All That Matters: Elections and Your Money

With an upcoming presidential election, it’s tempting to plan for various outcomes to protect your money. In this episode of All That Matters, Ross and Mike explain why that may be a big mistake.

The Year of the Big Mistake

Mike: I call 2024 the Year of the Big Mistake because I’ve seen the same theme year after year in my career. I’ve seen people approach election years with the attitude that if one candidate or party wins or loses, they’ll be forced to take action with their money. To help avoid this mistake, Ross and I are going to show four charts that show how the market views elections, and how the market has acted in past election years.

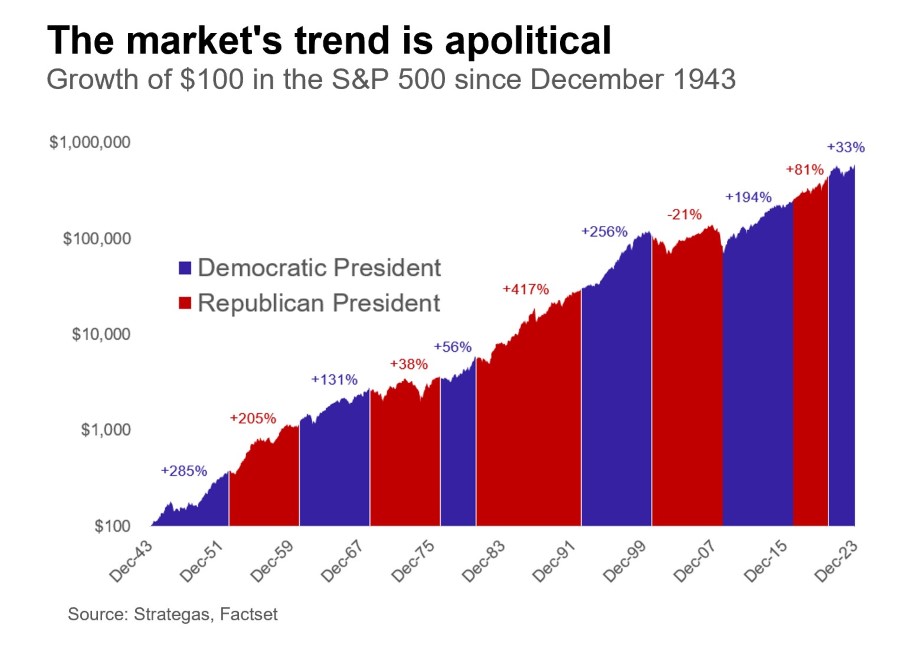

The first thing we want to show you is the history of the stock market during various presidencies, all the way back to December 1943.

The chart shows Democrat presidents, Republican presidents, and the growth of $100 all the way up to last year. And you’ll notice the trend of up and to the right. Why does the market look like this, Ross?

Ross: Overall, the market is apolitical. There are a million things that the market cares about—such as earnings growth and economic growth—before it cares about the politics of the day. It also pays attention to the trends and innovations that support that growth, things like AI and the internet. Ultimately, these are the levers that drive stock prices over time. And while policies matter and can have an impact on corporate performance, the trend is still up and to the right because companies continue to grow and do well, and it’s not because of who is sitting in Washington.

Mike: I like to play a game with this chart where I pinpoint when companies were founded. Look at when Apple, Boeing, Costco or Starbucks were founded. What you’ll notice is that those companies were created regardless of who was in the White House. Those companies were created by entrepreneurs who had a good idea, who wanted to solve a problem, create a new product, and the people who invested with them got to benefit from that. Aggregate all these companies together, and you get a portion of the U.S. stock market: companies and people creating and solving problems. That’s who you are investing in, not who sits in Pennsylvania Avenue.

