Planning for the Future of Social Security

2025 marks the 90th anniversary of the signing of the Social Security Act. Over the last 90 years, Social Security has paid more than $26 trillion in benefits; today, more than 66 million people rely on the program to support them in retirement. Yet, Social Security has been facing stiff challenges, and its long-term sustainability has been a point of concern for many years. In this video, Tim Steffen, Director of Advanced Planning, breaks down what you need to know about the future of Social Security, and how you can prepare.

The Current Status of the Fund

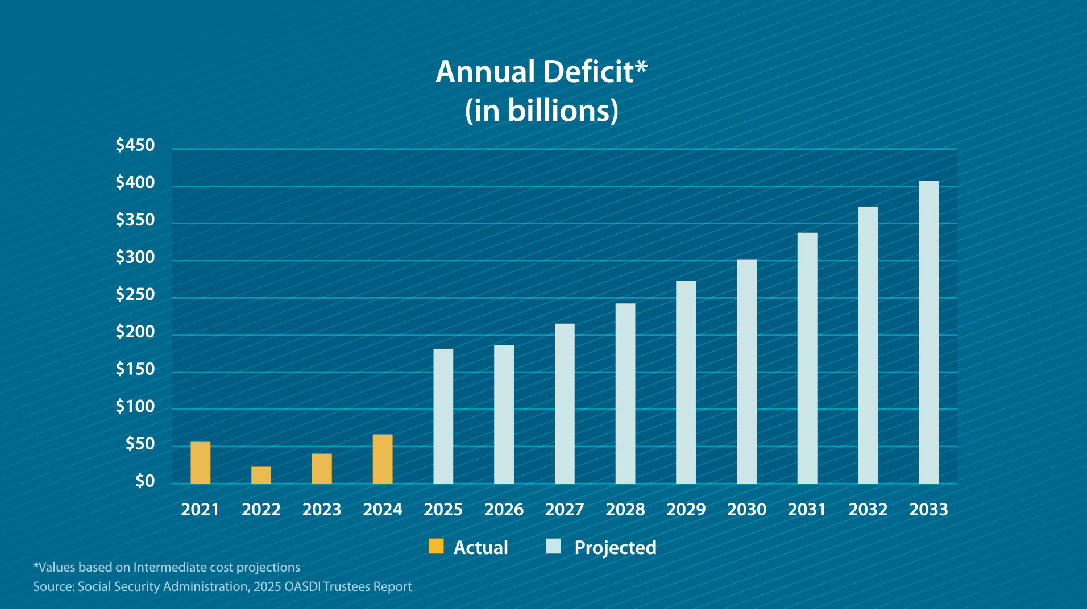

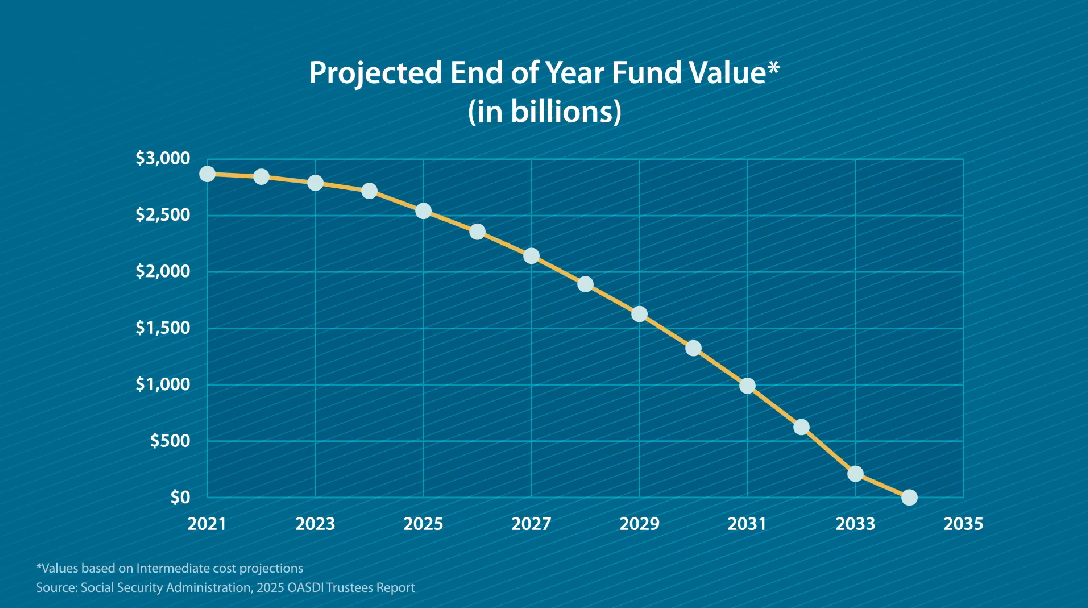

Social Security benefits are funded through a dedicated trust, primarily financed by payroll taxes collected from workers and employers. Every year, the Board of Trustees releases a report detailing the fund’s status and prior-year activity. In 2024, the program collected approximately $1.4 trillion in tax revenue and investment income; yet, expenses exceeded revenue. Because of this, the program needed to dip into $67 billion of its reserves to make payments, marking the fourth consecutive year of deficit spending. These deficits are projected to grow significantly in the coming years, and if they persist, the fund is projected to be depleted by 2034.

