re making the most of your financial resources, assets and benefits.

Get Your Budget in Order

Anticipating a budget for your lifestyle in retirement can be challenging: how you’ll live when you’re retired might be very different from how you’re living today. What working-life expenses will you lose, and what new ones might you pick up as you pursue activities and hobbies that are more personally meaningful?

Monitor Your Expenses

Go through your monthly statements and track what you’re spending now. A review of your current expenses can give you an idea of which ones you’ll maintain in retirement and which will go away. Remember that in retirement, you lose employment benefits – the biggest being employer-sponsored healthcare. A Baird Financial Advisor can help you decide which Medicare plans make sense for you (more on that below) and how best to plan for what Medicare doesn’t cover.

Take Another Look at Your Debt

It might also make sense to simplify your finances by eliminating as much debt as possible now – recurring debt during retirement can quickly deplete your savings. That said, a debt-free retirement may not always be practical or reasonable: Retirement can last 40 years or longer, which means you will likely need to take on major expenses like a new car or new roof.

Build Up Your Liquidity

The years before retirement are a great time to build up your personal liquidity – the more cash you have on hand, the longer you can go without drawing down your retirement savings. Liquidity can come in different forms – from an emergency fund to credit cards to a home equity line of credit – each with its own advantages and disadvantages. A securities-based line of credit has some unique advantage for those entering retirement and is worth a discussion with an advisor.

Track Your Personal Inflation

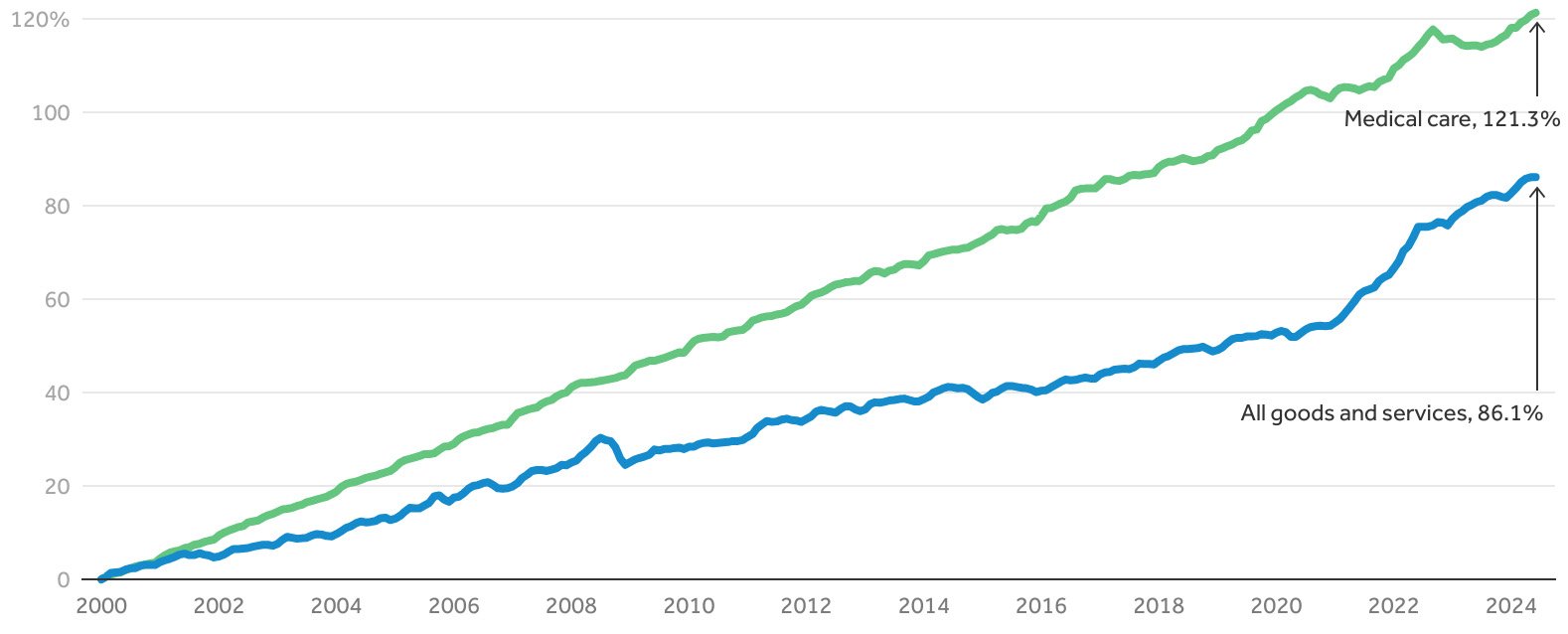

Inflation is a measure of how prices for goods and services have increased over time. You might find that inflation impacts your budget differently in retirement compared to when you were working. For example, not only might you require more medical care in retirement, but the cost of that care will likely have increased disproportionately over time due to inflation (see chart). The plans you create with a Baird Financial Advisor are designed to account for the effects of inflation on your financial health in retirement.

Chart 1. Inflation for medical care (green) has outpaced that for all goods and services (blue) over the past 25 years. Source: KFF-Peterson, Bureau of Labor Statistics Consumer Price Index data.

![]()

Financial planning for retirement has a lot of moving parts, and you need to plan for all of them if you intend to live comfortably and confidently. Our pre-retirement checklist is a free tool to help you make sure you’ve planned for every contingency.

