All That Matters: All-Time Highs, All-Time Worries

It’s the heart of summer 2025, and the stock market has been on a remarkable run – rebounding from April’s stormy selloff, climbing despite persistent uncertainty around a sweeping tax bill, and closing at multiple new all-time highs throughout July. In this episode, Mike and Ross address three big worries that may feel new, but have faced investors many times before.

The Tech Fear Cycle

Mike: We’ve been hearing a lot of new reports on AI lately. People are growing increasingly fearful about what it means for the job market and its potential negative impact on the economy. Ross and I decided to take a look through the history books. Widespread fear of new technology is nothing new. Innovations that are seemingly basic to us today once sparked major anxiety and resistance. Take electricity (pictured below) – something people once referred to as an “unrestrained demon.” And that’s not the only example. In 1825, people believed high-speed trains would tear their bodies apart. The sewing machine was expected to destroy jobs and social norms, especially around women’s roles. And when the telephone was invented, some feared it would cause deafness or even electrocution. The point is: people have always been afraid of new technology, but time and again, it’s gone on to improve the quality of our lives and move us forward.

Source: 1889 anti-electricity cartoon that first appeared in Judge magazine, illustrator unknown

Ross: Neither Mike nor I can say for certain what the future of AI looks like, but history suggests it’s unlikely to be a net destroyer of jobs. In the face of new technology and reshaped economies, people persist and adapt. Since 1940, 85% of employment growth has come from industries that didn't exist before. Smartphones, as one of the more recent examples, gave rise to the social media influencer, a career that employs approximately 50 million people worldwide and would’ve been out of the realm of possibility even 25 years ago. If you’re still skeptical about AI, here’s one thing to consider: own the companies building and investing in it. If you own the S&P 500, you already do. AI isn’t going away, and even if you don’t want to engage with it directly, you still have the opportunity to benefit from the growth it’s driving in the markets.

The Fed Blame Game

Mike: There’s also been a lot of discussion lately about interest rates and the role of the Federal Reserve. The current administration and Fed chairman Jerome Powell aren’t exactly seeing eye to eye. The President is pushing for rate cuts, but the Fed has been holding rates relatively steady, once again declining to cut at its most recent meeting. This tension isn’t new – throughout history, the Fed chair has often been in the headlines. Back in the 1980s, Paul Volcker, a Fed chair that served under Presidents Carter and Reagan, faced publish backlash for his policy decisions. Even President John F. Kennedy once called for an end to the Fed’s autonomy. This tension has existed throughout history because the Fed is such a powerful entity. The chairperson holds significant influence over the economy, and presidents often grow frustrated when the Fed’s independence complicates their economic agendas. It’s not uncommon for them to point to the Fed’s actions as the cause of economic hardship.

Ross: The Fed definitely makes a convenient scapegoat. Every president, regardless of party, wants the economy to thrive while they’re in office. While they work to stimulate growth and create jobs, those efforts can also fuel inflation. That’s when the Fed steps in because its independence allows it to raise rates and keep inflation in check. Right now, the administration is pushing for lower rates with the 2026 midterms in mind, but the Fed wants to maintain these rates to explicitly keep the economy in check in the face of inflationary pressures like tariffs. Whether you agree with the Fed's position or not, it’s clear they’ve long served as the scapegoat in these disagreements. And here’s something to keep in mind: even though the Fed cut rates last fall, long-term rates like mortgages have actually gone up – from around 6 % to 7 %. So, the relationship between Fed policy and borrowing costs isn’t always cut and dried.

Mike: There are so many moving parts in the economy, and the relationship between the economy and the markets is incredibly complex. Most people want lower borrowing costs, but the decision has to be weighed against inflation risks. President Trump is calling for lower rates while also pushing for economic stimulus through tax cuts and tariffs, something that doesn’t necessarily go hand in hand. The Fed chair has always been a target for criticism and today is no different. However, the role was thoughtfully designed to be shielded from political influence. And importantly, sole power doesn’t rest with a single individual, but rather with the 12-member voting committee.

Investing at the Peak

Mike: As the market reaches new all-time highs, a familiar myth tends to resurface – the idea that you should sell when the market hits a peak. We addressed this myth in our mythbusting episode, but it’s worth repeating: the market reaching an all-time high is not a reason to sell. I’d put it this way – you can’t let anxiety take over when the market is going down or when it’s going up. It’s important to stay grounded and avoid letting emotions drive your investment decisions, regardless of the direction of the market.

