2025 Mid-Year Market Outlook with Strategas

From tariff announcements to geopolitical tensions, the second quarter of 2025 has been marked by heightened macroeconomic noise. Strategas President Nicholas Bohnsack explores the key economic indicators and investment themes that shape his outlook for the remainder of the year.

Return to Market Insights

Key Questions at the Midpoint of 2025

How does Strategas think about investing against such a noisy macroeconomic backdrop?

The second quarter resembled a 'broken play’ in football, beginning with the Trump administration's new tariff policy in early April. Stock prices dropped quickly in response and spent the rest of the quarter gradually recovering. Attention has since shifted to tax policy and geopolitical developments in the Middle East. However, our focus remains on the foundational drivers of the markets: earnings and interest rates. Economic growth in the U.S. appears robust enough to continue expanding, barring a financial disruption.

When things get uncertain, we focus on the 'three Cs': unemployment claims, corporate credit, and corporate profits. Labor markets are currently stable, corporate credit spreads are being closely monitored, and corporate profit expectations are above recessionary thresholds. Overall, we maintain a cautiously optimistic outlook for the second half of 2025.

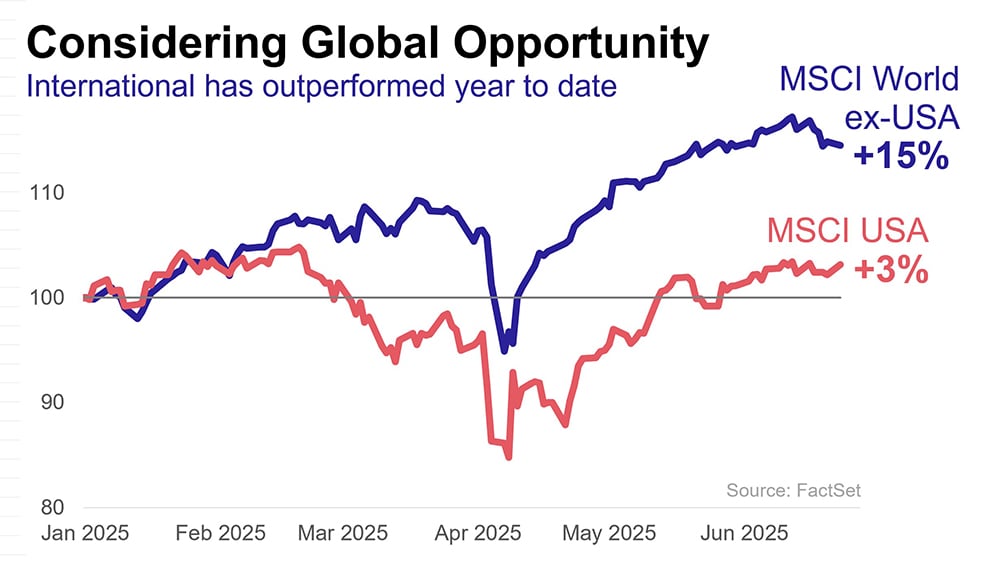

What are your thoughts about U.S. stocks vs. international stocks going forward?

