All That Matters: War and the Stock Market

When geopolitical tensions rise, what’s an investor to do? Mike Antonelli and Ross Mayfield offer up their perspectives on why focusing on your destination and sticking to a long-term plan is the best approach in a world where the future is unknowable.

Do global conflicts affect the stock market?

Mike: We have a serious topic today that’s led to a lot of conversations with both advisors and clients. War has been in the headlines and on people's minds over the last couple weeks. Ross and I want to talk to you about the impact that wars have on stocks and investing and money. We’ll leave aside the historical, political, and social impacts of war – that's beyond our purview. We really want to focus on your money and the stock market. So Ross, I'm going to kick it over to you to start.

Ross: This is the one question that we've been getting, and I appreciate how you’ve framed this conversation. There's obviously human tragedy occurring right now, but our job is to shepherd our clients' money toward their goals and that's what we’ll focus on. So can global conflicts matter for the stock market? They have and they haven't throughout history. The big thing is that context matters. Ultimately the questions that we have to get back to are “Will it impact corporate earnings? Will it impact the US consumer?” Today, the US economy is pretty strong. We're going to print a really strong third quarter GDP and the labor market is tight as a drum. The events in the Middle East have come at a time when the U.S. economy is pretty strong. And that makes a huge difference.

Mike: There's so much complexity to it. Like Ross said, it's very context-dependent. I will say this: war can bring about volatility in the market. It can also affect commodity prices like oil when conflicts go through large global trade areas, and that can affect the companies and the earnings of the United States. It’s not as bad as it has been in the past because the U.S. is now one of the world’s largest oil producers. So we can mitigate the impact on oil prices when there’s conflict in a very oil-rich region of the world.

What does history tell us?

Mike: Ross and I have two stories to help drive that point home that the impact of war depends on the economic environment already in place when a conflict breaks out.

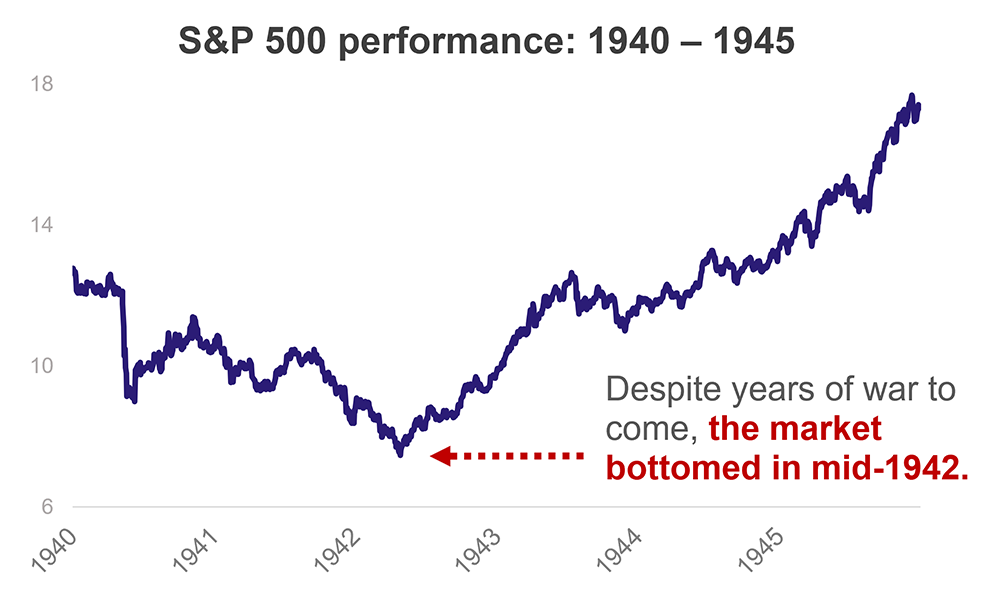

I want to take you back to 1941. It was a terrible year for the stock market. Pearl Harbor happens and we get pulled into World War II. The stock market had a rough time in 1941 but 1942 – the very next year – ended up being a good year for stocks. Why was 1942 better, even though WWII would rage for years longer? Well, the Battle of Midway happened in June of 1942. After that battle, the market gained confidence that the U.S could win the war in the Pacific. For the stock market, bad times started to get better after that battle.

