Three Tax Themes for 2025

Washington Policy Research

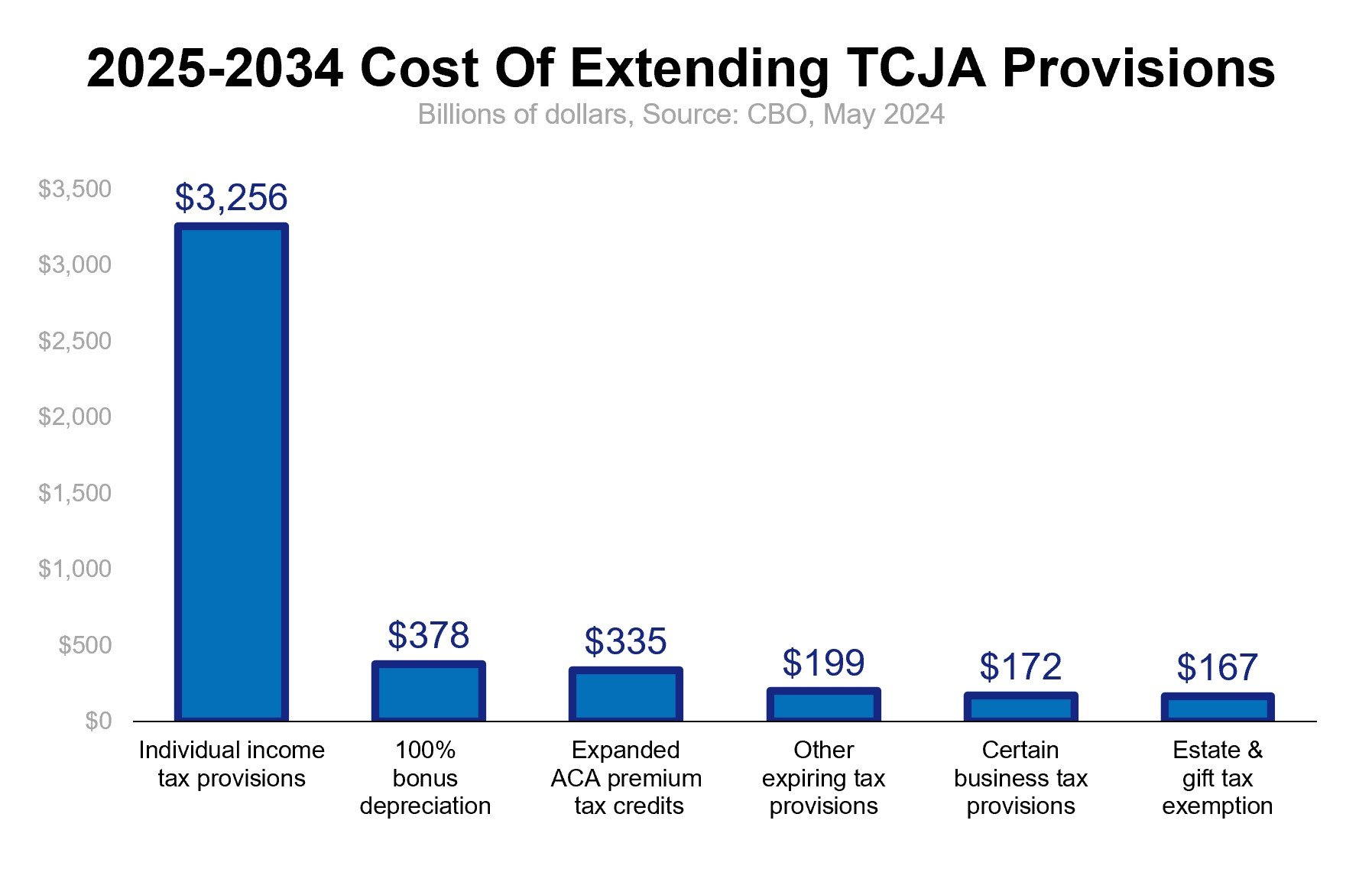

One of President Trump’s key policy priorities is to extend nearly all of the tax cut provisions included in the 2017 Tax Cuts and Jobs Act. Republicans in Congress will undertake this task using the budget reconciliation process, which requires just 51 votes (rather than 60) in the Senate, but which also requires payfors to offset the cost of the tax cuts.

Theme 1: Expiring tax cuts will be extended before the end of 2025.

