The COVID-19 Recession

The thing about recessions is that you’re only told about them after the fact. The National Bureau of Economic Research defines a recession as “a significant decline in economic activity spread across the economy, lasting more than a few months.” By this definition, it is a backward-looking measure – you need months of data to ultimately make the call. The Great Recession began in December 2007 but wasn’t officially announced until nearly a year later.

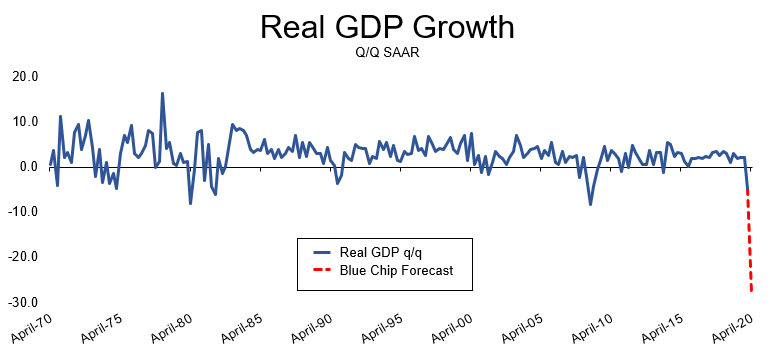

Still, we feel confident in proclaiming this: The United States is currently in the midst of a recession, and one unlike any we’ve ever seen before. The coronavirus pandemic and retaliatory lockdown froze the U.S. economy in place, halting economic activity quickly and dramatically. And while government stimulus has helped ease the pain slightly, the overall effect has been devastating. Since mid-March, more than 30 million Americans have filed for unemployment insurance, and economic data across the board is dismal. Ultimately, GDP fell by 4.8% in the first quarter, while Q2 is projected to plummet by as much as 35% – the worst contraction since the Great Depression (see chart).

What Makes This Recession Different

But this crisis is unique for reasons other than its raw devastation. Given the immediate and widespread halt on most economic activity, this will likely be the deepest and most abrupt recession ever. Further, most past recessions and market crashes could be described as largely self-inflicted, whether from excessive debt in the system, an asset bubble (such as housing or technology stocks), aggressive Federal Reserve action or some other catalyst. This crisis was none of that.

A rapidly spreading novel virus is probably more akin to a natural disaster or terrorist attack – an unpredictable and unprecedented outside force that can wreak tremendous havoc in the blink of an eye. Our response (both on the policy and consumer front) was necessarily extreme. Once a lethal virus begins spreading exponentially, it is nearly impossible to contain without a vaccine – once rung, that bell is hard to unring. But our preventative actions came at a great economic cost. To attempt an analogy, we put our body (the economy) in a medically induced coma in order to save our brain (hundreds of thousands of human lives) and ultimately live to fight another day.

What Could Recovery Look Like?

