The Paycheck Playbook: Making Your First Job Work for Your Future

When your first full-time paycheck arrives, it can be tempting to splurge – especially after years of living on a smaller budget. But exercising smart financial habits now can set you up for building long-term, sustainable wealth.

What better time to start building these habits than today?

Designing a Budget Blueprint

Once you have an idea of your take home pay, you can start building your budget to balance your income against key spending decisions like housing. A good rule of thumb is to spend less than 30% of your income on rent or a mortgage: For example, if you earn $5,000 per month, you could look for housing options that are around $1,500 per month. Once your housing is accounted for, factor in recurring expenses like utilities, internet, and car and student loan payments, followed by flexible expenses like clothing, entertainment, dining and more.

Along with budgeting, you’ll want to start planning for future goals and expenses such as a big trip or a down payment. And as time goes on, your goals will change – so by partnering with a Financial Advisor, you can help ensure your plan is adaptable to whatever stage of life you’re in.

Ditching the Debt

Americans aged 25 to 34 carry around $500 billion in total student loan debt, with many individuals carrying between $10,000 and $40,000.1 For recent grads, balancing debt repayment with new living expenses can be a real challenge – so making a solid debt repayment plan is essential.

As you create your budget, remember to include your student loan and credit card debt payments within it. And when it comes to credit cards, avoid only making the minimum payment – doing so can spread costly interest payments over a much longer time period.

Fueling Your Future

As a 20-something year-old who is just starting out in their career, saving for a far-off goal like retirement or a home purchase may seem overwhelming. However, starting early gives you a major advantage: the power of compounding, which can make a substantial difference in your long-term savings outcomes.

When it comes to retirement, employee benefit packages often include retirement plans like 401(k)s. If this is the case for you, contributing a portion of your paycheck to it is a smart move – especially if your employer will match a portion of what you put in (and effectively boost your retirement fund with free money). And if your employer doesn’t offer an employer-sponsored plan, consider opening an IRA: a tax-advantaged retirement savings account that those with earned income can put money into.

For emergency funds or other long-term savings goals, set aside a specific dollar amount monthly and consider putting it in a high-yield savings account or money market fund – as this can earn more interest than you otherwise would in a traditional savings account. If you still have some leftover cash and are interested in upping your investment game, remember that time is on your side – so more aggressive investments may be a great place to start. Your Financial Advisor can tailor the right approach for your goals and tolerance for risk.

Preparing for Life’s Curveballs

Oh, the joys of adulthood – insurance options, like health insurance, are one of those must-have expenses. And while many young adults can stay on their parents’ health insurance plan until age 26, it’s critical to compare the monthly rates, deductible, maximum out-of-pocket cost and more to your employer’s plan. Once you turn 26, though, you’ll need your own plan regardless, either through work or the health insurance marketplace.

Other types of insurance, like car and renter’s insurance, are important as well. If you live with your parents, you might stay on their car insurance – but once your primary address changes, you’ll have to get on your own plan. And if your address does change and you’re out on your own in your first apartment, don’t skip renter’s insurance. It’s often inexpensive, required by landlords, and could protect you from theft or damage.

Especially during a time when the cost of living is inflated, entering adulthood and managing your finances within it can be intimidating – but you don’t have to do it solo. Check out our post-grad planning checklist that can help you pave the way to your long-term goals, and share it with your Baird Financial Advisor for expert advice along the way.

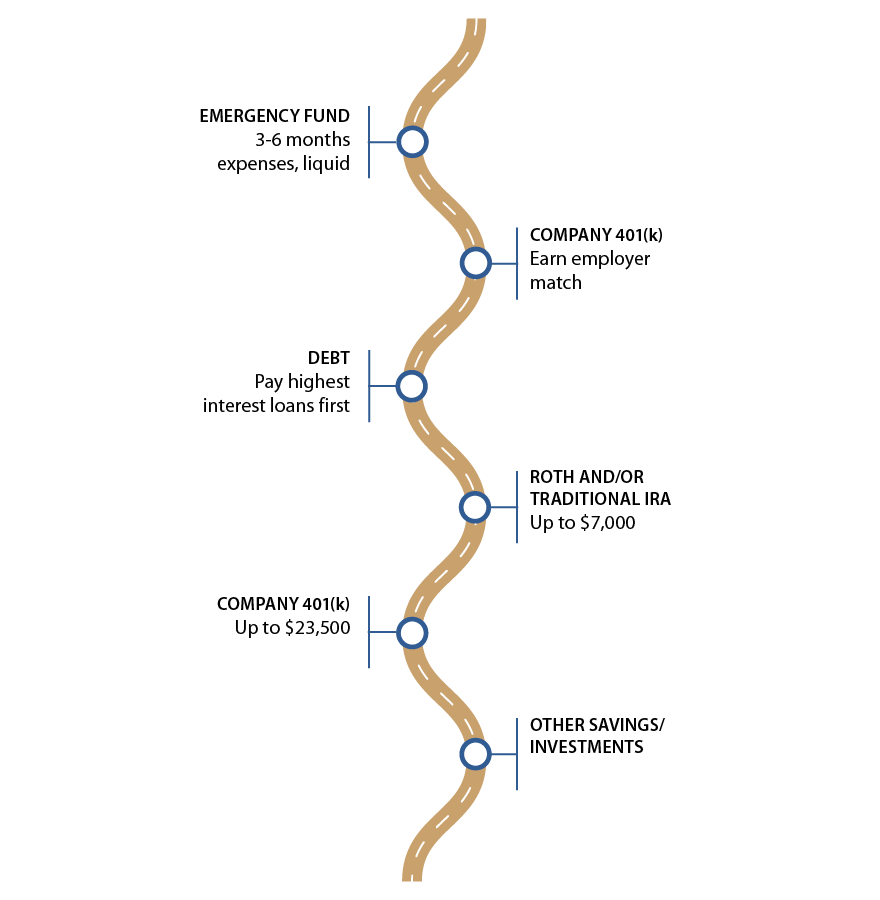

Wondering how to prioritize your savings goals? Use this as a guide. And remember, you don’t have to finish saving for one goal before you start saving for another – just keep this general order in mind.

1Federal Student Loan Portfolio | Federal Student Aid

This information has been developed by a member of Baird Wealth Solutions Group, a team of wealth management specialists who provide support to Baird Financial Advisor teams. The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.