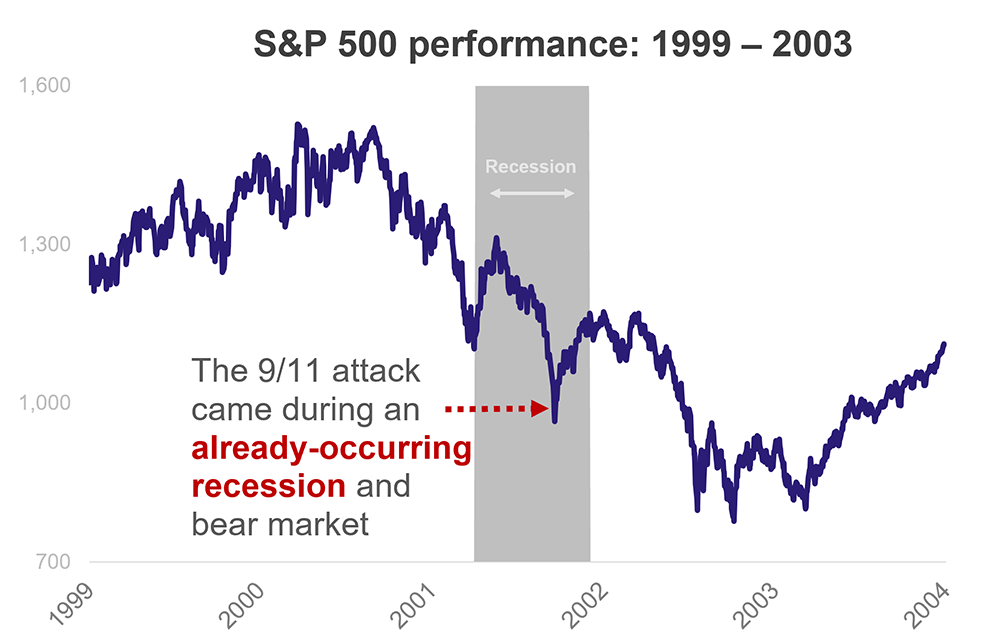

Ross: I have a more recent example that’s a perfect flip. So in September of 2001 we were already in a recession. The dotcom bubble had already been popping when 9/11 occurred. The attack was jarring enough to tip the U S economy into an even deeper funk. A shock like that can scare the consumer into a kind of retreat, and the U.S. economy is very consumer-driven. A year later, the market was down 17-18% because 9/11 was set against the backdrop of an already deflating economy. The conflict happened on American soil and the market closed for a week, then had a brutal return back when it opened – but there’s a bigger picture. The prevailing trend in place had nothing to do with a geopolitical event – it was about a tech bubble.

Another historical event that I think is kind of a critical comparison for today is the invasion of Kuwait in 1990. At the time, the Fed had been hiking interest rates just as they are today. The event was in the Middle East and not on American soil. And the oil price shock led to a minor recession in the U.S. That’s similar to the environment we're in today where the Fed has been hiking, where oil prices have popped up over the last couple of months. And a lot of folks are expecting a minor or mild recession in the next 12 to 18 months. To reiterate: the context surrounding a geopolitical event matters deeply. What's happening in the economy, what's happening in the stock market, and what's happening in the labor market are all super important for how these events color our world.

Mike: You really want to be asking yourself the following question: is the average U.S. consumer afraid? And you have to ask this for the entire economy. Think about someone who lives in Fargo, North Dakota or Oshkosh, Wisconsin or Lexington, Kentucky or Austin, Texas. Something has to spook them so much that they’re pulling back spending on restaurants and trips and so on. And 9/11 is the perfect example of that – we were all afraid and we retreated into ourselves. But is that happening now? A recent report says retail sales are at an all-time high. Ross mentioned GDP is doing very well. The labor market’s really strong. So nothing in the data right now suggests that the average U.S. consumer is afraid. Could that change?

Final conclusions

Ross: First of all, the future is unknowable. Even if we could predict the future I’m not sure we would know what the trade was to profit. You don’t know what the response of policy makers both at home and abroad will be. You don’t know what the Fed will do and how it will impact their rate hike policies. There’s all these second order effects that then turn into third order effects, and it’s this monstrous web of complexity that needs to be navigated. Even if you knew a big event was on the horizon, it would be really hard to invest in a hyper-specific way to make money.

Mike: I keep thinking back to 2020. The worst thing that can happen to the U.S. stock market is that companies of the United States can’t do business… can’t sell their products…can’t make money. That literally occurred in 2020. We put everybody in their homes and shut down the economy. And yet the stock market closed the year positive! Not only are we unable to predict second or third order effects, we also don’t know how people’s expectations change or how policymakers will respond. Ross, what’s most important to stocks in this moment?

Ross: To me, it’s still the U.S. Consumer. Do they have jobs? Are they going out and spending? That, and yields. A major war breaks out in the Middle East over the weekend. And on Monday and Tuesday, stocks are up in a big way. Why? Because people were buying Treasurys. They were flocking to a safe haven asset, and when people buy Treasurys, those yields go down. And when yields were down, the stock market took the opportunity to rally, despite all the geopolitical turmoil that had just broken out. So it shows how tough it is to play the path when there’s all these implications along the way.

Mike: Right. And if you can’t play the path, it’s best to play the destination. Your destination is your plan, your goal, what you want when you engage with your Baird Advisor. It’s best to play destination and not the path because the path is so impossibly hard to predict during global conflict. And I want to remind you that when you're investing in the stock market, remember what you're investing in. You're investing in the people that make up the companies of the United States, if that's what you've chosen to invest in. You're investing in those people waking up every day and solving problems and growing revenues and growing profits. And those people do that regardless of the current atmosphere around the world. In fact, I'd even argue that when times get more difficult, people get even better at their jobs. I know that's one of the lessons of 2020 is people just got better at what they were doing when they were forced to adapt really quickly. Human beings are very adaptable creatures. Very, very adaptable. So that's what you're investing in. Ross, any final words?

Ross: Remember what you’re invested in. Remember what your time horizon is. Remember why you’re invested in the first place. There have been a lot of grim geopolitical events, unfortunately, over the last 30 - 50 years. And if you've stayed invested through them, you've reaped the long-term gains of the stock market. So – as usual – stay focused on the long-term.

If you have additional questions on how the market might influence your portfolio and broader plans, your Baird Financial Advisor is only a phone call away. For more insight into managing your portfolio, check out our articles on bairdwealth.com and the latest issue of Digest.

The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.