Debt Ceiling Negotiations Likely To Go Down to the Wire

Strategas Washington Policy Research

With just over two weeks to go until the June 1 “X date” for the debt ceiling, the president and congressional leaders have begun negotiations on a deal to raise the debt ceiling and to enact some budget reforms. Congress often acts right before a deadline, but there could be some angst and volatility in the markets in the meantime.

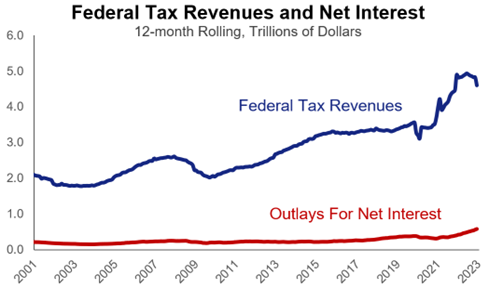

The X date is now June 1, but is still a moving target. Coming into this year, with divided government in Washington and a deteriorating U.S. fiscal environment, it was understood that the two parties would have a standoff over the debt ceiling. The U.S. hit the debt ceiling in January, and Treasury has been employing “extraordinary measures” ever since to avoid breaching that ceiling. Spending has increased this year due to higher interest costs and larger payments tied to inflation (e.g., Social Security cost of living adjustments), while tax revenues have fallen 6% over the last year. This led to the debt ceiling “X date” being moved up to June 1 from late July, though it is still a moving target.

Last week the president and congressional leaders and their staffs met and began negotiations on a deal to lift the debt ceiling. Directionally, it’s good news that we are moving towards a deal, even if progress has been slow. Negotiations will continue into this week, with the principals potentially meeting once more.

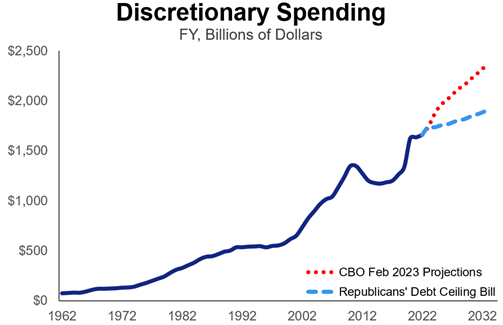

What does each party want in the debt ceiling negotiations? House Republicans are calling for a cap on discretionary spending, rescinding unspent COVID funding, and energy-permitting reform in exchange for raising the debt ceiling. Democrats have called for a “clean” increase, which means lifting the debt ceiling without any policy provisions attached.

What does each party want in the debt ceiling negotiations? House Republicans are calling for a cap on discretionary spending, rescinding unspent COVID funding, and energy-permitting reform in exchange for raising the debt ceiling. Democrats have called for a “clean” increase, which means lifting the debt ceiling without any policy provisions attached.

As of today, the Republicans have already passed a bill out of the House that gives them leverage in the negotiations. A clean debt ceiling bill does not have the votes to pass the Senate or the House. As a result, Democrats need to negotiate, and they are likely to push for some items they would like included, as well. For now, there has been little focus on raising taxes, but Democrats may ask for one or two items in that realm (e.g., an increase in the buyback tax).

The most likely outcome for a deal is a cap on discretionary spending, rescission of unspent COVID funding, energy-permitting reform, and potentially several other items. We anticipate a two-step process. The first step would provide a short-term debt ceiling increase with a topline agreement on the policy items in the deal. The second step would fill in the details of that topline agreement and be paired with another increase in the debt ceiling past the 2024 presidential election. The political debate is now about “how” to raise the debt ceiling, not “whether” to raise the debt ceiling, and that is an important distinction.

U.S. is unlikely to default. The threat of an actual default of the U.S. debt is an extremely low probability. Policymakers often talk about default during debt ceiling debates to pressure the other side of the aisle. It is important to note that the “X date” is not the same as the so-called “default date.” Treasury is expected to have a small cushion of funds on June 1 that should provide several days of breathing room before talk of prioritizing payments.

