Five for Friday

February 20, 2026

Bubble, Market Top, Social Security, January, Did You Know

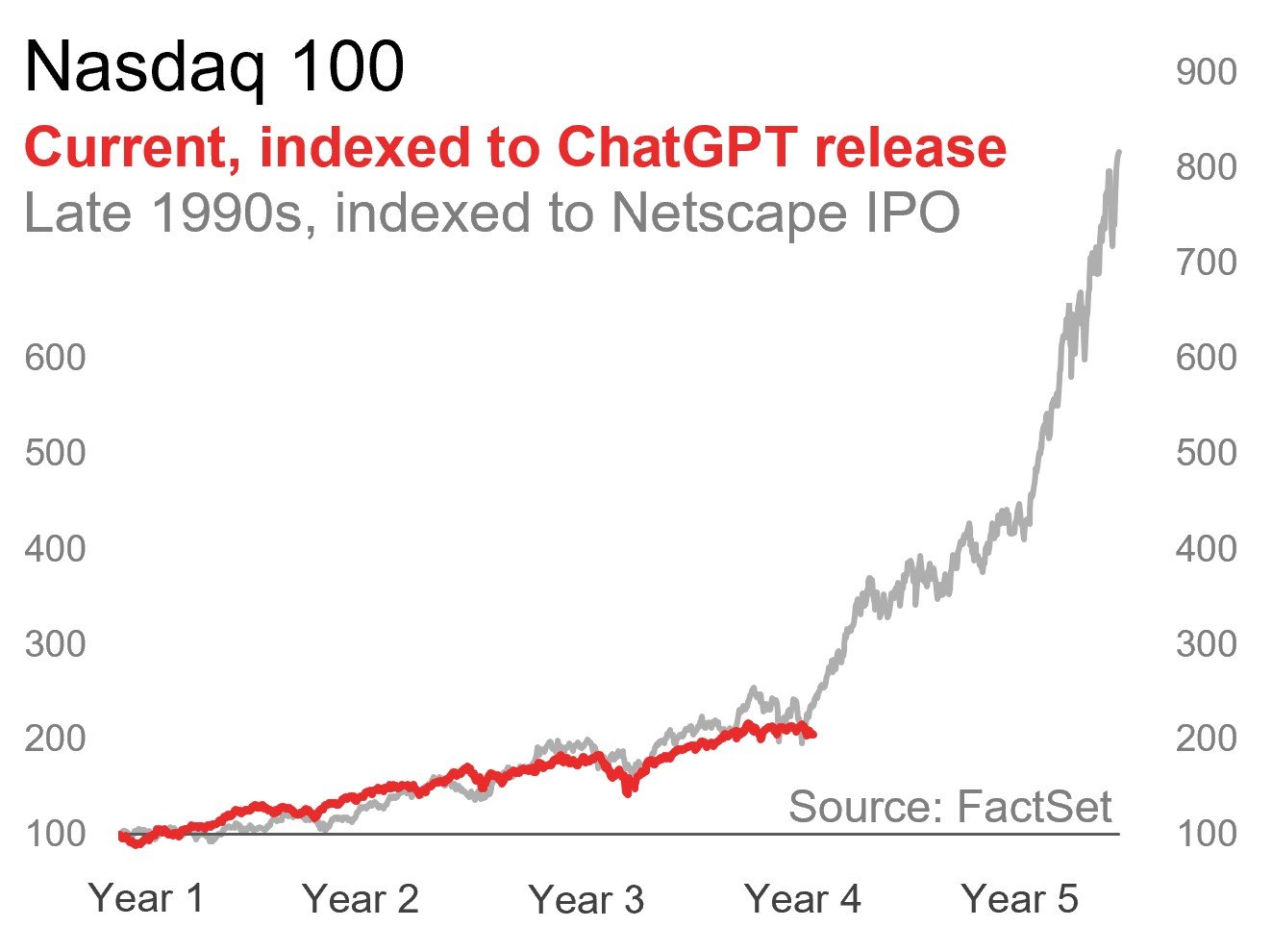

1. Bubble?

One of the most common questions I get is, “Are we in an AI bubble?” My answer has been – and still is – “no” for two main reasons. The first is price. Asset bubbles typically feature a parabolic price move in the underlying asset, often culminating in a “blow-off top” (when price goes almost vertical in a short period). The chart to the right helps clarify the difference between a bull market and a bubble. Second is sentiment. Bubbles are emotionally-driven, with prices increasingly dictated by euphoric sentiment and fear of missing out (rather than by the fundamentals). On that front, I’m reassured by the scrutiny of Big Tech's spending plans and funding sources (debt vs. cash). It’s a good sign that investors still care about cash flows and return on capital.