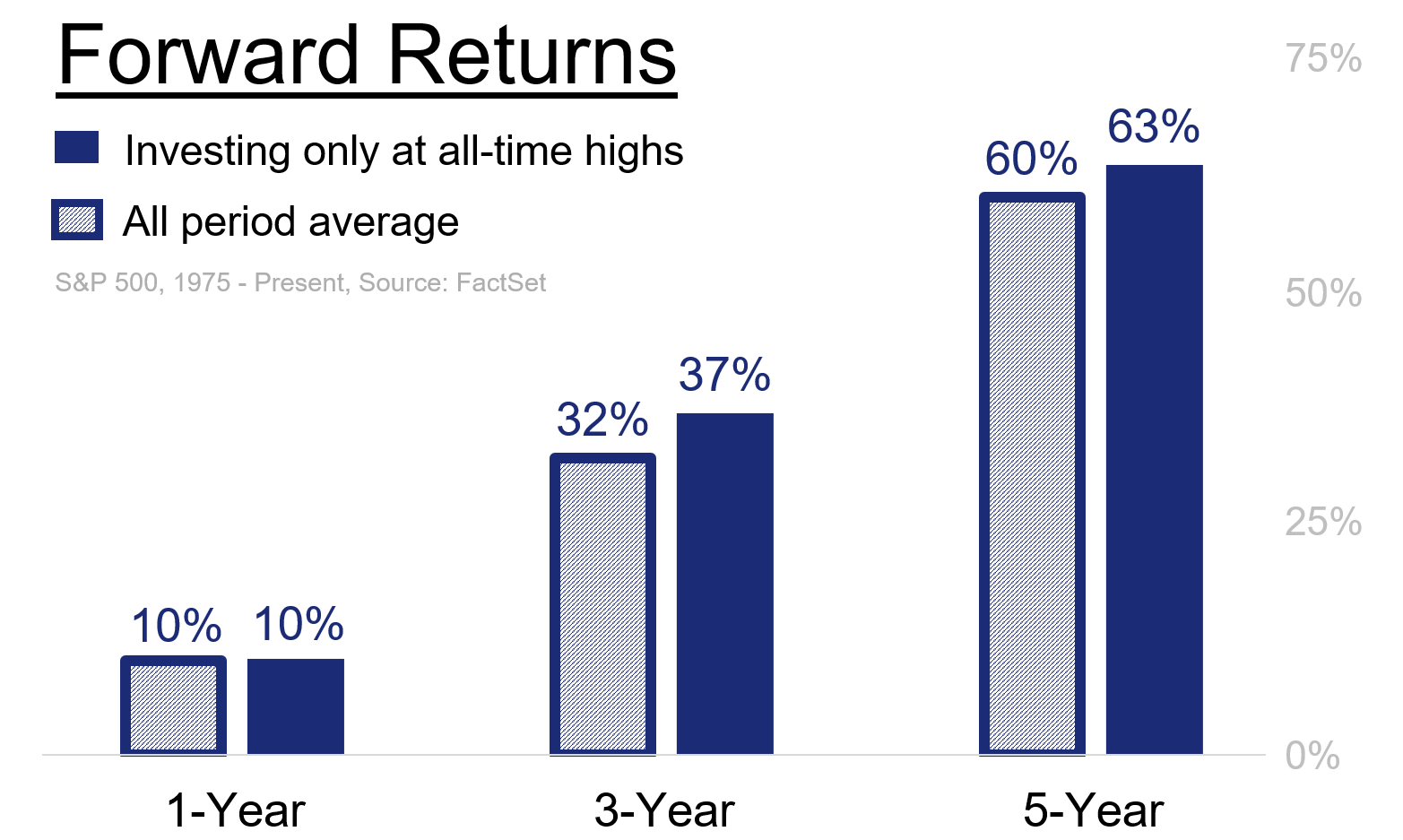

Ross: There are plenty of reasons to feel optimistic about investing at all-time highs. Historically, forward returns are actually stronger when you stay invested through them. We hit all-time highs a lot; it’s not like standing at the edge of a cliff but instead like reaching a base camp on a long climb. Since the 2009 bear market ended, we’ve seen over 400 all-time highs. The only calendar year since 2013 without one was 2023. So, if you had jumped out at the new all-time highs in 2014, you would have missed out on one of the greatest bull markets of all time. The same goes for 2018 and 2020. All-time highs don’t happen during recessions or bear markets – they’re a sign that things are working.

Mike: When the market peaks, it usually means that key indicators like company earnings and consumer spending are on the rise. While the market can shift quickly and rarely moves in a straight line, staying invested is essential for you to benefit from its ongoing growth and innovation.

This information has been developed by a member of Baird Wealth Solutions Group, a team of wealth management specialists who provide support to Baird Financial Advisor teams. The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.