In the Markets Now: Investing at All-Time Highs

In a world where an unlimited buffet of information exists at our finger tips, In the Markets Now covers the need-to-know in just one page.

Investing At All-Time Highs

Despite a roller coaster first half that seemed to pack a decade’s worth of news into a six month span ‒ tariff and trade uncertainty, wars in Europe and the Middle East, debt ceiling and deficit worries, etc. ‒ the S&P 500 closed out June at a fresh record high. As Strategas (a Baird company) Chief Investment Strategist Jason Trennert summed up, “the performance of markets in Q2 stands as a testament to the old, wry observation that with $1 million dollars and unlimited insider information, the average investor would go broke within a year.” A great line that is rooted in some deep truths.

For investors, all-time highs are something to be celebrated, but they also can elicit anxiety. Are we in a bubble? Should I take some money off the table? And perhaps the most common emotion I come across: a distrust of the market’s new record given the tumultuous macroeconomic and geopolitical backdrop. In those ways, today’s environment mirrors another recent all-time high: August 18, 2020, a record high that seemed unimaginable given the ongoing Covid-19 pandemic, lack of approved vaccine, and historic unemployment levels (among many other things). The situation was improving, but was it enough to warrant a new all-time high in the stock market? With hindsight, the answer was yes – the stock market jumped 32% in the year following the August 18 new high, and is up nearly 100% through today’s writing – but the immense uncertainty looming over the world in mid-2020 likely kept many from participating.

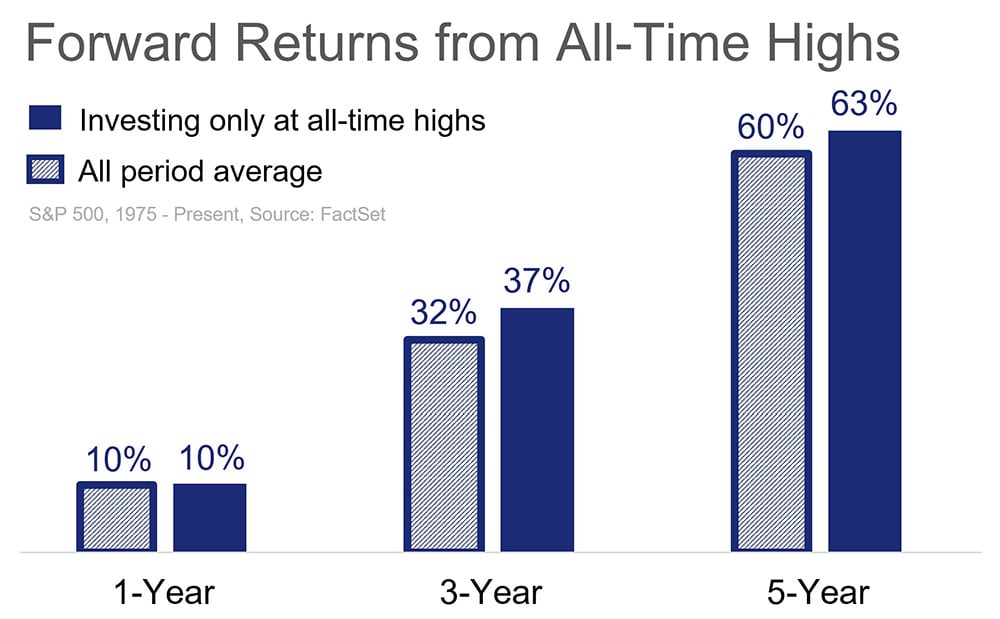

But that’s a unique example, so let’s zoom out. Are all-time highs generally buyable, or should investors wait for the next dip to put sidelined cash to work? On the former, all-time highs are decidedly buyable and are in fact quite a bullish indicator for the market. As one can see below, forward returns from all-time highs have been better than average over the last half century. While all-time highs will sometimes represent local market peaks, it’s more common that they’re signposts of better things to come. All-time highs rarely occur in isolation; momentum begets momentum in financial markets, and history shows that all-time highs typically beget more all-time highs before the lights come on and the party wraps up. Though the stock market is higher today than it has ever been, taking money off the table now is betting against the evidence of history.

On the question of waiting for a dip before investing, this idea is perfectly reasonable in theory and next-to-impossible in practice. Not only might that dip never come (consider the V-shaped bounces off the March 2020 and April 2025 lows that left any cash on the sideline eventually chasing the rally), but if it does, it certainly won’t be without reason. Investors hoping for a buyable dip amid early 2025’s record highs did eventually get one, but they would have had to put money to work amidst record policy uncertainty and a contentious trade war that challenged 50+ years of convention. No easy task.

Open the papers today, and one will find an unsettling message about the state of the world and economy. But look to the market and that message is much less ambiguous – record highs in the US and abroad, leadership from important and economically-sensitive sectors like Technology and Industrials, broad participation from stocks across different industries, and tight credit spreads. Not perfect, but bullish by any stretch of the imagination. Would it be surprising if the market needed a breather sometime soon? Not at all (Fall is historically a tough stretch anyway). But don’t miss the forest for the trees: over the past decade, the market has hit over 300 new all-time highs, each accompanied by reasons it couldn’t march on higher. And yet, each time it did. I’d expect that pattern to continue in 2025 and beyond.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy. Market and economic statistics, unless otherwise cited, are from data provider FactSet.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should not consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Copyright 2025 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.