In the Markets Now: Averages and Roller Coasters

In a world where an unlimited buffet of information exists at our finger tips, In the Markets Now covers the need-to-know in just one page.

Investing Is Like a Roller Coaster

Earlier this year, the world’s tallest steel roller coaster—the green giant “Kingda Ka” at Six Flags Great Adventure in New Jersey—was demolished. The coaster (at one time also the world’s fastest) went from 0 to 128 miles per hour in under 4 seconds, sling-shotting riders 456 feet into the air before returning them to earth nearly as quickly as they rose.

Paradise for some, torture for others. But despite 456 feet of near-vertical ascent (and a total track length of over half a mile), the average elevation change for those that braved Kingda Ka was no different than that of the person watching from a nearby park bench: 0.0 inches. Of course, that’s a ridiculous way to measure the experience of being on a roller coaster, but it highlights something that is true in other venues as well (including investing): averages can obscure important underlying truths.

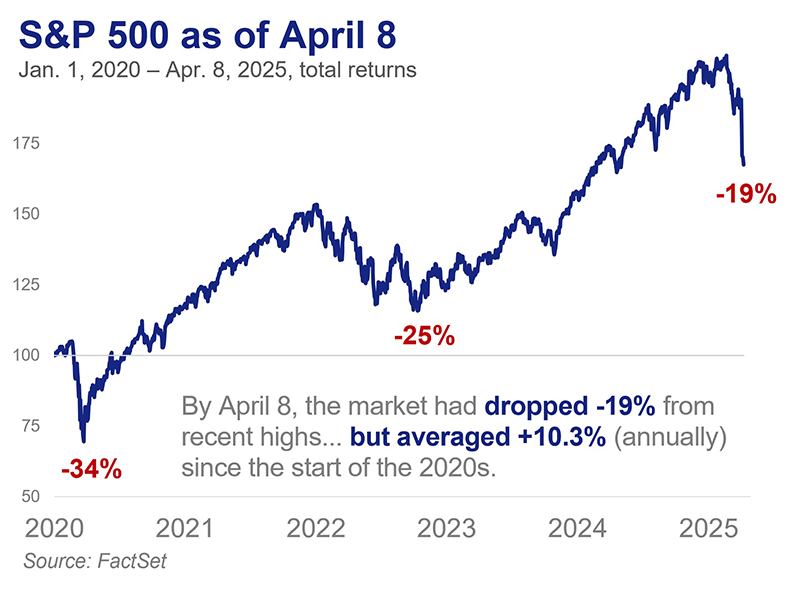

Over the past 100 years, the stock market has averaged a 10% annual return. This number is taught in investing classes, baked into countless financial planning softwares, and is even the answer you get if you ask ChatGPT for the stock market’s expected return. Much like a roller coaster’s average elevation change of zero, that 10% average obscures how the ride to get there looked and felt. Over the last 20 years, the S&P 500 averaged +10.3% a year (visualize $100 building to $700), making it a perfectly average stretch in terms of the result. But it also included six bear markets, the two deepest U.S. recessions since WW II, and several economic calamities. The ride more closely resembled Kingda Ka than Aesop’s slow and steady tortoise.

Of course, volatility is a feature of investing, not a bug. Risk and return are inherently linked—I’ve yet to see the investment that can generate a double-digit annual return with no volatility or risk of loss. And even if the underlying fundamentals of an investment are relatively steady, human participation in markets almost guarantees a heightened level of price fluctuation due to our emotional and behavioral follies. The stock market has risen over time, but the narrative of steady long-term growth is entirely different from the reality of consistent boom and bust. Despite the ~10% annual return since 1926, there have been more calendar years with a 30%+ gain or 30%+ loss than there have been years in the 5% to 15% range.

Further, the road taken can be nearly as important as the destination. Consider how investors felt on April 8, 2025. Having just endured one of the worst 4-day crashes in market history, the S&P 500 was down 19% from February levels and bearishness was at multi-year highs. And yet, even in that moment of panic, the S&P 500 was still up 68% across the entirety of the 2020s for just north of a 10% annualized return. It has been an unordinary decade in almost every way imaginable, from the pandemic that started it to a multifront trade war today. But in one critically important way, even at the market’s April nadir, the 2020s have been almost exactly average.

Ultimately, building a financial plan around long-term expected returns is prudent and can help anchor investors when things diverge too far in either direction. But proper expectations for just how extreme market volatility can be are just as, if not more, important than proper long-term return expectations. The long run is just a collection of short runs that must be managed through. Kingda Ka-sized returns can be had, but only if one has a plan to manage through the loops and drops along the way.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy. Market and economic statistics, unless otherwise cited, are from data provider FactSet.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should not consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Copyright 2025 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.