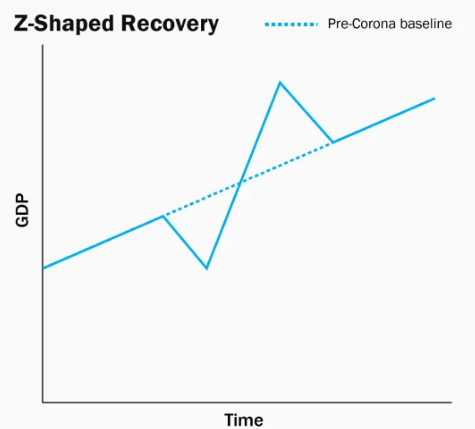

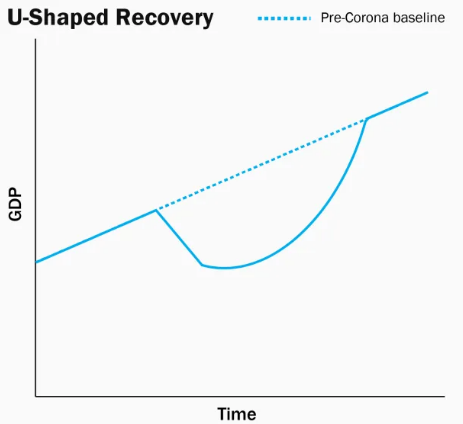

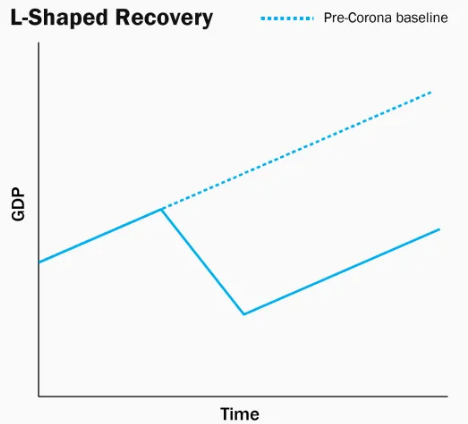

At this point, it remains too soon to say when a recovery could truly begin and what path it will take. While the worst-case scenarios have been removed from the table, the uncertainty we face going forward is still unprecedented. The alphabet soup of potential recovery scenarios is truly vast: V-, U-, W-, L-, Z-, Nike Swoosh-, and Square root-shaped, to name a few (see chart).

In the end, it is worth reiterating that this is a health crisis first and foremost. We cannot expect the economy or consumer behavior to recover until there is evidence that the pandemic itself is under some semblance of control. Here, significant progress has been made at a backbreaking pace. Healthcare professionals learn more about the virus every day, leading to significant progress on effective therapeutics, smarter resource allocation and rapid vaccine development. This progress is critical because, to oversimplify, all that matters now is the speed with which the world can return to normalcy.

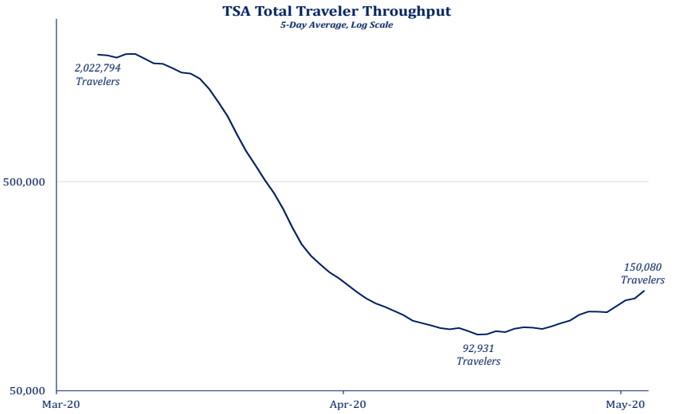

And there are green shoots in the real world. As dismal as it has gotten, restaurant and air travel data (see chart) have begun to tick up off their April lows, and the housing market remains fairly resilient. Still, it is the success of our broader reopening effort that holds the key to a strong economic recovery. Should a return to something resembling pre-COVID life occur sooner rather than later, a strong and robust rebound in Q3 or Q4 is possible, turbocharged by unprecedented government stimulus and pent-up consumer demand. Should a second wave appear in the fall or treatments and vaccines fall flat, a longer and much more devastating downturn could be the reality.

Financial Strategies During a Recession

But what can we do in times of historic uncertainty? We remind investors that the stock market and economy, while related, are not the same. Not only are the makeups very different (for example, the S&P 500’s largest companies are not necessarily the biggest employers or contributors to GDP), but the stock market is a forward-looking mechanism. This explains why a surprising share of a bull market’s returns accumulate in its earliest stages, often while still in a recession. Consider this: The S&P 500 bottomed on March 9, 2009, but the Great Financial Crisis recession lasted through June. By the time it officially ended, the S&P had already gained over 35%, and those investors who waited missed a big part of the bounce.

Further, times of crises offer invaluable opportunities to strengthen our financial plans. There are tons of financial planning opportunities in a COVID-19 world, including some brought to the forefront by new fiscal stimulus measures that might directly affect your situation. Tax-loss harvesting, rebalancing efforts, debt refinancing, risk tolerance reassessment, estate planning considerations – these just scratch the surface of direct actions you can take. And that is where a Baird Financial Advisor can help the most. In such an uncertain world, it pays to take control of what you can. A Baird Advisor can offer sound, objective investment advice and guidance on making sure your portfolio is in alignment with both the current investing environment and your larger financial goals.

The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.