All That Matters: The National Debt (Or Does It?)

We’re halfway through 2025, and with Congress deep in negotiations over a sweeping new tax bill, the national debt is once again front and center in the news. In “The National Debt (Take Two)”, Mike and Ross address the most common question they get while reminding viewers of the key principles that still hold true today, the history of the national debt and what it really means for the everyday investor.

The National Debt: Back in Focus

Recorded June 2025

Ross: With geopolitical tensions rising and a major tax bill moving through Congress, there’s no shortage of headlines. But there’s one question that keeps landing in our inboxes lately: Should I be worried about the national debt?

Mike: Ross and I first tackled this topic back in February 2024. Since then, the national debt has grown from $34.1 trillion to $36.2 trillion, but on the other hand, borrowing costs have barely changed and the markets have performed well. So, while it is big and looming, it’s not an issue that should dominate your daily concerns. The issue of the national debt is extremely complex. It’s wrapped up in politics, global economics, and the unique role of the U.S. as the world’s reserve currency. Can we manage it? Yes. Should it keep you up at night? Probably not.

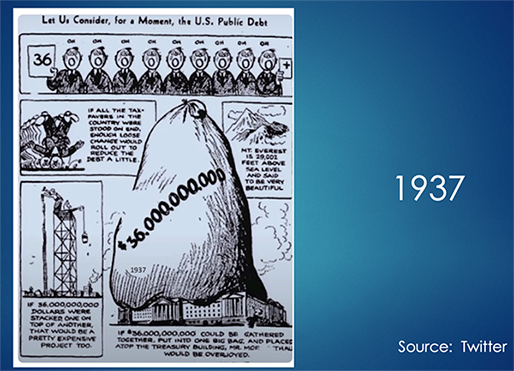

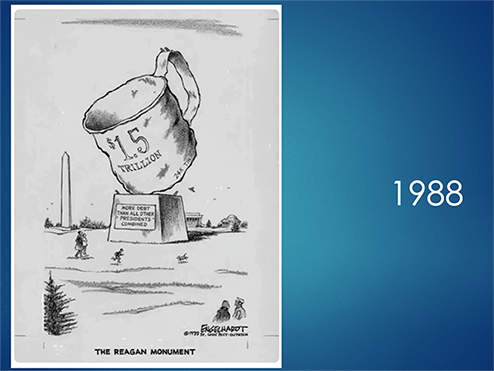

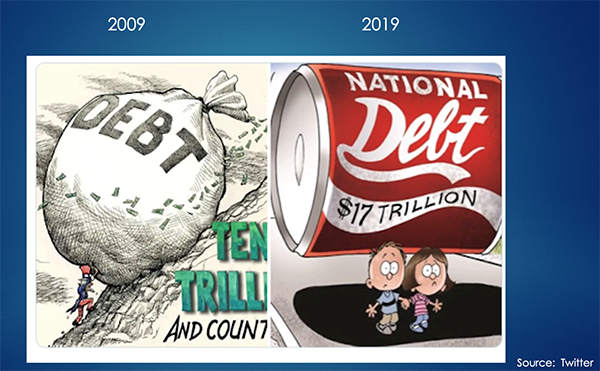

Ross: The national debt isn’t a new concern- it’s been part of the national conversation for years (if you don’t believe me, take a look at the cartoons below). The advice we gave back in 2024 still stands: the average investor shouldn’t let headlines about the national debt derail long-term planning and investment decisions. Our partners at Strategas, a Baird Company make a key point as they reevaluate this issue: comparing U.S. debt to household or corporate debt just doesn’t work. Unlike a consumer or a corporation, the U.S. issues its own currency, so the real risk isn’t default…it’s inflation.

Mike: And while no one wants the debt to grow unchecked, neither political party has shown much willingness to rein in spending. Both sides have historically prioritized their own agendas over meaningful reductions to the deficit. This creates a political landscape where headlines on the national debt surface every cycle, not as a serious policy priority, but as a talking point. So, focus on what you can control - your health, your finances, and your family. The national debt is real, but it’s been with us for centuries. Don’t let it take up more space in your mind than it deserves.

The History of the National Debt

Recorded February 2024

Mike: To really understand the national debt, we have to step back in time. The national debt has grown throughout the history of the United States. You can look back as early as Alexander Hamilton (first Secretary of the Treasury, 1789-1795), but there are a few other stops along the way. President Andrew Jackson – who is on the $20 bill – hated debt. He sold land out West and vetoed every spending bill he could, including funds for national highways, until he paid down the national debt. But then we were faced with a recession and horrible depression; it basically took about six years for the economy to grow again.

At the end of World War II, President Truman’s advisors came to him and predicted another Great Depression due to the debt incurred during the war. Did it happen? No. In fact, by the 1980s, the debt-to-GDP ratio was about 50% -- it had fallen to half.

Ross: Throughout history, debt has had an inherently negative connotation. It’s viewed as a burden more than a tool. There are folks in our space who are devoted to the idea that you should never have any debt. And I think that when people think of the national debt, they’re projecting their own views about personal debt onto the government’s debt. If there is one takeaway, it’s this: personal debt is not comparable to government debt. Especially for a government like the United States that is issuing debt in a currency that it also prints. Outside of the debt ceiling debates (which are entirely self-imposed), we cannot go bankrupt or default on debt that is issued in a currency we print. There are important issues to consider that are related to the pace that debt is growing (more on that below) but government debt operates differently from our own personal finances.

Mike: A major reason that people worry about national debt is because it’s been a political scare tactic tossed around by both parties for generations now. I found three cartoons from 1937, 1988, and 2019, all focused on the national debt. Like my friend Morgan Housel says in his book, it’s the Same As Ever, we’ve been having this conversation about National Debt forever.

