2026 Market and Policy Outlook

In the first part of Baird’s 2026 Outlook Series, Nicholas Bohnsack, President and Head of Portfolio Strategy at Strategas, a Baird company, talks through the firm’s outlook for 2026, highlighting emerging opportunities and signs of strength amid shifting market dynamics.

What is your outlook for the U.S. stock market and corporate profits in 2026?

As 2025 draws to a close, the US economy is emerging from a protracted soft patch in economic data (made worse by the extended U.S. government shutdown). But as we approach the year-end, we are seeing signs of life from the U.S. consumer. Retail sales around the holiday season have been growing relatively well, setting the economy up for what should be a decent first quarter in 2026. We are further encouraged by the potential for significant fiscal stimulus to hit the economy around tax season, as roughly $150 billion of incremental tax refunds are slated to be returned to U.S. consumers due to legislation in the One Big Beautiful Bill (OBBB) passed this summer. We also take comfort in a broadening base of U.S. profitability. Earnings have remained consistently strong throughout 2025, with the most recent quarter seeing bottom line growth of more than 13% and, even more encouragingly, top line growth of 8%. That's twice the rate of nominal GDP, and it's tough for the economy to get in trouble when U.S. corporate profits are following through on such robust expectations. When we look out to next year, we have an equally strong profit outlook. Our estimates are just slightly below consensus at about 10% earnings growth, but on the top line, we agree with the consensus opinion that we should see about 6.5% sales growth. All in all, a strong backdrop appears to be forming that can support the continued advance of U.S. shares.

What indicators are you watching to gauge whether the market is in bubble territory?

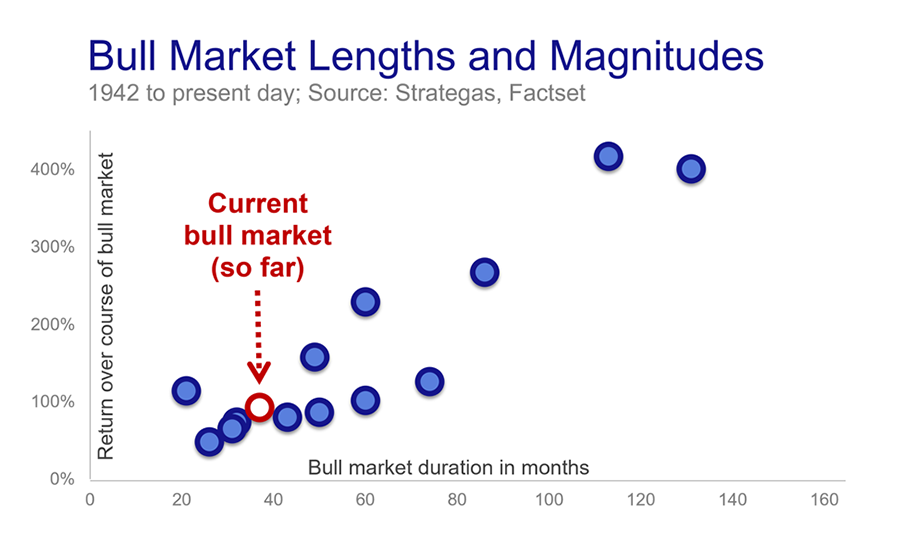

When we look at U.S. bull markets since the end of WWII, we see that the current run ranks near the bottom in terms of magnitude and duration. That might suggest that this bull market could have a way to go. Looking under the hood, we continue to see a strong bid to cyclical stocks that tend to do well when the economy is expanding. Stock prices are generally shaped by corporate earnings and interest rates. With the Federal Reserve in the second phase of a rate-cutting cycle and with US corporate profits showing persistent strength, we believe that valuations, while elevated, may have a bit more room for expansion. Moreover, though market concentration in the Magnificent 7 (the mega-sized tech companies at the heart of the artificial intelligence theme) is worth watching, we've seen a broadening of performance beyond this group in recent months. So we remain bullish on the resiliency of a diversified allocation across styles and sectors, backstopped by companies with strong free cash flow.