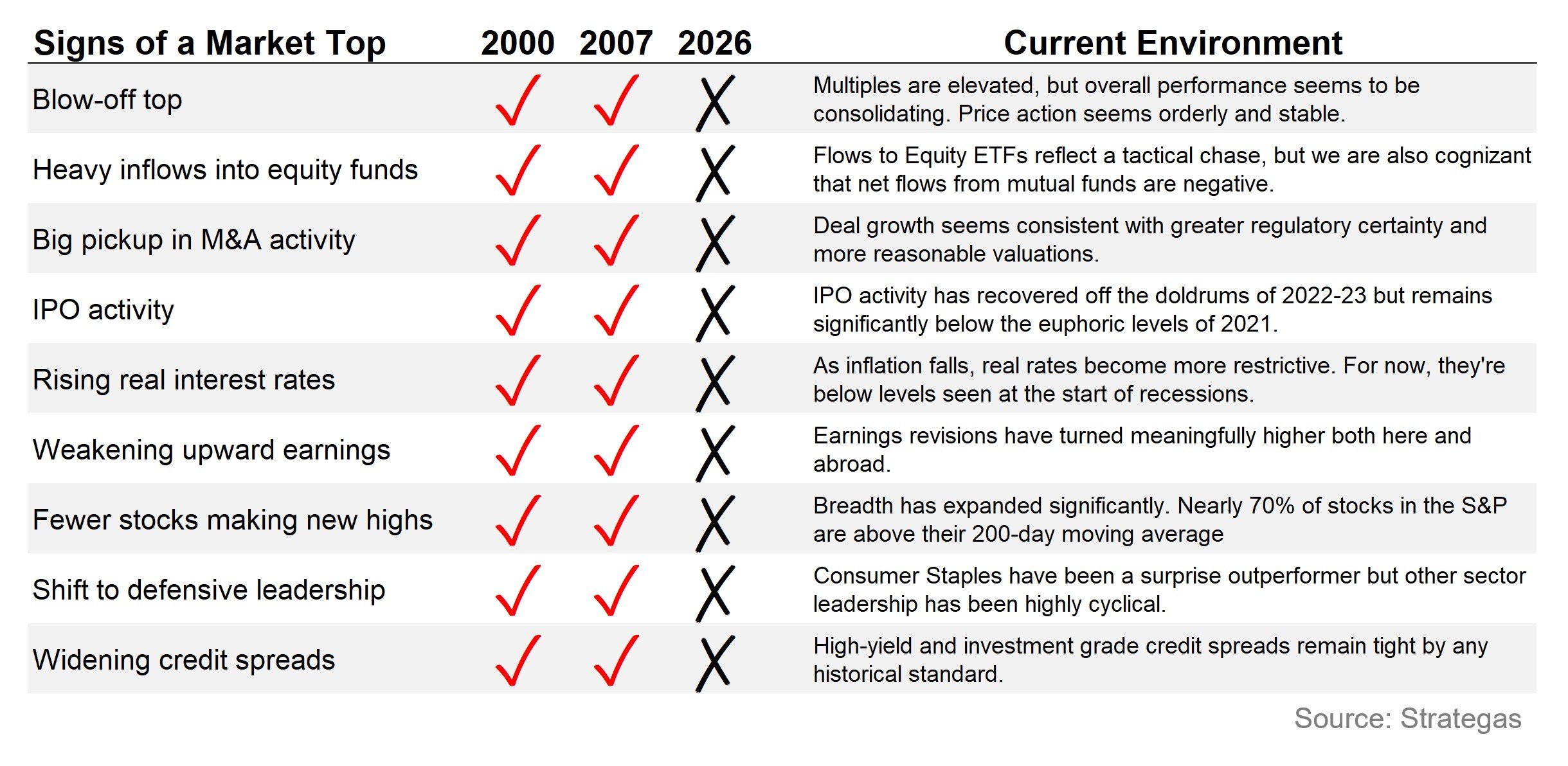

2. Market Top?

If we broaden our focus from “is it a bubble?” to “is the bull market in danger?” the signs pointing to a “yes” are still difficult to find. Our partners at Strategas (a Baird Company) publish a Bull Market Top Checklist (shown in the table below) as a way to measure the status of a bull market at any given time. As Strategas writes, “Not a single element of our checklist suggests that the broader market is in danger. Earnings growth remains robust, long-term interest rates are quiescent, and market leadership has broadened beyond the Technology sector. Some consolidation in Tech, in our opinion, increases the chances that the bull market continues to run.”

3. Social Security

Social security is back in the news with the release of the CBO’s 2026-36 outlook. Though the numbers involved have changed slightly with this new release, it’s still worth reading Baird’s Tim Steffen from last October on the future of the program.

4. January

. There’s an old investing adage that “as goes January, so goes the year,” (the thesis being that once late-year tax loss selling abates, January’s market performance indicates whether marginal demand is risk‑on or risk‑off and reflects the broader trend). But does the data back it up? Let’s find out. Over the last 75 years, the S&P 500 was positive in January 45 times. In those 45 years, the average full-year return was 17% (positive 89% of the time). For the 30 periods in which January was negative, the average full-year return was -2% (positive 47% of the time). All in all, we’ll take it as a good sign that this most recent January finished in the black.

5. Did You Know

Did you know that fake reviews cost online consumers an estimated $771 billion in 2025 ($0.12 on the dollar!) with costs expected to pass $1 trillion by 2030. Per Capital One, fake reviews boost product sales 12.5% in the first 2 weeks.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy. Market and economic statistics, unless otherwise cited, are from data provider FactSet.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should not consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Copyright 2025 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.