Once the trust fund is empty, Social Security will have to rely solely on payroll taxes to cover benefit payments. Unfortunately, this tax revenue won’t be enough to support promised benefits and is only projected to cover 81% of promised obligations in 2034 and beyond. So while payments won’t stop entirely, it’s likely they’ll need to be reduced by up to 20%.

![]()

Maximize Your Social Security Benefits

Through their advisor, Baird clients can receive a Social Security Analysis to determine the best time to take their benefit.

Proposed Solutions

There are two primary options available to address the looming depletion of Social Security: increase tax revenue or reduce benefit payments. Each year, the Board of Trustees outlines hypothetical strategies to illustrate the magnitude of the deficit and the potential impact of various solutions.

- Benefit Reductions: To restore long-term stability and fund the program into the future, benefit payments to both current and future beneficiaries would need to be cut by 22% immediately. If this reduction applied only to individuals starting benefits in 2025, the cut would rise to nearly 27%.

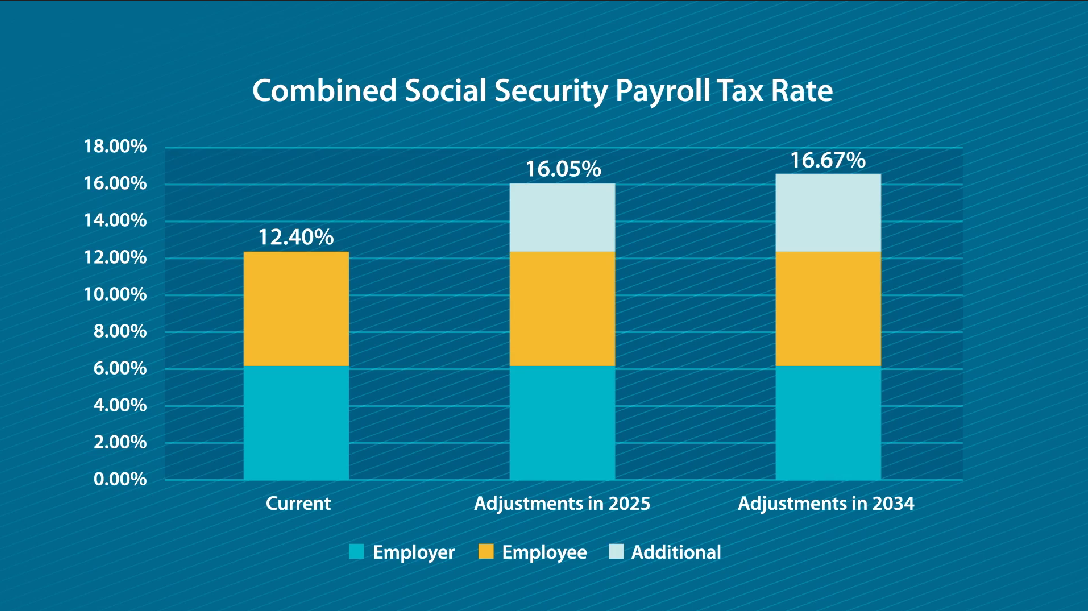

- Tax Increases: On the other hand, Congress could raise payroll taxes. Currently, employees and employers each pay 6.2% on the first $176,100 of wages for a total of 12.4%. If you’re self-employed, you pay both portions of that tax. To address today’s funding challenges, payroll taxes would need to increase by 3.65%. If delayed until 2034, the required increase jumps to 4.27%.