What should investors know about investing in midterm election years?

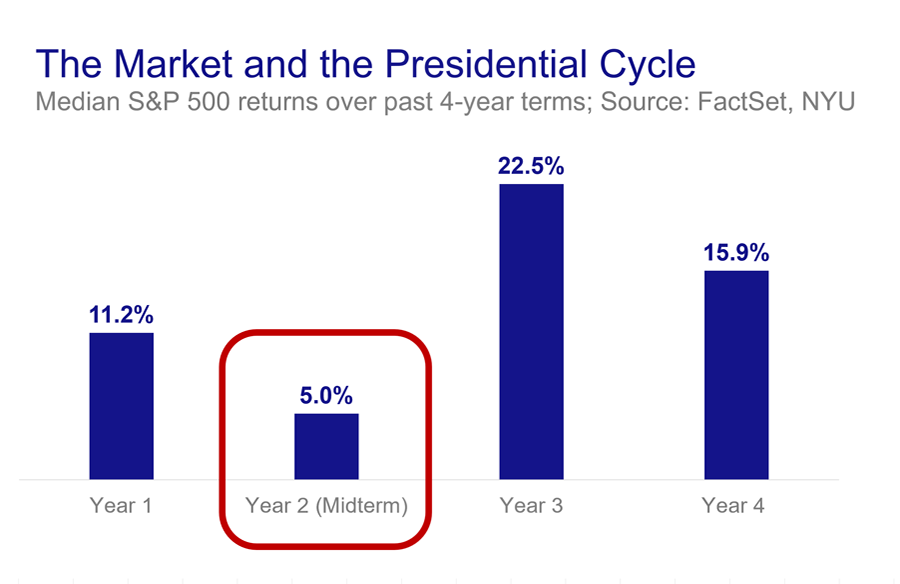

The U.S. presidential cycle is one of the most interesting performance profiles of any of the historical elements we look at. The stock market tends to do very well in the first year of a president's term—whether that president is new to the office, been reelected, or is in a second “first term” like President Trump. In the second year, however, the stock market has tended to recede modestly and ultimately finish the year flat as both parties gear up for contentious midterm election years (before breathing life into the third year as both parties grease the skids for a presidential campaign). One wonders, however, given the degree of fiscal stimulus on offer from the OBBB and the monetary stimulus on offer from the Fed's current easing cycle, whether the second and third year of this term may indeed be reversed relative to that historical pattern. Said another way, we could see stocks be stronger in 2026 on the back of a U.S. consumption wave and perhaps slightly weaker in 2027.

What economic theme do you think is being underdiscussed heading into 2026?

As the U.S. economy emerges from a fourth quarter soft patch, one of the most underappreciated themes—in our view—is the very real potential for a 2026 consumption wave. Consumer data has perked up as we enter the year-end holiday season and the Fed seems intent on keeping the labor market above water. Perhaps most importantly, the OBBB is slated to provide the U.S. taxpayer with as much as half a trillion dollars of refunds during the April filing period ($150 billion beyond the level of refunds we saw in 2024). There's also $250 billion in the package for corporate tax credits ($100 billion in 2025 and an incremental $150 billion in 2026). On top of that, the U.S. (along with Canada and Mexico) will host the 2026 FIFA World Cup. That will invite infrastructure spending in the months leading up to the event plus travel and leisure spending during the actual event. And last but not least, the United States will celebrate the 250th anniversary of the signing of the Declaration of Independence next year. Altogether, what looks to be a healthy cocktail for an expanding economy and a strong stock market.

In early 2026, part two of the 2026 Market, Policy & Planning outlook will feature Baird’s Wealth Planning team and their recommendations for what you should plan for in the year ahead.

This information has been developed by a member of Baird Wealth Solutions Group, a team of wealth management specialists who provide support to Baird Financial Advisor teams. The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.