Showdown Over the Debt Ceiling

Congress mandates how much debt the U.S. government can hold through a statutory debt ceiling. The current debt limit is $31.4 trillion, which was hit in January. Treasury is now employing "extraordinary measures" to keep the government functioning, but these measures will run out over the next few months and Congress will need to raise the debt ceiling. Should Congress fail to do so, the federal government will not have enough money to pay its bills, which could cut off more than $1 trillion of federal spending immediately. Should Treasury not use its existing cash flow to pay interest on U.S. debt, the government would default.

A Brief History of the Debt Limit

Since 1960, Congress has acted 78 times to raise, temporarily extend, or revise the definition of the debt limit. In most cases, these debt ceiling increases were not controversial. But raising the debt ceiling gets more difficult with divided government and when the U.S. fiscal situation is deteriorating. Both variables are in play today.

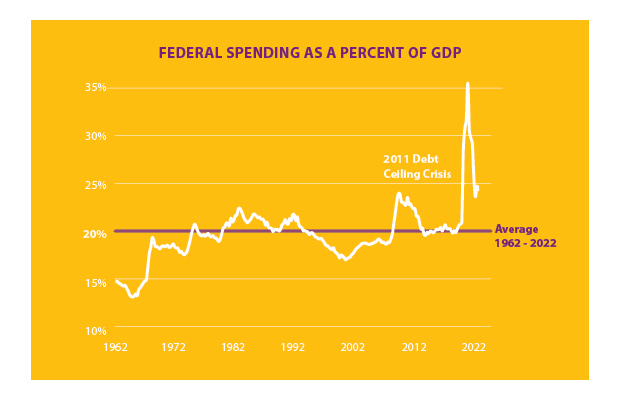

Historically, when federal spending increases above its long‐term average, the debt ceiling becomes a catalyst for deficit reduction. This was true in the mid‐'80s, mid‐'90s and early‐'10s. Today, federal spending is 24% of GDP, well above the 20% long‐term average. As such, there will likely be an effort to add deficit reduction to the debt ceiling debate, making the process more difficult politically and the outcomes more significant for markets. Ultimately, policymakers are trying to balance two objectives: ensuring the U.S. does not default on its debt, while also using the "must‐pass" catalyst of raising the debt ceiling to put the country on a better fiscal trajectory.

Where We Are Today

Current estimates suggest that the debt ceiling will need to be raised sometime between July and September, setting up a summer fight between Republicans and Democrats. This process is likely to be bitter, as there are no easy ways to raise the debt ceiling politically. There will be a real fight over spending cuts, and even if Republicans are not successful in cutting spending, a clean debt ceiling increase will be difficult to muscle through a divided Congress.

We believe House Republicans will follow a similar path to 2011, the last time federal spending was significantly above its long‐term average. Then, a Republican House passed a bill seeking to cut spending by capping discretionary spending. That legislative effort became the basis of negotiations with a Democratic Senate and President Obama. This episode taught us that leverage in a debt ceiling fight comes from the ability of the House to pass legislation and force a negotiation. Should Republicans fail to pass a bill out of the House, the party will lose its leverage and a clean(er) debt ceiling becomes the most likely outcome.

Over the course of the next few months, we expect volatility around the issue. House Republicans are likely to vote down a clean debt ceiling increase to prove to the Biden administration that some spending cuts are needed. It is also possible that Republicans pass a short‐term debt ceiling increase with modest spending cuts to buy time for a larger package.

Ultimately, we believe the U.S. is unlikely to default. The debate is really a fight over the level of budget reforms that will be enacted. Financial markets will have to evaluate the impact of those reforms on economic growth and the risk to Treasurys should Congress fail to act. We expect some volatility this summer, but ultimately believe Congress – after a heated debate – will get the job done.

The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.