Evaluate Your Resources

One of retirement’s biggest challenges is getting comfortable with the unknown: How long you will live, what your expenses will be like, how long your savings will last. Replacing the certainty of a regular paycheck with periodically – and sometimes unpredictably – pulling from an investment account may leave you uncertain if you can still accomplish everything you want in retirement. Spend some time now taking stock of all your assets – not only cash and investment accounts or the value of your house, but also insurance benefits or 401(k) plan balances from previous employers.

Save More Than You Think You’ll Need

While it’s smart to plan for what you think retirement might look like, the reality is you won’t know until you get there. Maybe you’ll have more grandkids to visit than you anticipated, or a European vacation will spark the idea of a vacation home in Barcelona. There are steps you can take to build up your financial flexibility now, like catch-up provisions to tax-advantaged retirement and health savings accounts for those over age 50. A Baird Financial Advisor can help you identify and maximize savings opportunities like these, and model a cash flow analysis to understand money coming in, and money going out.

Factor In RMDs

Once you turn 73, you may be required to draw down your financial resources through required minimum distributions. With a traditional IRA, you’ll be paying taxes on those withdrawals – so consider whether converting to a Roth IRA is for you. The period between when you retire and when you start to take Social Security or RMDs might put you in a lower tax bracket, which could present the opportunity for tax savings by recognizing capital gains or completing a Roth conversion. A financial advisor can help you identify which strategies may be right for you and when to put them into effect.

![]()

Retirement doesn’t just happen – the more you think about and plan for what your spending will be like in retirement, the more confident you’ll be when the big day comes. Our pre-retirement checklist can help you make sure your assets are ready when you are.

Decide When To File for Social Security and Medicare

Two of the biggest financial decisions in retirement are when to take Social Security and when to file for Medicare. While most people associate Social Security and Medicare with retirement, you can enroll before then – eligibility for filing for these programs’ benefits are based on age rather than working status.

File for Social Security

You can begin taking Social Security benefits as early as age 62, though you will only receive your full benefit if you wait until full retirement age (age 67 for those born in 1960 or later). Each year you delay receiving your benefits beyond full retirement increases your benefit payments by 8%, up to age 70. In such cases as divorce, widowhood or the death of a family member who was paying Social Security taxes, you might also have additional benefits available to you.

File for Medicare

Generally, people file for Medicare at age 65, though there are a few exceptions that allow for filing before then (typically health-related) or avoiding a late-enrollment penalty when filing after 65 (such as if you or a spouse are still working). The potential to file after age 65 could have some planning benefits, such as allowing you to continue contributing to a health savings account and avoiding doubling up on healthcare premiums. Beyond deciding when to file, there’s also a question of which Medicare programs (“parts”) to sign up for and what each of those programs includes – or doesn’t include.

There’s a lot that goes into deciding when to file for Social Security and Medicare, ranging from perceived longevity to healthcare and income needs. Our pre-retirement checklist can help you determine the timing that is best for you.

Start Planning: Claim Baird's Complimentary Pre-Retirement Checklist

Assess Your Healthcare Needs

People are living longer into retirement: The Social Security Administration estimates that 1 in 3 of today’s 65-year-olds will live past 90 and 1 in 7 will live past 95. With that increased longevity comes an increased need for services like senior housing and healthcare, particularly long-term care.

Map Out Your Healthcare Needs in Retirement

Take some time to consider what medical care you might require in retirement. Do you currently have medical concerns that will require additional care as you age? Are there genetic conditions that have affected a parent or sibling that you need to consider? There are actions you can take now, like contributing to a health savings account or taking out long-term care insurance, that could make a significant difference in managing these costs years down the line. As you map out your potential health journey during retirement, double-check that your insurance policies are robust enough to continue to pay for required care following the death of a spouse. A Baird Financial Advisor can help identify financial or insurance planning gaps that you can remedy while you’re still working.

![]()

Housing and healthcare are two of the biggest expenses in retirement, and whatever your retirement plans entail, it’s critical you get these two right. Our pre-retirement checklist can help you ensure you have your housing and healthcare bases covered.

Ready for Retirement? Get Baird's Complimentary Pre-Retirement Checklist

Update Your Estate Plan

A final box to check before you enter retirement is to ensure that all your estate planning documents are updated. Estate planning is never a set-it-and-forget-it process: As relationships change and people move in and out of your life, your feelings on the roles people should play regarding your estate and healthcare decisions will likely evolve.

Review Decisions Like Beneficiary Designations and Power of Attorney

As you consider consolidating accounts and potentially opening new ones, make sure your account titling and beneficiary designations reflect any changes in the makeup of your family and other loved ones. Now is a good time to review your other estate planning decisions, such as executor, trustee, financial power of attorney and healthcare power of attorney, to reflect how your family and personal life might have evolved over the years. Strategies like funding a college savings account or opening a special needs trust might benefit from planning while you’re still drawing a paycheck. A Baird Financial Advisor can work with you on a complete estate plan review to ensure your legacy plans, investments and other assets reflect your wishes.

![]()

What legacy do you want to leave for the next generation – and the generation after that? Make sure your loved ones are cared for with our pre-retirement checklist.

As you begin to consider these items, remember that planning for the long-term is essential: Once you retire, you could still have decades of living to do. The steps you take now to maintain your financial options in retirement could help preserve your financial flexibility in your golden years. Remember that your transition into retirement doesn’t need to be done all by yourself – a Baird Financial Advisor can help you adapt your finances to your needs and set you up for success.

This information has been developed by a member of Baird Wealth Solutions Group, a team of wealth management specialists who provide support to Baird Financial Advisor teams. The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.