Further, the U.S. government has plenty of cash to pay interest even if the “default date” is reached, and Treasury is expected to prioritize principal and interest payments on Treasury bonds. This means an actual default is highly unlikely. From there, Treasury would have to prioritize other government spending; there would be enough funds for Social Security, Medicare, & Defense, but other spending may be halted. This would be akin to a government shutdown, though in this case, it would be short-lived because new tax revenue is coming into Treasury on June 15. Nevertheless, we believe Congress will act before June 1, making discussion of prioritization of payments less relevant.

Further, the U.S. government has plenty of cash to pay interest even if the “default date” is reached, and Treasury is expected to prioritize principal and interest payments on Treasury bonds. This means an actual default is highly unlikely. From there, Treasury would have to prioritize other government spending; there would be enough funds for Social Security, Medicare, & Defense, but other spending may be halted. This would be akin to a government shutdown, though in this case, it would be short-lived because new tax revenue is coming into Treasury on June 15. Nevertheless, we believe Congress will act before June 1, making discussion of prioritization of payments less relevant.

Financial markets are likely more at risk after the debt ceiling is raised. In our opinion, the debt ceiling deadline itself is less of an issue for investors than the level of fiscal austerity that will be included in a deal to lift the debt ceiling. In 2011, nearly all of the decline in the S&P 500 occurred after a deal was reached to lift the debt ceiling. That included $2 trillion of spending cuts, a level of austerity that was larger than expected, which caused the market to reprice for lower long-term growth expectations. How much austerity is attached to the current debt ceiling deal will be similarly important. In addition, Treasury is currently providing liquidity into the financial markets ahead of the debt ceiling deadline by spending down its General Account. However, once the debt ceiling is raised, this liquidity injection will cease. Finally, the U.S. economy is already slowing. Putting it all together, there is likely more risk to markets after the debt ceiling is raised than before.

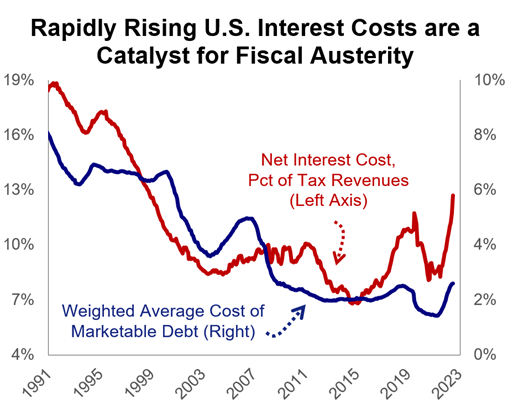

Fiscal austerity as a long-term theme. We are entering a period of fiscal austerity that could last for years. Rising interest rates are making it more expensive to service the national debt: U.S. interest costs are currently at 12.7% of tax revenues, and historically, when net interest costs reach 14% of tax revenues then financial markets begin to impose fiscal austerity on policymakers. We could be at that level by the end of the year. Those rising costs put pressure on the rest of the budget and force policymakers to implement changes to get the fiscal house in order. The debate over the debt ceiling is just the first bite of fiscal austerity. The Social Security and Medicare Trust Funds are expected to become insolvent within the next 10 years, putting additional pressure on policymakers.

Fiscal austerity as a long-term theme. We are entering a period of fiscal austerity that could last for years. Rising interest rates are making it more expensive to service the national debt: U.S. interest costs are currently at 12.7% of tax revenues, and historically, when net interest costs reach 14% of tax revenues then financial markets begin to impose fiscal austerity on policymakers. We could be at that level by the end of the year. Those rising costs put pressure on the rest of the budget and force policymakers to implement changes to get the fiscal house in order. The debate over the debt ceiling is just the first bite of fiscal austerity. The Social Security and Medicare Trust Funds are expected to become insolvent within the next 10 years, putting additional pressure on policymakers.

We are accustomed to an environment of fiscal stimulus and cutting taxes, but that will end as the U.S. needs to address its long-term fiscal outlook. This will require investors to change their thinking about the fiscal backdrop.

The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient to base an investment decision on. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Strategas Asset Management, LLC and Strategas Securities, LLC are affiliated with and wholly owned by Robert W. Baird & Co. Incorporated, a broker-dealer and FINRA member firm, although the firms conduct separate and distinct businesses.

Copyright 2023 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.

Related Links

If you follow the financial news, you've undoubtedly seen a lot of consternation over the debt ceiling fight in Washington. Here's what you need to know as you think about your own finances.