Three Policy Themes for 2026

Presidents tend to enact economic stimulus policies in the first year of their presidencies ‒ when their political capital is the highest ‒ to accelerate economic growth in their second year (the midterm election year). In year two, given the economic cushion that is in place, presidents tend to become more populist as they are often underwater with voters heading into the midterm elections. So far, 2026 is proving no different, with the president offering populist policy solutions, such as a cap on credit card interest rates and banning institutional investors from buying single-family homes, as he looks ahead to the midterm elections.

“Shock-and-awe” economic policy will be the 2026 backdrop. US economic policy is shifting away from the austerity caused by tariffs in 2025 to stimulus in 2026. The One Big Beautiful Bill Act enacted in July included both consumer and business tax cuts that were designed to offset the negative economic impact of the tariffs. However, there was a timing mismatch for the consumer. Rather than cutting individual income tax rates directly, which would have had an immediate impact on the consumer, Congress changed tax deductions. As a result, the consumer tax cuts will arrive in the form of tax refunds in early 2026. Consumers will see a 44% increase in tax refunds in 2026 as compared to 2025 (an incremental $150 billion). In addition, although the business tax cuts were made retroactive to January 2025, we expect more businesses to take advantage of the provisions this year. Given the significant economic stimulus coming in 2026, in combination with a Federal Reserve that has been lowering interest rates, U.S. economic growth should accelerate.

Populist proposals will feature prominently. Historically, the president’s party loses an average of 28 seats in the House of Representatives in the midterm year. Today, Democrats need to win just a net three seats to win control of the House. Affordability has been a key issue in recent elections and it will remain a key issue in the 2026 midterm elections. Hence, the president is focused on how to lower costs for consumers, offering policy proposals to lower housing, health care, and electricity costs. Not all of these policy priorities will be enacted, but they create policy uncertainty, which impacts markets.

