A Perspective on the Market

With equity and fixed income markets off to a remarkably rough start this year, Strategas Chairman and CEO Jason Trennert answers a spate of questions that Baird has heard from clients.

Do you expect this heightened volatility will continue?

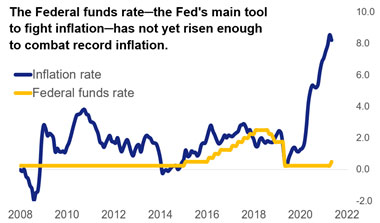

I think it’s likely that the volatility will continue because I don't think the Fed is anywhere near its neutral rate. Inflation (based on CPI) is over 8%, and the Fed funds rate is only 0.75%. There’s a lot of room for the Federal Reserve to keep tightening, and there are going to be increased concerns about the potential of recession next year. Be sure to check out our key market takeaways.

What is your thinking on inflation and the Federal Reserve? Can the Fed stick the soft landing?

The Fed has a chance to stick the landing, but the longer inflation goes, the more difficult it is to rein in. And it's a moving target. The Fed is getting aggressive (tightening) now but was still buying securities (easing) in March. Their problems are compounded by that late start. Past that, we have supply chain issues, an enormous amount of monetary stimulus in the system, and even discussions about states and localities providing stimulus to consumers to counteract inflation. Unfortunately, I think a lot of those efforts will be counterproductive.

Given global supply chain problems, how are you thinking about geopolitical tension?

The tailwind for disinflation that we've seen since the early 2000s (i.e. globalization) is likely over. It's difficult to describe globalization as dead, but there are a lot more concerns about its effects now than there were just a few years ago. There’s also skepticism about whether trade can make other countries more “Western,” especially after the pandemic and the Russian invasion of Ukraine. So in our opinion, a good portion of that “peace dividend” is going to go the other way. That's how we're thinking geopolitical concerns could impact inflation, bond yields, and earnings multiples.

The tailwind for disinflation that we've seen since the early 2000s (i.e. globalization) is likely over. It's difficult to describe globalization as dead, but there are a lot more concerns about its effects now than there were just a few years ago. There’s also skepticism about whether trade can make other countries more “Western,” especially after the pandemic and the Russian invasion of Ukraine. So in our opinion, a good portion of that “peace dividend” is going to go the other way. That's how we're thinking geopolitical concerns could impact inflation, bond yields, and earnings multiples.

How do you reconcile a hot domestic labor market and fairly strong S&P 500 earnings with the rising probability of recession?

The consensus 2023 earnings estimate for the S&P 500 is around $250. We have it at more like $235, and even that may be optimistic. The labor market is tight as a drum but profit margin pressures will make it more difficult for companies to add workers at the pace they have been. A combination of higher inflation, Fed tightening, and weaker labor markets should ratchet up recession concerns. That doesn't mean recession is a foregone conclusion, but I think the increasing odds of it stem from the Fed letting inflation get out of control.

What is your outlook for equity markets over the rest of 2022?

We feel strongly that clients should stick with high quality companies that trade as a multiple of earnings and cash flows (as opposed to a multiple of sales) and that distribute cash back to shareholders via dividends or share repurchases. Because of inflation, we’d be wary of companies that don't return money to shareholders and that are trading as a multiple of sales. In our Sector Allocation and Asset Allocation notes we detail our thinking.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient to base an investment decision on. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Strategas Asset Management, LLC and Strategas Securities, LLC are affiliated with and wholly owned by Robert W. Baird & Co. Incorporated, a broker-dealer and FINRA member firm, although the firms conduct separate and distinct businesses.

Copyright 2022 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.