Preparing for Widowhood

It’s commonly understood that women tend to live longer than men – but the age that women lose their spouse is younger than most people realize.

Roughly 30% of women are widowed by the time they are 65, leaving them solely responsible for managing their wealth, home and family.1 At Baird, we help families plan for the future, both the expected and unexpected.

In our Preparing for Widowhood series, Jackie Russell and Jaleigh White discuss their experiences and share their advice in navigating the loss of a spouse.

The Impact of Widowhood

There are many misconceptions surrounding widowhood. While it’s not a happy topic, it’s important to discuss to ensure you and your family are ready for any outcome.

In this discussion, Jackie and Jaleigh explain the difficult decisions woman face immediately following the death of their spouse and the vulnerability a person faces after losing a loved one.

The impacts of widowhood are far reaching – affecting taxes, estate planning and even household management. Hear more from Jackie and Jaleigh on how best to prepare

The Benefits of an Effective Plan

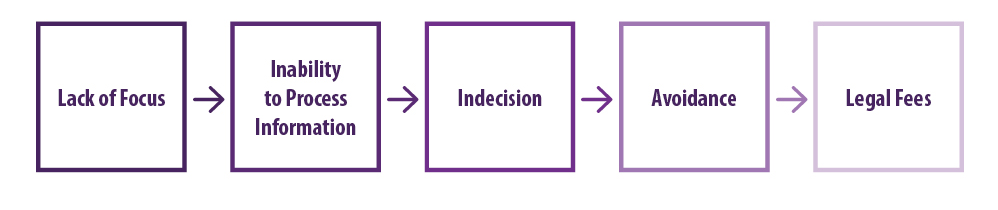

Avoidance Vs Proactive Planning

It’s natural to want to avoid difficult conversations when they don’t need to be had, but addressing it head on leaves both of you better prepared for the unexpected.

What Planning Is Not

An effective plan is not leaving an advisor’s number for your spouse to call after you’re gone – it’s a plan made between you and your spouse, together.

You Don’t Have To Face This Alone

It’s important to have a trusted partner who understands the vulnerability of balancing financial matters after the loss of a loved one. Connect with a Baird Financial Advisor today to help you and your spouse:

- Review your estate plan: Ensuring loved ones are cared for as intended.

- Prepare for changes in cash flow: Planning for how a loss may affect both your earned and retirement income.

- Discuss and plan for long-term care needs: Exploring how your care might change when living independently.

- Revisit your financial plan: Creating what-if scenarios to plan for investments, insurance and more.

Related Links

1 U.S. Census Bureau. Current Population Survey, Annual Social and Economic Supplement, 2022. Release date: August 2023. Available at: https://www.census.gov/ data/tables/2022/demo/age-and-sex/2022-older-population.html.