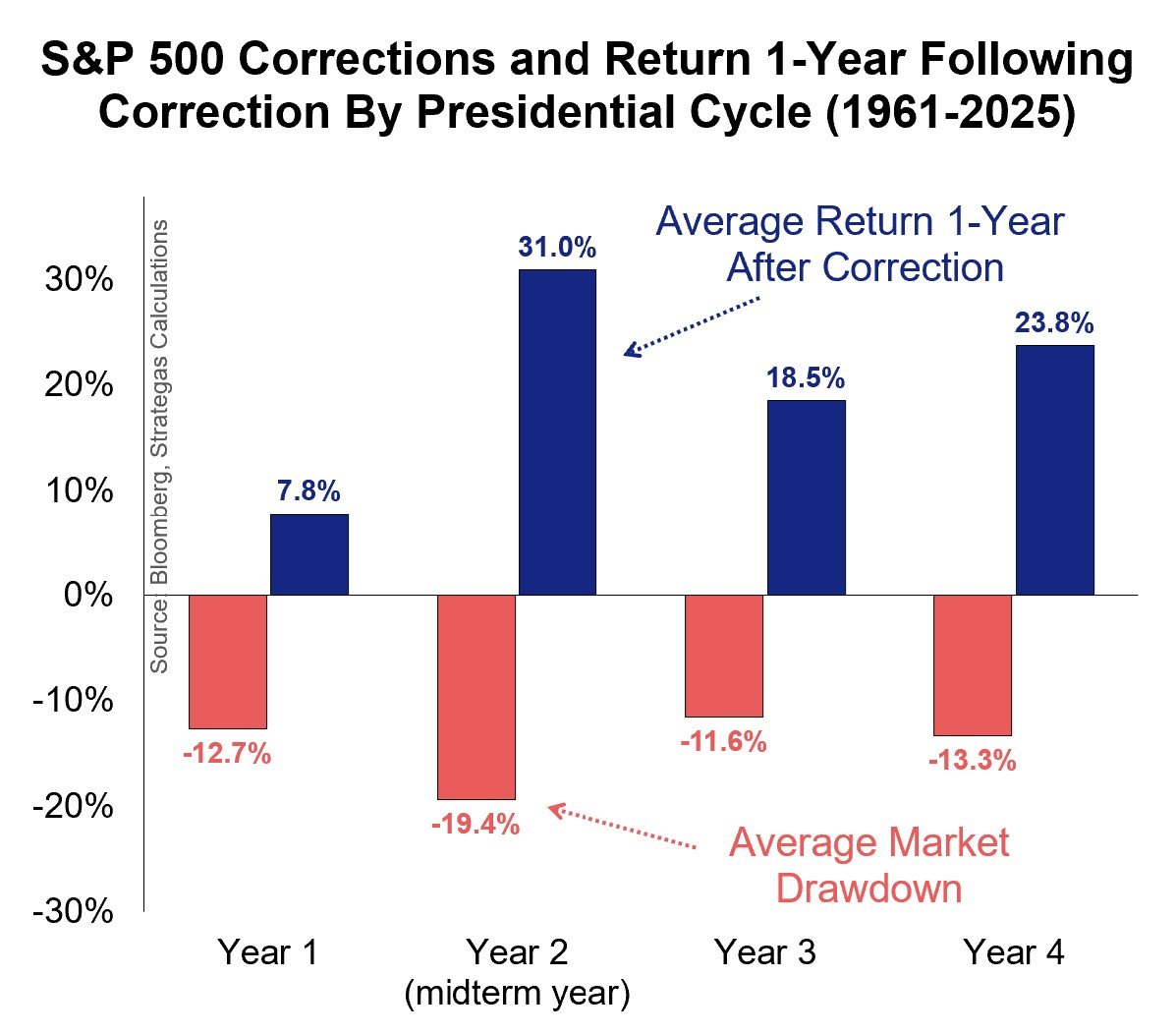

The market is more volatile in midterm years. Presidents becoming more populist in the second year of their term is one reason that midterm election years have larger intra-year equity market drawdowns than the other three years in the presidential cycle (19% on average rather than 12-13% in the other three years). Despite generally accelerating economic growth in midterm election years, the equity market becomes more defensive. Still, that volatility has tended to become a buying opportunity; the S&P 500 has not declined in the 12 months following a midterm election since 1938.

APPENDIX – IMPORTANT DISCLOSURES

Past performance is not indicative of future results. This communication was prepared by Strategas Securities, LLC (“we” or “us”). Recipients of this communication may not distribute it to others without our express prior consent.

This communication was prepared by Strategas Securities, LLC (“we” or “us”). Recipients of this communication may not distribute it to others without our express prior consent. This communication is provided for informational purposes only and is not an offer, recommendation or solicitation to buy or sell any security. Unless otherwise cited, market and economic statistics come from data providers Bloomberg and FactSet. This communication does not constitute, nor should it be regarded as, investment research or a research report or securities recommendation and it does not provide information reasonably sufficient upon which to base an investment decision. This is not a complete analysis of every material fact regarding any company, industry or security. Additional analysis would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any particular client and is not presented as suitable to any other particular client. Investment involves risk. You should review the prospectus or other offering materials for an investment before you invest. You should also consult with your financial advisor to assist you with your analysis, risk evaluation, and decision-making regarding any investment.

The performance and other information presented in this communication is not indicative of future results. The information in this communication has been obtained from sources we consider to be reliable, but we cannot guarantee its accuracy. The information is current only as of the date of this communication and we do not undertake to update or revise such information following such date. To the extent that any securities or their issuers are included in this communication, we do not undertake to provide any information about such securities or their issuers in the future. We do not follow, cover or provide any fundamental or technical analyses, investment ratings, price targets, financial models or other guidance on any particular securities or companies. Further, to the extent that any securities or their issuers are included in this communication, each person responsible for the content included in this communication certifies that any views expressed with respect to such securities or their issuers accurately reflect his or her personal views about the same and that no part of his or her compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in this communication. This communication is provided on a “where is, as is” basis, and we expressly disclaim any liability for any losses or other consequences of any person’s use of or reliance on the information contained in this communication.

Strategas Securities, LLC is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), a broker-dealer and FINRA member firm, although the two firms conduct separate and distinct businesses. A complete listing of all applicable disclosures pertaining to Baird with respect to any individual companies mentioned in this communication can be accessed at https://www.rwbaird.com/research-coverage/. You can also call 1-800-792-2473 or write: Baird PWM Research & Analytics, 777 East Wisconsin Avenue, Milwaukee, WI 53202.