Source: Twitter

National Debt Basics

Mike: So Ross, let’s tackle why the national debt even exists. The United States is a credit-based economy, which means there are assets and liabilities. And for the country to grow, assets and liabilities both need to grow.

When we issue debt, we’re issuing liabilities, but every liability is an asset for somebody else. Just two entities in our economy borrow on a large scale: the private sector and the public sector. So if you want the country’s debt to go down, you need the public sector to spend less and you need the private sector to take on more debt to keep the economy from shrinking. But do we really want the private sector, which is prone to crises, levering up so the public sector can save money?

Ross: I don’t think so. From history, we know that an over-levered private sector has led to some of the most prominent financial crises. The 2008 crisis is a perfect example of an over-levered private sector. If you gave me the choice, I’d rather the government borrow while the private sector focuses on managing their personal balance sheets.

Mike: The next question is, Is our nation bankrupt? In a blog post called I wrote about what our nation’s assets and liabilities are. Let’s say the national debt is $33 trillion and we have $400 trillion in social security and unfunded Medicare and all these other programs. That number seems crazy, doesn’t it? But let’s remember that if we have debt, we also have assets. Our assets include land, national resources in the ground and above the ground, and we also have the United States government, which has the ability to tax the most productive private sector in the history of the world. And that private sector pays their taxes in dollars. So how much is it worth to be able to tax our economy into perpetuity?

Ross: It’s almost unquantifiable in a positive way. Because as you mentioned, the government can tax in the same currency that it pays interest with. The United States has the most productive economy in the world, the biggest stock market in the world, and some of the biggest and most productive private companies in the world. The U.S. government has the ability to tax each of those sectors. Whenever these debt headlines come up, I think of “denominator blindness,” a term Barry Ritholtz coined. You can’t just think about X amount of debt, you have to compare it to something. For consumers, you compare debt to income. The national debt is the same way, and the assets of the United States are borderline unquantifiable.

Crucial Considerations of the National Debt

Mike: We’re not trying to say that the national debt is no big deal. But instead of focusing on the total amount of debt, we care about 1) how fast the national debt is growing and 2) how we’re servicing that debt. Remember how the debt-to-GDP ratio fell to about 50% after World War II? It’s not that we paid down the debt, it’s that our economy (the GDP) outgrew those levels of debt. And while today we’re at high levels of debt, if the economy continues to grow, we can also outgrow those levels of debt. It may take a long time, but it is possible.

Ross: And we can service the debt. Interest costs are going up, but they’re still well below the amount we bring in on tax revenue. Just by that number alone, more comes in than goes out to service national debt. Both political parties have ideas about how they want to manage the national debt, and at different times throughout history there have been ratings downgrades or bond market sell-offs that keep the national debt in focus. There are things that can be done to manage the pace that the national debt grows and how easy it is to pay interest on. But from an investor perspective, is the national debt inhibiting any of the things that matter? Over the course of history, it’s never been something that investors have needed to worry about. And if investors had worried enough to stay out of the market, they would have missed tremendous gains in economic growth and stock market performance.

Mike: Dear reader, if I could transport you to my birth year, 1973, and you knew that the national debt was going to go from $450 billion all the way up to $33 trillion, would you have invested? And what if we transported you to 1991, when Ross was born, and you knew the debt was going to go from $3 trillion up to $33 trillion—would you invest? Of you course you would, because you would know that the economy and corporate profits grew alongside the debt over that period.

Final Thoughts

As we wrap up, I want to put things into better perspective from an investor standpoint. There’s a spectrum of worries you have in your life and they’re ranked as to how likely they are to happen and how much they would affect you. It’s the same thing for your money. If I were to say there’s 500 worries that can impact your money and your ability to save, I’d put the national debt towards the bottom. When it comes to the top three worries, I’d say it’s your savings and your spending, what interest rates are doing, and how solid your plan is when it comes to things like tax planning and estate planning.

Ross: There’s a tiering approach to consider. The things that are directly in your control like saving, spending and planning are in the top tier. And then there’s a tier of external factors like interest rates and the Federal Reserve, and the earnings of the companies that you’re invested in. As part owners, we want those companies to continue to grow. And we should ask ourselves if these companies care about the national debt. For these large tech companies who are investing in AI and the next wave of consumer products., do they talk about the national debt in their C-suite meetings? The broad answer is no. And so the people who invest in those companies should probably follow suit, focusing more on interest rates, inflation, earnings and so on.

Mike: Do you think Howard Schultz was weighing the national debt when he was creating Starbucks? Of course not. He did what he could to create products and value for not only himself and his shareholders, but for the country and economy as a whole.

Before joining private wealth management, I spent my career talking to institutional clients who managed pensions and hedge funds and trillions and trillions of dollars. And when I asked them what they were worried about, the national debt never came up once in 12 years. Because they were focused on corporate earnings and how the economy was doing. Worry is a natural part of life, but try to keep it all in perspective.

Ross: Case in point: my two-year-old has a 529. I’m investing as long-term as possible to set her up for success, and we’re invested in stocks and bonds and are U.S.-centric. If I were worried about the national debt, that’d be reflected in my portfolio. But with a spectrum of worries, it falls towards the bottom.

If you have additional questions on how the market might influence your portfolio and broader plans, your Baird Financial Advisor is only a phone call away. For more insight into managing your portfolio, check out our articles on bairdwealth.com and the latest issue of Digest.

This article was originally published in February 2022 and was updated with more current information in June 2025.

The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.