Market Selloffs During Presidencies

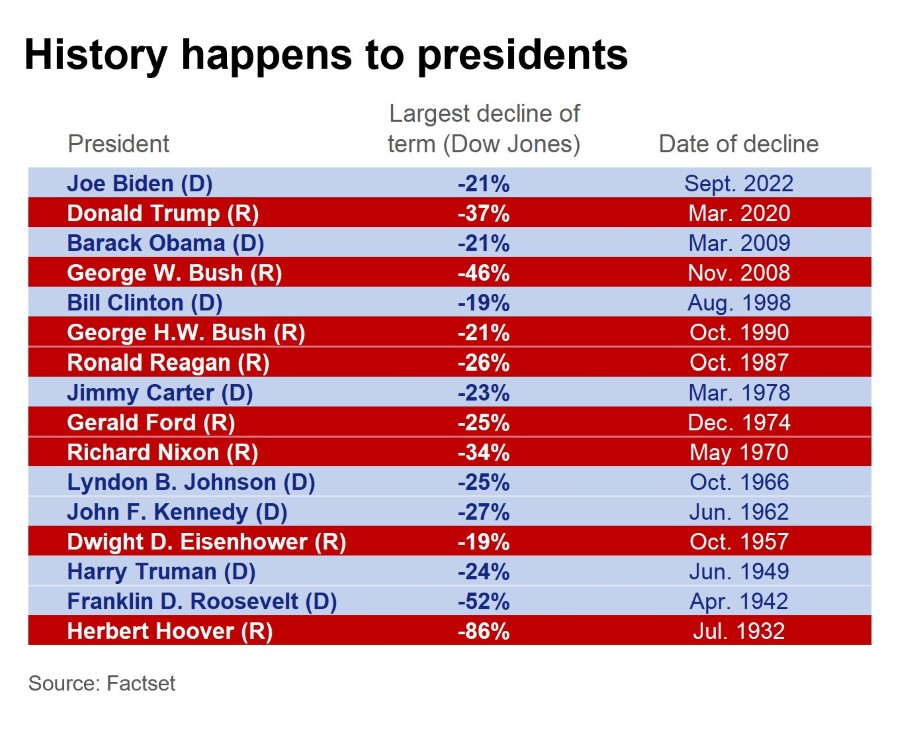

Mike: Our next chart looks at every single president back to Herbert Hoover, and the sell-offs that each president has experienced. Notice anything here, Ross?

Ross: It’s the inverse of what we just showed. The market is apolitical, and bear markets are apolitical. These events are usually caused by something completely irrelevant to who is in the White House. It might be a currency crisis overseas, or perhaps a banking crisis in the U.S. that was brewing for a decade. The president may shape policy, but bear markets and recessions are just going to happen regardless of who is in office. It’s not necessarily of their making, and it usually isn’t.

Mike: Every president all the way back to Herbert Hoover has had a double-digit decline in the stock market during their presidency. There’s the Cuban missile crisis in there. There’s presidential scandals in there. There’s long-term capital imploding. There’s COVID. There’s the global financial crisis. Just because somebody sits in the office doesn’t mean they’re immune from market sell-offs.

Ross: We’ve seen a handful of bear markets just in the last five years, driven by interest rates, by COVID-19. These downturns were going to happen regardless of who was in the White House at a given time. And whoever wins in Novemberwill face a big correction or a bear market during their term. You can almost set your watch to that.

The Stock Market During Election Years

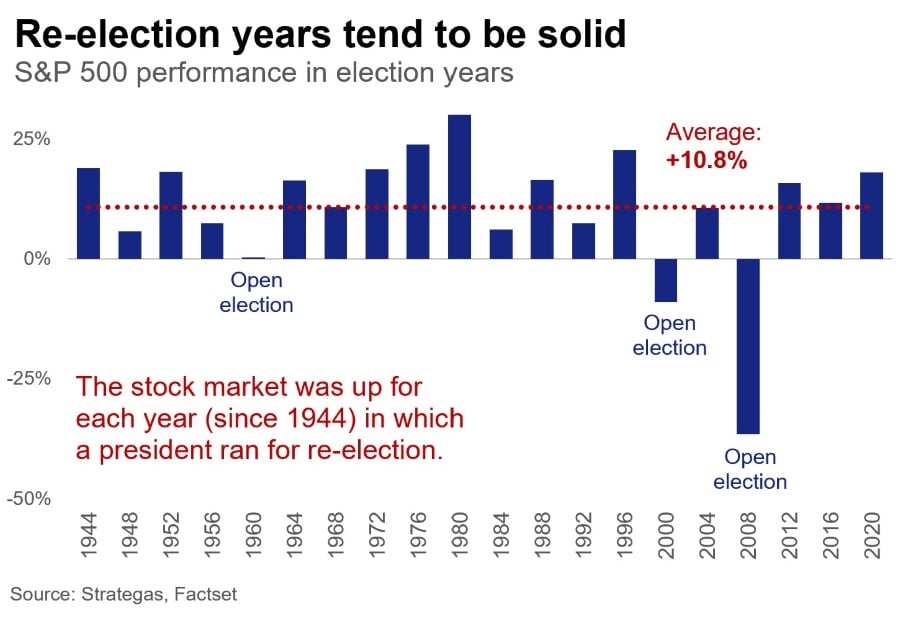

Mike: We’ve shown how the market performs during presidential terms, but let’s take a closer look at what happens in the market during election years.

