Is the Dollar Losing Its Place as the Reserve Currency?

But while a slow move away from dollar dominance might continue – exacerbated in part by current trade rhetoric and a trend toward deglobalization – a lack of good alternatives and America’s still-dominant position within the global economy will likely keep the dollar established as the world’s reserve currency for the foreseeable future.

What Is Meant by a “Reserve Currency”?

At its core, a reserve currency is one held in large amounts by central banks and financial institutions around the world to use for transactions, investments and settlements. But the dollar’s status as the international currency of choice was not established by any formal declaration – rather, the dollar assumed this role in the post-WWII world alongside America’s emergence as the world’s major economic and military power.

How Does a Currency Become a Reserve Currency?

The U.S. Treasury identified several key factors:

- The size of the domestic economy. The U.S. is the largest economy in the world by a sizeable margin, and growing at a faster pace than most other developed nations.

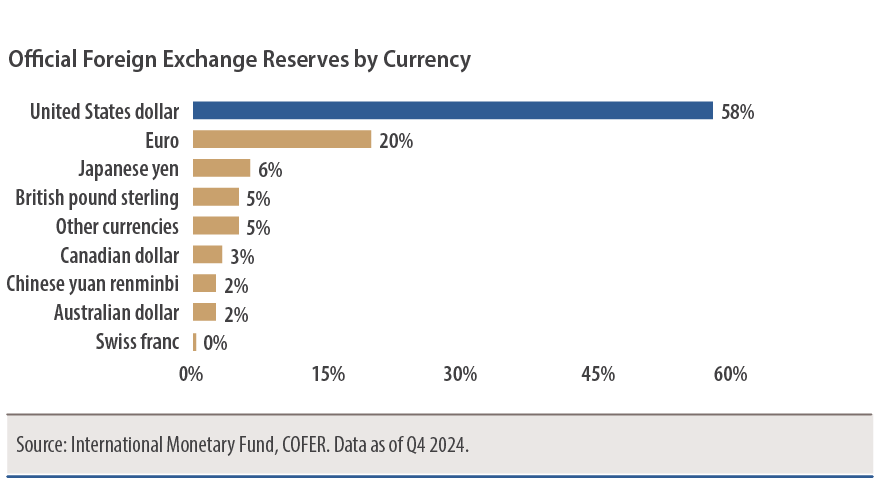

- The importance of the economy in international trade. The U.S. dollar represents 58% of official foreign exchange reserves and is used in 88% of foreign exchange transactions. This widespread usage reduces uncertainty and costs across all layers of global finance, resulting in robust network effects.

- The size, depth and openness of financial markets, and the convertibility of the currency. The U.S. has the world’s largest bond and stock market by a significant margin and is considered one of the most financially open countries on Earth.

- The use of the currency as a key point of reference in the global financial system. Recent estimates suggest that nearly 50% of global GDP is anchored to the U.S. dollar by way of currency peg. That figure far surpasses the U.S.’s competitors.

- Domestic economic policies. With the ongoing trade rhetoric and America’s large budget deficit, the country’s domestic economic policies are the big question. This concern is not without merit, but we shouldn’t overlook the extent to which other nations deal with similar issues or minimize the ways in which U.S. policy is business-friendly: The U.S. has a competitive corporate tax framework, independent central bank, large and liquid capital markets and massive consumer base.

With nearly 60% of the global reserve currency market, the U.S. dollar is 3× larger than its closest competitor and 10× all others.

How Could the Dollar Losing Reserve Status Impact My Investments?

It’s important to note that reserve status is not a prerequisite for equity strength. Plenty of international companies have outperformed without the benefit of their home country having reserve currency status – and plenty of U.S. companies have failed despite it. A change in the dollar’s reserve currency status would alter many things, but it would not change the profit motive inherent to companies operating in a free market system – nor would it change the process by which those profits translate into price gains for stockholders.

And remember: A weaker dollar does not mean a loss of reserve currency status. Currencies appreciate and depreciate based on economic factors like interest rates and inflation, but a weakening dollar should not be equated with the loss of reserve currency status. For instance, the U.S. dollar fell over 40% between 2001 and 2008 and remained solidly in place as the global reserve currency.

As far back as the 1970s, nations have been threatening to cut links with the dollar – to little avail – as the widespread use and influence of the U.S. dollar leave many countries vulnerable to unfriendly American policy choices, such as tariffs or sanctions. While there are certainly incentives for other nations to diversify their reserve base, the death of the dollar has been predicted more times than one could count. So while a weaker dollar might persist as the new trade regime evolves, the dollar’s reserve status looks to be on solid ground – and as long as that remains the case, narratives about its imminent demise will persist. Buckle up.

This information has been developed by a member of Baird Wealth Solutions Group, a team of wealth management specialists who provide support to Baird Financial Advisor teams. The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.