The individual income tax changes included in the 2017 tax bill expire at the end of 2025. If Congress takes no action, tax increases will go into effect on January 1, 2026. Most of those tax changes will fall on middle-class individuals. While there are rumblings that Congress will struggle to pass legislation given the very slim majority Republicans hold in the House of Representatives, the key thing to remember is that members of Congress do not want taxes to increase on middle-class individuals. That will create a catalyst for Congress to act, and to extend most (if not all) of the 2017 tax cuts before the end of the year. That means that individuals are unlikely to see higher income tax rates or changes to the Alternative Minimum Tax, the 20% pass-through exemption (Section 199A), or the estate tax.

Theme 2: Trump is looking to add tax-related campaign promises to the tax bill.

During the campaign, Trump promised to eliminate taxes on tips, promised to increase the state and local tax (SALT) deduction, and called for lowering the corporate tax rate to 15% for domestic manufacturers. We anticipate that Trump will try to include those proposals in the 2025 tax bill, but their inclusion could be constrained by how much fiscal capacity Congress has in developing the tax bill. The reconciliation process sets specific requirements for how much the legislation can increase the deficit. Otherwise, the provisions have to be paid for with higher revenues or decreased spending. Including these tax provisions will increase the cost of the tax bill and payfors will have to be included to offset the cost. This is why Trump is so focused on tariffs and the ability to generate revenue from higher tariffs on imports into the United States. Congress is unlikely to enact tariffs through legislation and congressional budget scorekeepers will not credit Trump’s executive actions on tariffs as paying for the tax cuts. Regardless, Trump will point to the revenue raised from tariffs as providing an offset to the tax bill.

Theme 3: Payfors need to be included in the tax bill.

As noted above, payfors will need to be included in the tax bill. We expect these offsets to include some spending cuts, including cuts to Medicaid and other health care programs, and potentially some tax increases, such as an increase in the 1% buyback tax. Congress could also choose to extend the tax cuts for a limited number of years (e.g., 5) in order to reduce the cost. A key first step in the process is for Congress to decide on the size of the deficit increase to be allowed with the tax bill. That decision will provide greater clarity on the size of the payfors needed and which may be included. We’ll be watching these items closely as they develop

Appendix - Important Disclosures

Past performance is not indicative of future results. This communication was prepared by Strategas Securities, LLC (“we” or “us”). Recipients of this communication may not distribute it to others without our express prior consent.

This communication was prepared by Strategas Securities, LLC (“we” or “us”). Recipients of this communication may not distribute it to others without our express prior consent. This communication is provided for informational purposes only and is not an offer, recommendation or solicitation to buy or sell any security. Unless otherwise cited, market and economic statistics come from data providers Bloomberg and FactSet. This communication does not constitute, nor should it be regarded as, investment research or a research report or securities recommendation and it does not provide information reasonably sufficient upon which to base an investment decision. This is not a complete analysis of every material fact regarding any company, industry or security. Additional analysis would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any particular client and is not presented as suitable to any other particular client. Investment involves risk. You should review the prospectus or other offering materials for an investment before you invest. You should also consult with your financial advisor to assist you with your analysis, risk evaluation, and decision-making regarding any investment.

The performance and other information presented in this communication is not indicative of future results. The information in this communication has been obtained from sources we consider to be reliable, but we cannot guarantee its accuracy. The information is current only as of the date of this communication and we do not undertake to update or revise such information following such date. To the extent that any securities or their issuers are included in this communication, we do not undertake to provide any information about such securities or their issuers in the future. We do not follow, cover or provide any fundamental or technical analyses, investment ratings, price targets, financial models or other guidance on any particular securities or companies. Further, to the extent that any securities or their issuers are included in this communication, each person responsible for the content included in this communication certifies that any views expressed with respect to such securities or their issuers accurately reflect his or her personal views about the same and that no part of his or her compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in this communication. This communication is provided on a “where is, as is” basis, and we expressly disclaim any liability for any losses or other consequences of any person’s use of or reliance on the information contained in this communication.

Strategas Securities, LLC is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), a broker-dealer and FINRA member firm, although the two firms conduct separate and distinct businesses. A complete listing of all applicable disclosures pertaining to Baird with respect to any individual companies mentioned in this communication can be accessed at http://www.rwbaird.com/research-insights/research/coverage/third-party-research-disclosures.aspx. You can also call 1-800-792-2473 or write: Baird PWM Research & Analytics, 777 East Wisconsin Avenue, Milwaukee, WI 53202.