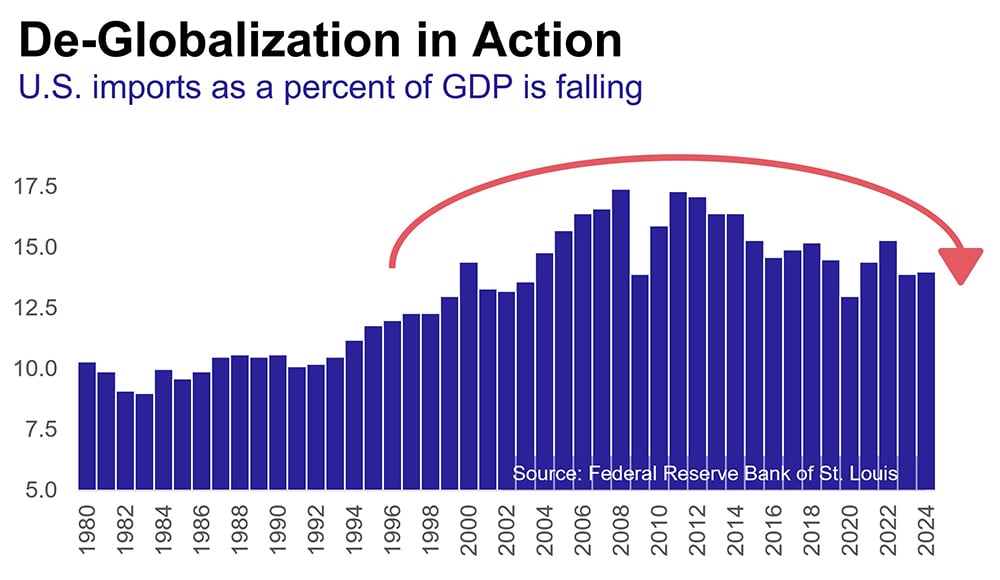

The U.S. economy continues to outperform its global peers, but our team sees growing merit in increasing exposure to international equities. From a cyclical perspective, the dominance of U.S. mega-cap stocks—particularly the Magnificent 7—appears stretched in both price and valuation. We anticipate a broadening of equity market leadership and have begun to tactically increase international exposure in our portfolios. From a more secular standpoint, deglobalization is expected to remain a defining theme. In terms of asset allocation, diversification will remain important, and gold may play a role in the transition from domestic to international stock ownership.

What are a few of your highest conviction themes for the second half of 2025?

There are four dominant investment themes for the remainder of 2025: deglobalization, cash flow aristocrats, artificial intelligence, and the industrial power renaissance.

At mid-year, the focus narrows to two:

- Cash flow aristocrats: In an environment of rising uncertainty and elevated capital costs, companies with strong free cash flow are well-positioned to preserve optionality. At a high level, corporations can use their cash in seven ways: dividends, share buybacks, debt retirement, acquisitions, capital expenditures, labor compensation, and retained earnings. Three of those options return money to investors, while another three represent an opportunity to reinvest in the firm. Firms that manage the final option, retained earnings or free cash flow, are likely to be rewarded by the market in times of uncertainty.

- Deglobalization: Deglobalization continues to reshape both the geopolitical and economic landscape. Issues such as trade, national defense, resource procurement, and intellectual property are central to this massive shift. We believe that nearly every major investment decision in the coming years will need to account for the implications of deglobalization.

Important Disclosures

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

This communication was prepared by Strategas Securities, LLC (“we” or “us”). Recipients of this communication may not distribute it to others without our express prior consent. This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security. Market and economic statistics, unless otherwise cited, come from data providers FactSet and Bloomberg. This communication does not constitute, nor should it be regarded as, investment research or a research report or securities recommendation and it does not provide information reasonably sufficient upon which to base an investment decision. This is not a complete analysis of every material fact regarding any company, industry or security. Additional analysis would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any particular client and is not presented as suitable to any other particular client. Investment involves risk. You should review the prospectus or other offering materials for an investment before you invest. You should also consult with your financial advisor to assist you with your analysis, risk evaluation, and decision-making regarding any investment.

The performance and other information presented in this communication is not indicative of future results. The information in this communication has been obtained from sources we consider to be reliable, but we cannot guarantee its accuracy. The information is current only as of the date of this communication and we do not undertake to update or revise such information following such date. To the extent that any securities or their issuers are included in this communication, we do not undertake to provide any information about such securities or their issuers in the future. We do not follow, cover or provide any fundamental or technical analyses, investment ratings, price targets, financial models or other guidance on any particular securities or companies. Further, to the extent that any securities or their issuers are included in this communication, each person responsible for the content included in this communication certifies that any views expressed with respect to such securities or their issuers accurately reflect his or her personal views about the same and that no part of his or her compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in this communication. This communication is provided on a “where is, as is” basis, and we expressly disclaim any liability for any losses or other consequences of any person’s use of or reliance on the information contained in this communication.

Strategas Securities, LLC is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), a broker-dealer and FINRA member firm, although the two firms conduct separate and distinct businesses. A complete listing of all applicable disclosures pertaining to Baird with respect to any individual companies mentioned in this communication can be accessed at http://www.rwbaird.com/research-insights/research/coverage/third-party-research-disclosures.aspx. You can also call 1-800-792-2473 or write: Baird PWM Research & Analytics, 777 East Wisconsin Avenue, Milwaukee, WI 53202.