Ross: Election years are when the news is going to be shouting at you every day about the deeply partisan stuff. It’s when it gets noisy and scary. But throughout history, election years have been as average as they could be. The average S&P 500 return in an election year going back to World War II is 11-ish percent.

Election years are better for the market when an incumbent is running for reelection. Since World War II, the stock market has had a positive return in every election year where there was an incumbent, because the incumbent tends to promise things to get reelected. Alternatively, you’ll see that the three down markets were all a result of an open election. But generally speaking, the stock market has tended to do well in almost any year –pick a year out of the hat and it’s likely to be positive.

Market Performance and Government Makeup

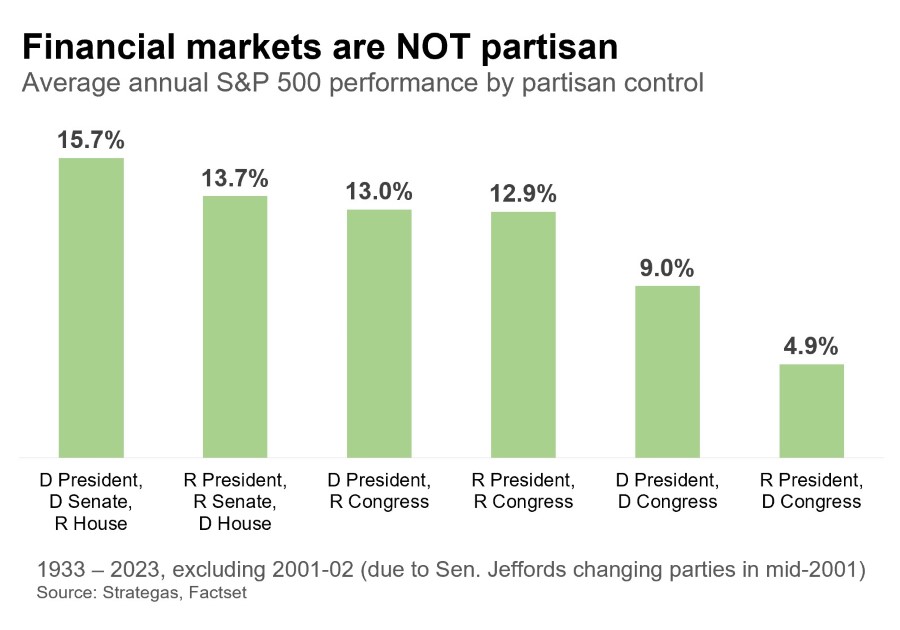

Mike: So we’ve talked about the presidential election, but what about Congress? How does the stock market perform under various forms of our government?

Historically, the average stock market return in any given year is 9-10%. You’ll notice that the only partisan power combination that has a lower average annual return is R-President / D-Congress.Two of the worst bear markets happened when we had a Republican president and the Democrats controlled both houses of Congress: the global financial crisis and the 1973-74 bear market. If we removed those two events, the returns for that combination would shoot right back to average.

Ross: This chart shows that – whatever the makeup – the market has been positive over the last 100 years. It goes back to, “history happens to the president.” For example, the global financial crisis is pulling that one bar down, but that crisis was the result of decades of policy that was shaped well before that makeup was in Congress and the White House. There is no partisan makeup that is a red flag for the stock market, and all of the makeups have had average returns high enough to invest through and reach long-term goals that beat inflation.

Final Thoughts

Mike: Everything we’ve discussed is evidence-based and uses averages. Past performance is no guarantee of future results. But what the data shows us is that the stock market and your money does not root for a certain election outcome. Your money and your stocks are concerned with interest rates and how the economy is doing and consumer spending and all the other levers that drive corporate profits. That’s what I’m trying to get at with the Big Mistake: it conflates social and financial elements and assumes that something needs to happen with your money based on what you think may happen with the election. History is quite clear that when it comes to your investments, you should be watching how publicly-traded companies are doing.

Ross: News media is as pervasive as it is increasingly negative. These headlines are beamed at us from all angles, 24 hours a day, making it challenging to separate the news from the noise and what matters for your money. We know how difficult it is to ignore alarming headlines when it comes to your money.

Mike: You may be tempted to want to make some change with your money based on the election, but history has never shown that to be a good decision. Financial history shows that what you’re investing in is the long-term growth of the United States. And that’s what we’ll remind you of almost every time.

If you have additional questions on how the market might influence your portfolio and broader plans, your Baird Financial Advisor is only a phone call away. For more insight into managing your portfolio, check out our articles on bairdwealth.com and the latest issue of Digest.

The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.