Bull & Baird: What Moves the U.S. Stock Market?

Headline from January 3, 2026: US forces seize Venezuelan leader Maduro

Market reaction since the event: +1.5% (as of Jan 7, 2026)

You’d think that a secret U.S. operation to detain a foreign leader in the middle of the night and fly him to New York to face federal charges would spark volatility in the stock market, right?

Nope. In fact, we’ve started the year by hitting new all-time highs.

So, you might be wondering: What does move the U.S. stock market? What does it care about if not headline-grabbing global events like we just witnessed? Allow me to simplify it for you.

There are four major forces that drive stock market movement on a day-to-day basis (this is not intended to be an exhaustive list).

- Earnings – What are companies saying about their profits, their forward outlooks, and the current state of their business?

- Interest rates – Are interest rates going up or down? Will the Federal Reserve cut rates or hike them at their next meeting? Rates affect everything in the economy.

- Flows – Are people moving money in and out of the stock market in such a way that it affects prices?

- Investor Sentiment – How do people feel about their jobs, their homes, and their prospects for future economic security?

Now ask yourself: Does the event I’m watching on TV or reading about in the news affect those four things in a meaningful way?

Often, the answer is no.

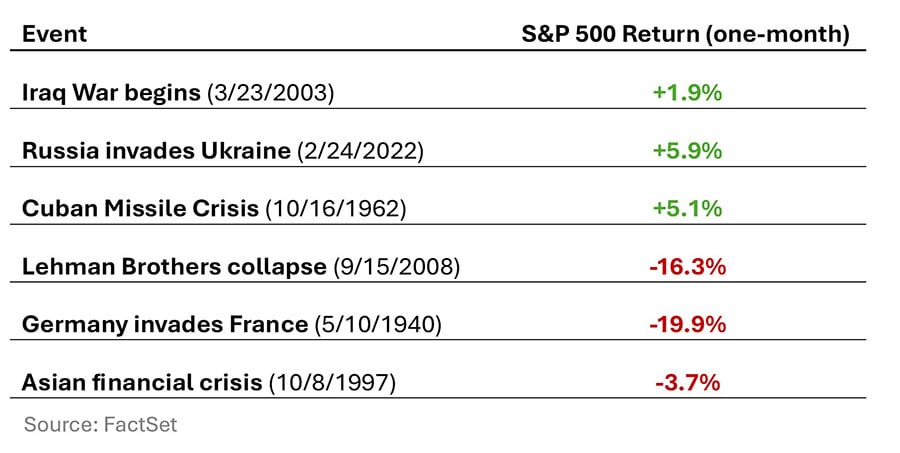

Let me give you a few examples of major global shocks and how the market acted one month later:

Notice which events caused declines in US stock prices. It was the ones that affected all four of the forces I mentioned—earnings, interest rates, flows, and investor sentiment—all at once.

How about the Cuban Missile Crisis? Surely that affected sentiment or flows? It did, but it was resolved so quickly that the impact was minimal.

The best way I’ve seen day-to-day stock market movement explained is this simple question: “Are things getting better, worse, or staying the same for the U.S. economy and the companies inside it?”

Remember the massive tariff-related selloff in April of 2025? The market thought to itself “If this happens, things will get worse for U.S. companies and consumers.” Then, the massive tariff levels were backed off and stocks rallied.

Better…worse…same?

Better…worse…same?

That’s all the market is thinking about every second of the day.

Could there be longer-term consequences for our actions in Venezuela? Like, say, the price of oil or global perceptions of the U.S.? Sure, but the market will deal with them as they come.

When global headlines scare you, I want you to remember that history is full of chaotic events. It’s always been like this. History is just one darn thing after another.

What can you do about that? Talk to your Baird Financial Advisor, stick to your plan, keep your friends and family close, live your life. That’s the way forward.

The information reflected in this post is an opinion and subject to change. Past performance is not a guarantee of future results. Diversification does not ensure profit or protect against loss. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances. Speak to your Baird Financial Advisor before making investment decisions.