A blended solution – pairing modest tax increases with smaller benefit reductions – is also possible. Additional options could include raising the full retirement age, expanding how much of your income is subject to payroll tax, revising how the trust fund is invested or more. Regardless of the option chosen, one thing is clear: the longer Congress waits to implement a change, the more drastic the measures will have to be.

Best Practices for Social Security

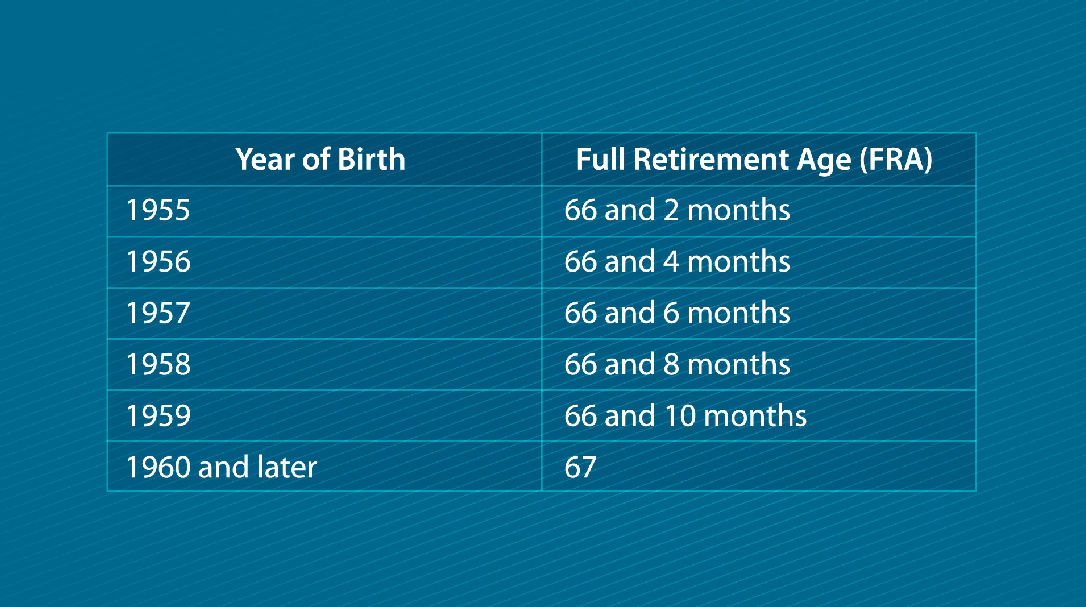

Given the uncertainty around the future of Social Security, you may be looking for ways to maximize your benefit. The first step is understanding how your benefit is calculated and what rules influence your payout amount. One important concept is Full Retirement Age (FRA) – the age at which you qualify for your full Social Security benefit. If you were born in 1960 or later, your FRA is 67. If you were born earlier, you will reach FRA slightly sooner depending on your birth year:

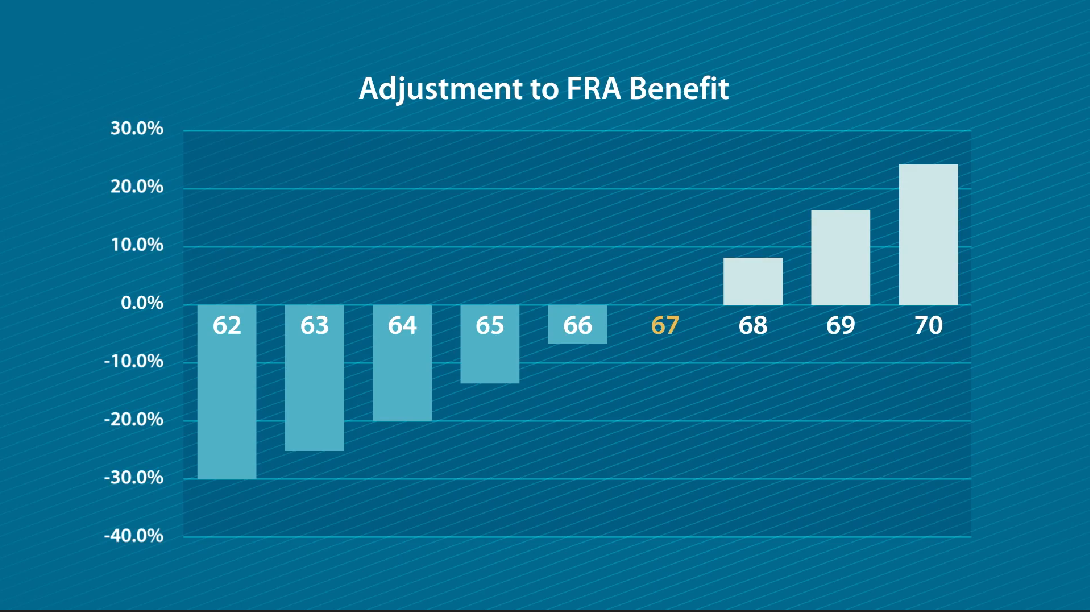

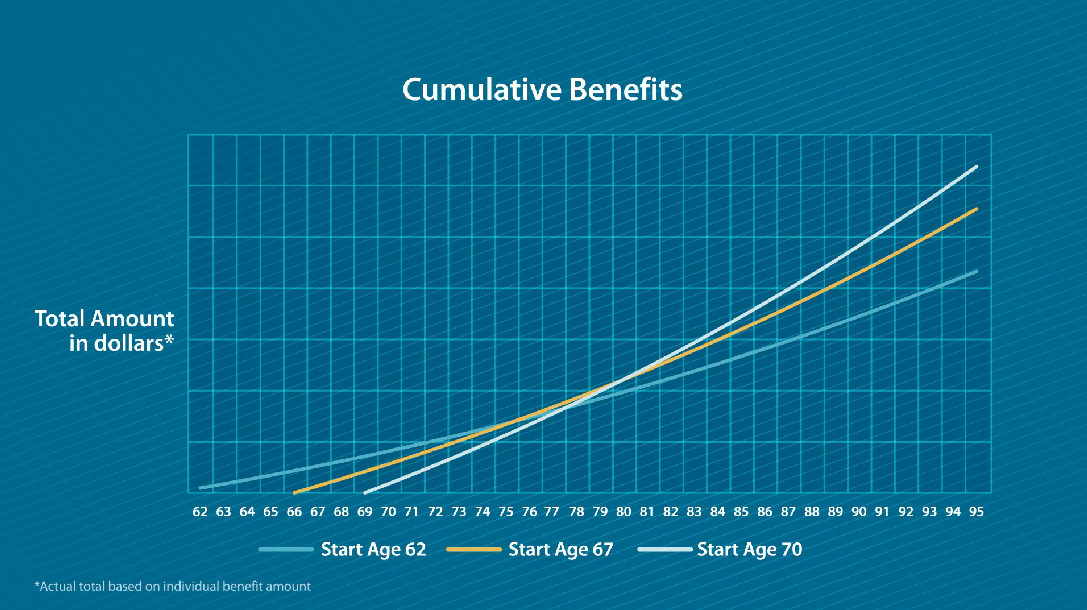

Importantly, you can choose when to begin receiving benefits – you may begin collecting as early as age 62 or as late as age 70. The timing of this decision significantly impacts the amount you receive throughout retirement. For example, if you have an FRA of 67 but start receiving benefits at age 62, you could see your payment reduced by 30%. On the other hand, delaying until age 70 could result in a 24% increase.

For many, cash flow concerns or a desire to enjoy benefits when they’re younger is a reason to claim early. Those who delay typically value their higher monthly payment, which can also result in a larger survivor benefit for their spouse. Life expectancy is another key consideration. Generally, if you expect to live into your early 80s or beyond, delaying benefits often results in greater lifetime income. Other factors include your retirement date, Medicare enrollment, and how benefits are coordinated between spouses.

Connect with a Baird Financial Advisor team

Given the many variables, it’s essential to evaluate all of your options before choosing when to take Social Security. Fortunately, a Baird Financial Advisor team can help you build a personalized strategy that aligns with your broader wealth plan. Together, we can revisit your goals, projected lifespan, and other key factors to determine a claiming strategy that is right for you. If you’re nearing age 60, we especially encourage you to reach out. We look forward to helping you navigate this important aspect of your financial future.

This information has been developed by a member of Baird Wealth Solutions Group, a team of wealth management specialists who provide support to Baird Financial Advisor teams. The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.

Ready for a true partner?

We’d love to get to know you, and have a conversation about how we can support you in your journey to building financial confidence.